Are the emerging markets currency woes a legitimate threat to developed market stocks (as in bear market)? Or are they a convenient excuse for a long overdue correction (anything less than a 20% decline)? Of course only time can answer, although lots of "experts"---shooting in all directions---will give it a shot.

While I may have the sense that---given the near-term economic potential (per recent indicators) of developed markets, healthy corporate balance sheets, the not-bubbly valuations for stocks worldwide, the lack of the euphoria that often precedes bear markets, the positive sloping yield curve (signaling no recession in sight), my, and others, assessment of the emerging market currency "crises" that have occurred during my tenure (they were ultimately wonderful buying opportunities) and the long-term growth prospects for emerging economies (where 85% of the world's population lives)---we're not yet on the verge of the next great bear market, the fact of the matter is not I nor anyone else can know for certain.

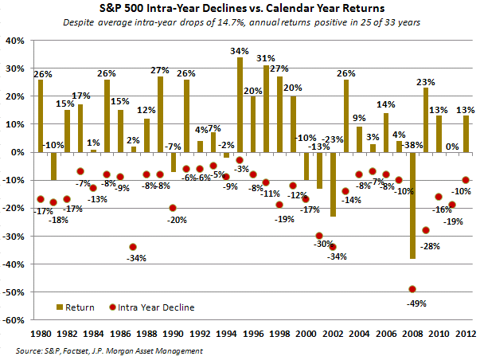

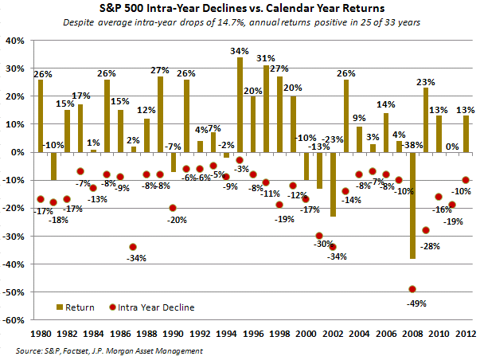

You've heard a thousand times that corrections are normal, essential even, phenomena. The thing is, they don't happen simply because they're a normal, essential part of the process. They happen because something occurs in the world that---for a brief while---frightens folks out of the stock market. If that something turns out to be a short-term blip in an otherwise upward sloping global economy, history will chalk up a market decline of 10-20% (should we get there) as a healthy, garden variety correction. If, however, it morphs into a global recession, we will indeed experience our next bear market (a 20+% decline in the major stock indices).

The few givens (I didn't get to the long-term technicals) I presented in paragraph two are all legitimate reasons to believe that the bull is not yet ready to concede to the bear. But of course things can, and often do, change in a hurry. The wise investor understands that the market is forever a precarious place in the short-run and, therefore, thinks in long-run terms. Long-run success comes from having the patience to weather the inevitable storms (big and small).

Comfort/patience amid the turmoil means possessing a confidence that comes from maintaining an asset mix that is consistent with your circumstances, rebalancing the major asset classes (equity and fixed income) and making sector (tech, staples, financials, etc.), style (large cap value, small cap growth, etc.) and location (U.S., Europe, emerging mkts, etc.) adjustments---at the margin---periodically. In essence, allowing the market to correct what needs correcting without reacting, accepting periodic declines in your portfolio's value, and adjusting intelligently along the way.

All that said---simply for our edification---I will be offering up deeper insights into the issues du jour as 2014 unfolds.

Here's a link to Franklin Templeton's Mark Mobius's (he's been the emerging markets guru for as long as I can remember) latest commentary on the present state of emerging markets...

Friday, January 31, 2014

Market Commentary (audio)

Click the play button below for today's commentary...

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-31-14.m4a"][/audio]

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-31-14.m4a"][/audio]

Tuesday, January 28, 2014

Market Commentary (audio)...

Click the play button for today's commentary:

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-29-14.m4a"][/audio]

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-29-14.m4a"][/audio]

Monday, January 27, 2014

Policy battle scars - and - The definition of ludicrous...

"The bad economist sees only what the effect of a given policy has been or will be on one particular group; the good economist inquires also what the effect of the policy will be on all groups." Henry Hazlitt

Here's economist Paul Krugman this morning:

Now, just to be clear, the very rich, and those on Wall Street in particular, are in fact doing worse under Mr. Obama than they would have if Mitt Romney had won in 2012. Between the partial rollback of the Bush tax cuts and the tax hike that partly pays for health reform, tax rates on the 1 percent have gone more or less back to pre-Reagan levels. Also, financial reformers have won some surprising victories over the past year, and this is bad news for wheeler-dealers whose wealth comes largely from exploiting weak regulation. So you can make the case that the 1 percent have lost some important policy battles.

Let's inquire into what the effect of those "important" policy battles has been on other groups:

The partial rollback of the Bush tax cuts, the health reform tax hike, and the threat of yet more tax increases have induced what you would call tax policy uncertainty. Add in regulatory uncertainty and you have a recipe for a serious lack of job-creating capital investment, which, like (go figure) job growth, has been anemic of late. So perhaps the 1 percent aren't the only ones who've lost some "important" policy battles. I wonder how the whole inequality narrative would play against a healthier employment backdrop?

Now, if you read Krugman's article, and happen to consider yourself a "progressive", you'll take issue with my issue. You'll chastise me for not pointing out that Krugman is mainly targeting Wall Street "wheeler-dealers". And while you'd be right (mainly), I'd chastise you back for not acknowledging that, per the above excerpt, the scope of his disdain indeed encompasses "the very rich" beyond Wall Street as well.

And, besides, the tax hikes were not targeted at merely the Wall Street rich---and the financial industry is clearly not the only one suffering from regulatory anxiety. In fact I'd argue that of all the industries dealing with a stricter regulatory regime, the financial industry is by far the coziest with the regulators.

The funny thing is, as I've stated here before, Krugman often makes legitimate points with regard to the pernicious concentration of power wielded by "organized money", but his insistence that some solution lies in placing yet more power in the hands of the very individuals (politicians) who empower those power-wielders is the definition of ludicrous.

Krugman demonstrates time and again his unwillingness to look beneath the surface of his many assertions (I suspect he fears that what he'd find wouldn't sit well with his fans). And while this propensity secures his popularity, it, sadly, makes him .... well, read again my opening quote.

Sunday, January 26, 2014

Next week...

The reason the market's been so volatile of late is obvious, it's because I'll be on vacation next week :(. And since I won't be around to comment on the goings on---to help you maintain a healthy long-term perspective on short-term developments---I thought I'd turn you over to some of today's regularly published pundits. Here are this morning's headlines followed, in italics, by my pithy perspectifying.

Stocks May Fall Again as Fed Stays Course

Stocks will fall again, eventually, regardless of what the Fed does. And by the way let's hope to hell they do stay the course (that would be continuing to cut back QE), so the economy can correct whatever imbalances have resulted from all that "stimulus".

Volatility is Your Friend

Okay. That's one of those statements that I could do so much with I don't even know where to begin.

Corrections Fears Are Overblown: Buy the Dip

No doubt the advice of a fully invested chap who's been predicting great things for 2014.

Bullish Percent Indicators Reflect Healthy Correction

Bullish, Bearish, Piggish, Shmiggish---a correction here regardless of the indicators would be healthy.

Stock Market Shock Dictates Continued Avoidance of Passive Long Positions

Okay, then you should try to time the stock market. Yeah, that'll work.

Weakness Likely to Spill Over Into This Week, Though Short-Term Bottom Near

No doubt the words of a man who woke up this morning with a hunch... Well, shoot, I'd love to stick with that snide remark, but it's not fair to the pundit. His prediction comes from his in-depth analysis of where the market and its various sectors sit in relation to their 20, 50 and 200 day moving averages, momentum indicators, market breadth and the action in foreign markets. While I'm not big on technical analysis, I, being an advisor to long-term investors, do track the 200 day MAs for the various sectors we hold. And, yes, that is one of the indicators suggesting that the long-term trend remains intact. Although things can change in a hurry.

Welcome Janet Yellen, now don't screw it up!

When I read this title I had the thought that these are the words of a man who doesn't understand that no one, even the FOMC, can safely steer an economy. But I was pleasantly surprised to read that he and I are on the same page when it comes to tapering QE. Here's his final paragraph:

Markets May Tank on Emerging Market Chaos

The market will tank now and again on any of an infinite array of possibilities. The secret to sanity is to maintain an asset mix that is consistent with your temperament (meaning one that won't incite you into panicky selling during the inevitable tanking) and your time horizon (the younger you are---the further away you are from spending your portfolio---the more volatility you can justify).

So there you have it. Actually, there you have eight "it"s. Just pick the one you like (the last one, the last one) and stick with it. You're then free to focus on other things as the market meanders its way into the next week, the next month, the next year, etc.

Have a great week!

Marty

Stocks May Fall Again as Fed Stays Course

Stocks will fall again, eventually, regardless of what the Fed does. And by the way let's hope to hell they do stay the course (that would be continuing to cut back QE), so the economy can correct whatever imbalances have resulted from all that "stimulus".

Volatility is Your Friend

Okay. That's one of those statements that I could do so much with I don't even know where to begin.

Corrections Fears Are Overblown: Buy the Dip

No doubt the advice of a fully invested chap who's been predicting great things for 2014.

Bullish Percent Indicators Reflect Healthy Correction

Bullish, Bearish, Piggish, Shmiggish---a correction here regardless of the indicators would be healthy.

Stock Market Shock Dictates Continued Avoidance of Passive Long Positions

Okay, then you should try to time the stock market. Yeah, that'll work.

Weakness Likely to Spill Over Into This Week, Though Short-Term Bottom Near

No doubt the words of a man who woke up this morning with a hunch... Well, shoot, I'd love to stick with that snide remark, but it's not fair to the pundit. His prediction comes from his in-depth analysis of where the market and its various sectors sit in relation to their 20, 50 and 200 day moving averages, momentum indicators, market breadth and the action in foreign markets. While I'm not big on technical analysis, I, being an advisor to long-term investors, do track the 200 day MAs for the various sectors we hold. And, yes, that is one of the indicators suggesting that the long-term trend remains intact. Although things can change in a hurry.

Welcome Janet Yellen, now don't screw it up!

When I read this title I had the thought that these are the words of a man who doesn't understand that no one, even the FOMC, can safely steer an economy. But I was pleasantly surprised to read that he and I are on the same page when it comes to tapering QE. Here's his final paragraph:

I'd love to see Yellen continue the taper to invite further buying opportunities. This way, the next time the market continues another leg up over 16,000, the move will be au naturale and healthy, just like our recovering domestic economy.

Markets May Tank on Emerging Market Chaos

The market will tank now and again on any of an infinite array of possibilities. The secret to sanity is to maintain an asset mix that is consistent with your temperament (meaning one that won't incite you into panicky selling during the inevitable tanking) and your time horizon (the younger you are---the further away you are from spending your portfolio---the more volatility you can justify).

So there you have it. Actually, there you have eight "it"s. Just pick the one you like (the last one, the last one) and stick with it. You're then free to focus on other things as the market meanders its way into the next week, the next month, the next year, etc.

Have a great week!

Marty

Friday, January 24, 2014

How quickly skin can thin. (Q and A)

Let's eavesdrop on Q (the concerned investor) and A (the sage adviser) as they discuss this week's stock market:

Q: The market got creamed the past couple of days. How come?

A: Because some stockholders have decided to sell and buyers aren't willing to pay last week's prices.

Q: Yeah yeah, we've had that discussion before. Just get to why the market's selling off.

A: Oh, alright... If you believe the headlines it's because emerging market currencies have been getting whacked lately.

Q: Okay, so why is that?

A: While there are no doubt some country-specific issues involved, here's how I see things from a purely global perspective. Over the past few years emerging markets have seen monster inflows of capital, much of which came from speculators leveraging the Fed's ultra-easy monetary policy. The idea being that if the U.S. is going to print a trillion dollars a year, the dollar itself has to lose ground against certain other countries' currencies. So speculators borrow dollars at incredibly low interest rates then buy the foreign currencies they believe will appreciate against the dollar. If they're right and the dollar tanks against their currency of choice, they can make a bundle in a hurry. However, they're taking a bundle of risk in the process. If, say, the Fed looks to back off the money-creating, and the dollar looks, therefore, to increase against their currency of choice, they stand to lose a bundle as all those who were looking to exploit the same opportunity reverse their positions, thus killing the value of those other currencies. Add in a bit of utter stupidity on the part of foreign leaders who would institute capital controls (try to keep the money in the country) and you have the recipe for a nasty bit of selling. That's what's happening as we speak.

Q: But you've been so positive on emerging markets. What are you thinking now?

A: My optimism had/has nothing whatsoever to do with money flows inspired by the actions of central bankers. I remain long-term bullish based on some very basic facts. Such as: 85% of the world lives in emerging markets, younger populations live in emerging markets, infrastructure needs are extreme in many emerging markets, and lives are improving dramatically in many emerging markets. That said, the old risk/reward trade off (the higher the risk the higher the reward) exists in emerging markets like it does nowhere else. The potential reward is extreme, but, make no mistake, all manner of risk---market, political, inflation, business, currency---is extreme as well. You go there with a modest amount of your portfolio and you exercise patience.

Q: So this selloff is all about emerging markets and it's nothing to worry about?

A: No, I don't believe it's all about emerging markets, and whether or not you worry is entirely up to you.

Q: So what else is going on?

A: Well, recently reported earnings, while not horrible, have been a bit of a disappointment. I think that may have some folks rethinking 2014. Plus, a few recent economic data points have come in weaker than expected.

But here's the thing, the stock market can't simply go up forever---as much as folks would like it to. It's kinda funny how seemingly thick-skinned investors will tell you we need a good 10+% correction just to keep people honest. But when it begins to happen---and Dow 16,500 starts heading toward Dow 14,850---you'd think the whole world's coming to an end. You'd think, for example, that the default of a few fancy Chinese investment schemes will spell doom to financial life as we know it. It's amazing how quickly skin can thin...

Q: So do you think we're finally going to see that 10% correction?

A: I know we're finally going to see it.

Q: So this is it?

A: Uh, I don't know, maybe, maybe not.

Q: Is 10% as bad as it'll get?

A: No, I think it'll get a lot worse.

Q: Seriously?

A: Duh!

Q: So you're thinking this is the start of the next bear market?

A: No, that's not what I'm thinking, although it's possible. What I'm saying is, there is no doubt in my mind that one day we'll see the next bear market. I just can't tell you when.

Q: Do you think the market is expensive right now?

A: It depends on what stock, what sector, what country, and what valuation metric you're looking at. There's the q-ratio that values stocks by dividing the price of the entire market by the replacement cost of every publicly traded company. By that measure, while it remains a long way below where it was before the tech bubble burst, the U.S. market's trading on the high side. If you're looking at P/E (price to earnings) ratios, stocks are historically okay here---unless interest rates spike and earnings don't.

Q: So should I be worried?

A: Like I said, that's up to you. I'd be worried a year from now if we don't get some sort of a correction this year. I think it's way overdue, but I thought that last year as well. Thank goodness we didn't trade that thought.

Q: Should we be doing anything?

A: Yes, we should continue rebalancing your portfolio a couple times a year. If the market continues to decline we'll be buying back to your target when it's time to rebalance. If it continues higher, we'll be selling, like we've been doing for the past few years. With a little sector-tweaking in the process.

Q: So business as usual?

A: Yep, for now...

Q: The market got creamed the past couple of days. How come?

A: Because some stockholders have decided to sell and buyers aren't willing to pay last week's prices.

Q: Yeah yeah, we've had that discussion before. Just get to why the market's selling off.

A: Oh, alright... If you believe the headlines it's because emerging market currencies have been getting whacked lately.

Q: Okay, so why is that?

A: While there are no doubt some country-specific issues involved, here's how I see things from a purely global perspective. Over the past few years emerging markets have seen monster inflows of capital, much of which came from speculators leveraging the Fed's ultra-easy monetary policy. The idea being that if the U.S. is going to print a trillion dollars a year, the dollar itself has to lose ground against certain other countries' currencies. So speculators borrow dollars at incredibly low interest rates then buy the foreign currencies they believe will appreciate against the dollar. If they're right and the dollar tanks against their currency of choice, they can make a bundle in a hurry. However, they're taking a bundle of risk in the process. If, say, the Fed looks to back off the money-creating, and the dollar looks, therefore, to increase against their currency of choice, they stand to lose a bundle as all those who were looking to exploit the same opportunity reverse their positions, thus killing the value of those other currencies. Add in a bit of utter stupidity on the part of foreign leaders who would institute capital controls (try to keep the money in the country) and you have the recipe for a nasty bit of selling. That's what's happening as we speak.

Q: But you've been so positive on emerging markets. What are you thinking now?

A: My optimism had/has nothing whatsoever to do with money flows inspired by the actions of central bankers. I remain long-term bullish based on some very basic facts. Such as: 85% of the world lives in emerging markets, younger populations live in emerging markets, infrastructure needs are extreme in many emerging markets, and lives are improving dramatically in many emerging markets. That said, the old risk/reward trade off (the higher the risk the higher the reward) exists in emerging markets like it does nowhere else. The potential reward is extreme, but, make no mistake, all manner of risk---market, political, inflation, business, currency---is extreme as well. You go there with a modest amount of your portfolio and you exercise patience.

Q: So this selloff is all about emerging markets and it's nothing to worry about?

A: No, I don't believe it's all about emerging markets, and whether or not you worry is entirely up to you.

Q: So what else is going on?

A: Well, recently reported earnings, while not horrible, have been a bit of a disappointment. I think that may have some folks rethinking 2014. Plus, a few recent economic data points have come in weaker than expected.

But here's the thing, the stock market can't simply go up forever---as much as folks would like it to. It's kinda funny how seemingly thick-skinned investors will tell you we need a good 10+% correction just to keep people honest. But when it begins to happen---and Dow 16,500 starts heading toward Dow 14,850---you'd think the whole world's coming to an end. You'd think, for example, that the default of a few fancy Chinese investment schemes will spell doom to financial life as we know it. It's amazing how quickly skin can thin...

Q: So do you think we're finally going to see that 10% correction?

A: I know we're finally going to see it.

Q: So this is it?

A: Uh, I don't know, maybe, maybe not.

Q: Is 10% as bad as it'll get?

A: No, I think it'll get a lot worse.

Q: Seriously?

A: Duh!

Q: So you're thinking this is the start of the next bear market?

A: No, that's not what I'm thinking, although it's possible. What I'm saying is, there is no doubt in my mind that one day we'll see the next bear market. I just can't tell you when.

Q: Do you think the market is expensive right now?

A: It depends on what stock, what sector, what country, and what valuation metric you're looking at. There's the q-ratio that values stocks by dividing the price of the entire market by the replacement cost of every publicly traded company. By that measure, while it remains a long way below where it was before the tech bubble burst, the U.S. market's trading on the high side. If you're looking at P/E (price to earnings) ratios, stocks are historically okay here---unless interest rates spike and earnings don't.

Q: So should I be worried?

A: Like I said, that's up to you. I'd be worried a year from now if we don't get some sort of a correction this year. I think it's way overdue, but I thought that last year as well. Thank goodness we didn't trade that thought.

Q: Should we be doing anything?

A: Yes, we should continue rebalancing your portfolio a couple times a year. If the market continues to decline we'll be buying back to your target when it's time to rebalance. If it continues higher, we'll be selling, like we've been doing for the past few years. With a little sector-tweaking in the process.

Q: So business as usual?

A: Yep, for now...

Thursday, January 23, 2014

Market Commentary (audio)

Click the play button below for today's commentary...

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-24-14.m4a"][/audio]

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-24-14.m4a"][/audio]

Yet more minimum wage commonsense...

Here's Don Boudreaux making perfect commonsense on the minimum wage topic:

A Note To All Socially Conscious Consumers:

To those of you who like to engage in ‘socially conscious’ consumption, here’s a partial list of companies that you might wish to boycott on the grounds that they are anti-poor. These companies, if this account is correct, are petitioning in support of raising the minimum wage – a policy that makes it illegal for anyone whose skill-sets are very low to work. Not only does such legislation deny these poorest of poor denizens of America opportunities today to earn income, it prevents these poor people from gaining the work experience and on-the-job skills that they would get by being employed. Such cruel and anti-social businesses do not deserve your consumer patronage.

• Costco

• Eileen Fisher

• Ben & Jerry’s

• Dansko

• New Belgium Brewing

• Parnassus Investments

• Organic Valley

• Zingerman’s

A snippet from An Open Letter to a Business Owner Who Supports Raising the Minimum Wage (be sure to read the entire letter):

Your statement raises many questions. For example: if all employers would be better able to “stay competitive” by paying all of their workers wages above the current minimum, why do they not already do so? After all, you now pay such higher wages. Why do you suppose that your particular business plan will work equally well for other firms? Asked differently, why do you presume that other business owners are so inept that they’re leaving easy money on the table?

If history is any guide, you – a business owner who supports a higher minimum wage – actually presume no such ineptness on the part of your competitors. Your support for raising the minimum wage is almost surely driven by your wish to increase your profitability by throttling your competitors.

A Note To All Socially Conscious Consumers:

To those of you who like to engage in ‘socially conscious’ consumption, here’s a partial list of companies that you might wish to boycott on the grounds that they are anti-poor. These companies, if this account is correct, are petitioning in support of raising the minimum wage – a policy that makes it illegal for anyone whose skill-sets are very low to work. Not only does such legislation deny these poorest of poor denizens of America opportunities today to earn income, it prevents these poor people from gaining the work experience and on-the-job skills that they would get by being employed. Such cruel and anti-social businesses do not deserve your consumer patronage.

• Costco

• Eileen Fisher

• Ben & Jerry’s

• Dansko

• New Belgium Brewing

• Parnassus Investments

• Organic Valley

• Zingerman’s

A snippet from An Open Letter to a Business Owner Who Supports Raising the Minimum Wage (be sure to read the entire letter):

Your statement raises many questions. For example: if all employers would be better able to “stay competitive” by paying all of their workers wages above the current minimum, why do they not already do so? After all, you now pay such higher wages. Why do you suppose that your particular business plan will work equally well for other firms? Asked differently, why do you presume that other business owners are so inept that they’re leaving easy money on the table?

If history is any guide, you – a business owner who supports a higher minimum wage – actually presume no such ineptness on the part of your competitors. Your support for raising the minimum wage is almost surely driven by your wish to increase your profitability by throttling your competitors.

Wednesday, January 22, 2014

Market Commentary (audio)

Click the play button below for today's commentary:

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-23-14.m4a"][/audio]

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-23-14.m4a"][/audio]

Into new woods - and - one thing the market has going for it...

Good news for the stock market: We're out of the woods. That is, we're, for the moment, beyond any major political risk stemming from budget and debt ceiling battles in the U.S. (I'm guessing Congress will concede the debt ceiling next month with little more than a whimper). We're also, in my view, just beyond the risk that the Fed tapering its bond purchases (AKA quantitative easing [QE]) will majorly roil the stock market---although a strong wind could push us right back into those woods. We're, thus, beyond any near-term recession risk ("strong wind" caveat applies there as well), and if the IMF has it right the global economy (Europe even) will pick up a little steam in 2014. So, Whew!!

Of course we can't forget what "out of the woods" essentially means---it means we've made it through a particular set of challenges. Perhaps, therefore, we should say we're out of the woods we were just in. And there's nothing about finding our way beyond one set of woods that keeps us from entering another. Which by the way we have.

While it'll be refreshing, if I'm right, to not be so focused on Congress (at least till we approach the mid-terms this fall) and the Fed in '14, our eyes will be straining to see through the forest of corporate earnings (reported and estimated), of interest rates rising in response, let's hope, to a growing economy, of market valuations worthy of close scrutiny (earnings will need to handily beat expectations to justify today's valuations, particularly when interest rates begin to rise) and of a number of other potentialities that, if I were to address each one, would put you to sleep (if I haven't already).

So I'll cut to the chase here and tell you what I see as one potentially big thing the stock market has going for it going forward: The fact that it's reached its present level while corporations worldwide remain perched atop trillions in zero-interest-earning cash. Companies have been able, either through cost cutting, accounting tricks or share buybacks---or all three---to report consistently improving earnings (justifying the bidding up of their share prices) for the past several years. Last year, however, was a year of multiple (as in price to earnings [P/E] multiple) expansion. Which means share prices grew at a substantially faster pace than did per share earnings. Now there's nothing horrible about that---as long as P/Es don't get ridiculously stretched (as they did in the late '90s), and as long as earnings growth accelerates a bit from here. Why is a pick up in the rate of earnings growth so essential at this juncture? It's because P/E multiples tend to contract during periods of rising interest rates. And multiples contract in one of two ways, as a result of rising earnings or of falling stock prices. Which takes us back to what I keep saying---for the stock market to withstand higher interest rates, higher interest rates have to come as a result of a faster growing economy.

Now, back to all that corporate cash. There are two schools of thought: The prevailing one among policymakers and Keynesian economists is, alas, (in my humble view) the wrong one---that consumption grows the economy. The other one, the correct one, says that production grows the economy---that, ultimately, we must produce before we can consume (read Goods Buy Goods). Which speaks volumes about one of the chief reasons why we remain mired in a historically slow recovery: it's that companies have been reluctant to invest in the research, development and, eventually, the production of new stuff---the kinds of activities that would grow the economy and put people to work. I'd love to explore with you why companies have, to this point, idled the fuel that would propel themselves and the global economy to greater heights, but that would take more time than you and I can spare at the moment (just think new regs, the probability of more new regs, and the threat of higher taxes). So, for now, suffice it to say that despite what I just alluded to, I suspect (or hope) that---barring the next Great Recession occurring anytime soon---companies are about to begin (ever so gingerly, alas) doing more than simply buying back their own stock with all that cash. Which, again, could do wonders for the economy, employment, and, ultimately, earnings growth and share prices going forward. Time will tell...

Of course we can't forget what "out of the woods" essentially means---it means we've made it through a particular set of challenges. Perhaps, therefore, we should say we're out of the woods we were just in. And there's nothing about finding our way beyond one set of woods that keeps us from entering another. Which by the way we have.

While it'll be refreshing, if I'm right, to not be so focused on Congress (at least till we approach the mid-terms this fall) and the Fed in '14, our eyes will be straining to see through the forest of corporate earnings (reported and estimated), of interest rates rising in response, let's hope, to a growing economy, of market valuations worthy of close scrutiny (earnings will need to handily beat expectations to justify today's valuations, particularly when interest rates begin to rise) and of a number of other potentialities that, if I were to address each one, would put you to sleep (if I haven't already).

So I'll cut to the chase here and tell you what I see as one potentially big thing the stock market has going for it going forward: The fact that it's reached its present level while corporations worldwide remain perched atop trillions in zero-interest-earning cash. Companies have been able, either through cost cutting, accounting tricks or share buybacks---or all three---to report consistently improving earnings (justifying the bidding up of their share prices) for the past several years. Last year, however, was a year of multiple (as in price to earnings [P/E] multiple) expansion. Which means share prices grew at a substantially faster pace than did per share earnings. Now there's nothing horrible about that---as long as P/Es don't get ridiculously stretched (as they did in the late '90s), and as long as earnings growth accelerates a bit from here. Why is a pick up in the rate of earnings growth so essential at this juncture? It's because P/E multiples tend to contract during periods of rising interest rates. And multiples contract in one of two ways, as a result of rising earnings or of falling stock prices. Which takes us back to what I keep saying---for the stock market to withstand higher interest rates, higher interest rates have to come as a result of a faster growing economy.

Now, back to all that corporate cash. There are two schools of thought: The prevailing one among policymakers and Keynesian economists is, alas, (in my humble view) the wrong one---that consumption grows the economy. The other one, the correct one, says that production grows the economy---that, ultimately, we must produce before we can consume (read Goods Buy Goods). Which speaks volumes about one of the chief reasons why we remain mired in a historically slow recovery: it's that companies have been reluctant to invest in the research, development and, eventually, the production of new stuff---the kinds of activities that would grow the economy and put people to work. I'd love to explore with you why companies have, to this point, idled the fuel that would propel themselves and the global economy to greater heights, but that would take more time than you and I can spare at the moment (just think new regs, the probability of more new regs, and the threat of higher taxes). So, for now, suffice it to say that despite what I just alluded to, I suspect (or hope) that---barring the next Great Recession occurring anytime soon---companies are about to begin (ever so gingerly, alas) doing more than simply buying back their own stock with all that cash. Which, again, could do wonders for the economy, employment, and, ultimately, earnings growth and share prices going forward. Time will tell...

Today's TV Segment (video)

This morning Zara discussed this year's market backdrop and how it differs from 2013's. Click here to view...

Tuesday, January 21, 2014

Market Commentary (audio)

Click the play button below for today's commentary. If this doesn't work on your device, please email me at marty@pwadvisorsinc.com and I'll send you the audio file...

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-21-14.m4a"][/audio]

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-21-14.m4a"][/audio]

Monday, January 20, 2014

A determined campaign of optical obfuscation, of distortion by dilution...

Please read Paul Krugman's article before continuing.

Convincing stuff? Well, read on:

The reality of rising income in America is encouraging. Since the late 1970s the lives of the bottom half of the workforce have improved measurably right along with the incomes of the top 1 percent, while "progressives"---amid a nation (top to bottom) full of cell phones and satellite TVs, Blue Rays and X-Boxes, microwaves and cordless mouses, and myriad etceteras and etceteras---dispute reality with statistics that merely measure the growth, lack thereof actually, in wages over the past few decades. That's right, even some economists, make that "progressive" economists, go there and insult the intelligence of every American with functioning eyeballs. They talk of "numbers", but never of notebooks.

The numbers are their open invitation to bring out that age-old political weapon that, when deployed at the right moment---like when the economy is contracting, or growing slowly---works oh so well: that would be the inciting of class warfare. It's a determined campaign of optical obfuscation. At its cruder end this campaign comes close to outright falsification; at its more sophisticated end it involves using fancy footwork to propagate what I think of as the myth of middle-class stagnation.

For examples of de facto falsification, one need look no further than the recent columns by Paul Krugman of the New York Times. Krugman revels in insulting every economist, and any(sighted)one else who would dare point his fellow citizens past the ends of their noses. The story goes like this: America's affluent are affluent at the expense of everyone else. "At this point", in his own words, "the rise of the 1 percent at the expense of everyone else is so obvious that it's no longer possible to shut down any discussion of rising inequality with cries of "class warfare"." He wields his bravado in such a way that you almost believe you've been, to this point, oblivious to the "obvious". Then you come to your commonsenses and realize that it is Krugman, never your eyes, that would deceive you---that what's truly "so obvious" is that folks on every rung of the income ladder are visibly better off today than they've ever been.

O.K., that's what crude obfuscation looks like. What about the fancier version?

Krugman loves to cite the works of "progressive" think tanks, like the Economic Policy Institute. In his latest he links to a column written by Lawrence Mishel and Colin Gordon showing a 1973-2012 real wages chart for all workers. It supports Krugman's assertion, proves it actually, that real wages for the bottom half of the workforce have stagnated or fallen. Here's a snippet from their article:

I guess the "fruits" group doesn't include cell phones and satellite TVs.

Not only is that fancy obfuscation, it's pure political genius (it makes voting victims out of non-victims). Although it should be viewed---in the face of present-day's ubiquitous amenities---as the most disgusting political manipulation.

Oh, and A HUGE by the way, the Economic Policy Institute calls itself "a non-partisan think tank". Now note above the assertion that "Shared prosperity rests on policies and institutions (collective bargaining, a decent minimum wage, strong labor standards, etc.) that sustain the bargaining power of workers." Hmm... "collective bargaining", "labor standards", "bargaining power of workers"...Hmm... smells a little fishy. I wonder who chairs the board of the EPI? Let's click on the Board of Directors tab and see. Ooookay, now it's making sense: The chairman of the (cough cough) non-partisan Economic Policy Institute is---you ready?---none other than good old Richard Trumka, President of the AFL-CIO!! And this would be Krugman's idea of a credible source. Oh my!!

So then, how can the myth of middle class stagnation be sustained? Mainly through a strategy of distortion by dilution. You almost never hear class warmongers talk about the glaring contrast between life in the 70s and life today. Instead they talk about "real wages". This may sound like an innocent choice, but it's not, because it misses the miracles of virtually all manner of technology stemming from a system that rewards the inventors, innovators and distributors of those miracles.

Think of it this way, the fortunes (okay, the wages) of those who deliver the goods and services that allow the rest of us to enjoy so much more wealth per dollar earned (that would be "shared prosperity") will of course grow faster than the wages of the rest of us---as they should.

In closing, I can't help but sympathize with Krugman on one point. He states:

While the finance industry has no doubt played an essential role in the development of the material miracles highlighted above, I do deeply share the frustration that many (not all) of those who were so instrumental in the inflating of the real estate/mortgage backed securities bubble walked away, wealth intact. What is utterly amazing, and unconscionable, is that the likes of Krugman would have us place yet more power in the institution (the Federal Government) that fed those fat cats the fruits of other people's labor. Oh my!!

Convincing stuff? Well, read on:

The reality of rising income in America is encouraging. Since the late 1970s the lives of the bottom half of the workforce have improved measurably right along with the incomes of the top 1 percent, while "progressives"---amid a nation (top to bottom) full of cell phones and satellite TVs, Blue Rays and X-Boxes, microwaves and cordless mouses, and myriad etceteras and etceteras---dispute reality with statistics that merely measure the growth, lack thereof actually, in wages over the past few decades. That's right, even some economists, make that "progressive" economists, go there and insult the intelligence of every American with functioning eyeballs. They talk of "numbers", but never of notebooks.

The numbers are their open invitation to bring out that age-old political weapon that, when deployed at the right moment---like when the economy is contracting, or growing slowly---works oh so well: that would be the inciting of class warfare. It's a determined campaign of optical obfuscation. At its cruder end this campaign comes close to outright falsification; at its more sophisticated end it involves using fancy footwork to propagate what I think of as the myth of middle-class stagnation.

For examples of de facto falsification, one need look no further than the recent columns by Paul Krugman of the New York Times. Krugman revels in insulting every economist, and any(sighted)one else who would dare point his fellow citizens past the ends of their noses. The story goes like this: America's affluent are affluent at the expense of everyone else. "At this point", in his own words, "the rise of the 1 percent at the expense of everyone else is so obvious that it's no longer possible to shut down any discussion of rising inequality with cries of "class warfare"." He wields his bravado in such a way that you almost believe you've been, to this point, oblivious to the "obvious". Then you come to your commonsenses and realize that it is Krugman, never your eyes, that would deceive you---that what's truly "so obvious" is that folks on every rung of the income ladder are visibly better off today than they've ever been.

O.K., that's what crude obfuscation looks like. What about the fancier version?

Krugman loves to cite the works of "progressive" think tanks, like the Economic Policy Institute. In his latest he links to a column written by Lawrence Mishel and Colin Gordon showing a 1973-2012 real wages chart for all workers. It supports Krugman's assertion, proves it actually, that real wages for the bottom half of the workforce have stagnated or fallen. Here's a snippet from their article:

Low– and middle-wage men and women lose ground across this era—a pattern interrupted only by the sustained growth, low unemployment, and minimum wage increases of the late 1990s. The growing wage inequality fed greater household income inequality (wages and salaries make up more than three-quarters of median family income) as those at the top received disproportionate wage gains. And the lessons are clear as well: Shared prosperity rests on policies and institutions (collective bargaining, a decent minimum wage, strong labor standards, etc.) that sustain the bargaining power of workers. In the absence of those institutions, only exceptional stretches of full employment have interrupted the failure of the wages, incomes, and living standards of ordinary Americans to benefit from the fruits of economic growth.

I guess the "fruits" group doesn't include cell phones and satellite TVs.

Not only is that fancy obfuscation, it's pure political genius (it makes voting victims out of non-victims). Although it should be viewed---in the face of present-day's ubiquitous amenities---as the most disgusting political manipulation.

Oh, and A HUGE by the way, the Economic Policy Institute calls itself "a non-partisan think tank". Now note above the assertion that "Shared prosperity rests on policies and institutions (collective bargaining, a decent minimum wage, strong labor standards, etc.) that sustain the bargaining power of workers." Hmm... "collective bargaining", "labor standards", "bargaining power of workers"...Hmm... smells a little fishy. I wonder who chairs the board of the EPI? Let's click on the Board of Directors tab and see. Ooookay, now it's making sense: The chairman of the (cough cough) non-partisan Economic Policy Institute is---you ready?---none other than good old Richard Trumka, President of the AFL-CIO!! And this would be Krugman's idea of a credible source. Oh my!!

So then, how can the myth of middle class stagnation be sustained? Mainly through a strategy of distortion by dilution. You almost never hear class warmongers talk about the glaring contrast between life in the 70s and life today. Instead they talk about "real wages". This may sound like an innocent choice, but it's not, because it misses the miracles of virtually all manner of technology stemming from a system that rewards the inventors, innovators and distributors of those miracles.

Think of it this way, the fortunes (okay, the wages) of those who deliver the goods and services that allow the rest of us to enjoy so much more wealth per dollar earned (that would be "shared prosperity") will of course grow faster than the wages of the rest of us---as they should.

In closing, I can't help but sympathize with Krugman on one point. He states:

And who are these lucky few? Mainly they're executives of some kind, especially, although not only, in finance. You can argue about whether these people deserve to be paid so well, but one thing is clear: They didn't get where they are simply by being prudent, clean and sober.

While the finance industry has no doubt played an essential role in the development of the material miracles highlighted above, I do deeply share the frustration that many (not all) of those who were so instrumental in the inflating of the real estate/mortgage backed securities bubble walked away, wealth intact. What is utterly amazing, and unconscionable, is that the likes of Krugman would have us place yet more power in the institution (the Federal Government) that fed those fat cats the fruits of other people's labor. Oh my!!

Sunday, January 19, 2014

We Clean Our Own Office - Or - Utterly Shameful!

We clean our own office---uh, actually, the staff cleans our office. Seven years ago, when we moved in---when we left the parent company and struck out on our own---my partners and I assumed we'd hire a cleaning service to tidy up the place at the end of each day, like the old company did. Well, after receiving a few quotes---to clean our moderate-sized facility housing nine individuals---we scratched our heads in puzzlement (seriously we each sat there scratching our heads). While I can't remember the exact numbers, suffice it to say that hiring a maid-service made no sense to us. As it stands the place always seems to sparkle, and I don't even know when Gladys and the gang gets to it (the bathroom, btw, is out in the common area and not our responsibility).

Yeah, I know, my bad. You'd think an investment consultant, business owner who writes on the economy would have thoroughly explored the question of productivity---of having handsomely-paid staff perform menial labor. As you'll see in a second---not that this answers the productivity question---we have unusual staff.

Now, let's say there's a teenager living in the apartment complex down the street who could use a few extra bucks for himself, or to help his parent(s) make ends meet. How refreshing would it be for the young fella to garner the courage to walk over to our complex and knock on a few doors? He might wander into our office and inquire as to whether we'd consider hiring him to clean up the place a few days a week. I'd have to ask Gladys to know for sure, but I'm guessing that---to do a job worthy of remuneration---it'd take one person at least 3 hours each time. Beginning this July 1st, the minimum wage in California will be $9 per hour. It's currently $8, but knowing that it's about to become $9 (then $10 on January 1, 2016), I'm calculating $9. So, assuming 3 hours a day, 3 days a week, we'd be spending (forgetting payroll taxes to keep it simple) about $350 a month (roughly $400 come 1/1/16). Actually, that doesn't sound half bad. However, knowing Gladys (my admin assistant/office manager for the past 20+ years) she'd tell me "NO WAY!" (she's remarkably responsible with her employer's money, and she's not to be crossed). She and the rest of the staff seem to have a system that works (and there's no cleaning a bathroom), and nobody's complaining.

Now, what if we and the unemployed teenager were unshackled by the minimum wage law? What if he came a knocking and opened negotiations with, say, a $9 an hour offer? Being that I'd have no choice but to have Gladys handle it, $9 would be a definite no, as would $8, and as would, I strongly suspect, $7. But when we get to $6 or $5, and Gladys starts thinking what else she and the others might be doing with whatever time they spend cleaning, the young man just might have a shot at making a few bucks and, more importantly, knowing what it's like to have a job, to learn responsibility, to take pride in his work, in his tenacity, in his self-sufficiency, to learn how to deal with a tough, hard-nosed boss (that would be Gladys), etc. I'm seriously getting goosebumps as I type!

But, damn!, reality just set in. It's not going to happen. Not because there's no willing teenager next door---not because there's no price low enough to get Gladys's attention---but because one of the most discriminatory laws on the books entirely destroys the opportunity. It's utterly shameful!

I know what you're thinking, fast food. That's what I did after school (Der Wienerschnitzel) my junior year for something like $2.75 an hour. And there is a Taco Bell just around the corner. A Taco Bell with a franchisee who, I assure you, is trying to figure out how to handle the coming increase in his labor costs.

My little example here is the kind of situation studies---the ones, that is, promoted by proponents of raising the minimum wage---altogether miss. They're not looking at firms like ours whose employees earn way above minimum wage. Firms that might indeed, for the right price, bring in a part-time unskilled worker. They're not considering (or not disclosing, or they're explaining away) the fact that while the nearby Taco Bell franchisee may (let's hope) find other ways (other than laying off workers) to compensate for the hit to labor costs---the odds of that needy, unskilled, unemployed teenager getting hired onwill diminish have diminished (California's already done it) greatly. Again, it's utterly shameful!!

Yeah, I know, my bad. You'd think an investment consultant, business owner who writes on the economy would have thoroughly explored the question of productivity---of having handsomely-paid staff perform menial labor. As you'll see in a second---not that this answers the productivity question---we have unusual staff.

Now, let's say there's a teenager living in the apartment complex down the street who could use a few extra bucks for himself, or to help his parent(s) make ends meet. How refreshing would it be for the young fella to garner the courage to walk over to our complex and knock on a few doors? He might wander into our office and inquire as to whether we'd consider hiring him to clean up the place a few days a week. I'd have to ask Gladys to know for sure, but I'm guessing that---to do a job worthy of remuneration---it'd take one person at least 3 hours each time. Beginning this July 1st, the minimum wage in California will be $9 per hour. It's currently $8, but knowing that it's about to become $9 (then $10 on January 1, 2016), I'm calculating $9. So, assuming 3 hours a day, 3 days a week, we'd be spending (forgetting payroll taxes to keep it simple) about $350 a month (roughly $400 come 1/1/16). Actually, that doesn't sound half bad. However, knowing Gladys (my admin assistant/office manager for the past 20+ years) she'd tell me "NO WAY!" (she's remarkably responsible with her employer's money, and she's not to be crossed). She and the rest of the staff seem to have a system that works (and there's no cleaning a bathroom), and nobody's complaining.

Now, what if we and the unemployed teenager were unshackled by the minimum wage law? What if he came a knocking and opened negotiations with, say, a $9 an hour offer? Being that I'd have no choice but to have Gladys handle it, $9 would be a definite no, as would $8, and as would, I strongly suspect, $7. But when we get to $6 or $5, and Gladys starts thinking what else she and the others might be doing with whatever time they spend cleaning, the young man just might have a shot at making a few bucks and, more importantly, knowing what it's like to have a job, to learn responsibility, to take pride in his work, in his tenacity, in his self-sufficiency, to learn how to deal with a tough, hard-nosed boss (that would be Gladys), etc. I'm seriously getting goosebumps as I type!

But, damn!, reality just set in. It's not going to happen. Not because there's no willing teenager next door---not because there's no price low enough to get Gladys's attention---but because one of the most discriminatory laws on the books entirely destroys the opportunity. It's utterly shameful!

I know what you're thinking, fast food. That's what I did after school (Der Wienerschnitzel) my junior year for something like $2.75 an hour. And there is a Taco Bell just around the corner. A Taco Bell with a franchisee who, I assure you, is trying to figure out how to handle the coming increase in his labor costs.

My little example here is the kind of situation studies---the ones, that is, promoted by proponents of raising the minimum wage---altogether miss. They're not looking at firms like ours whose employees earn way above minimum wage. Firms that might indeed, for the right price, bring in a part-time unskilled worker. They're not considering (or not disclosing, or they're explaining away) the fact that while the nearby Taco Bell franchisee may (let's hope) find other ways (other than laying off workers) to compensate for the hit to labor costs---the odds of that needy, unskilled, unemployed teenager getting hired on

Saturday, January 18, 2014

Are you feeling euphoric?

Good news for stock market bulls this week: The American Association of Individual Investors sentiment survey shows a reduction in bullishness---to 39% from the recent high mark of 55%. Bearishness however has only risen from 18% to a still-low 21%. Which means the move in sentiment has been primarily from bullish to neutral.

I suggested the other day that the, albeit very slight, downward volatility in early January might bring sentiment down a bit. The fact that it has tells me that folks remain jittery, and that's a beautiful thing if you hope for a continued rise in the market.

I believe John Templeton had it right:

He also said, and this one's irrefutable:

Which means, next up is a bear market. The question is, are you feeling euphoric?

I suggested the other day that the, albeit very slight, downward volatility in early January might bring sentiment down a bit. The fact that it has tells me that folks remain jittery, and that's a beautiful thing if you hope for a continued rise in the market.

I believe John Templeton had it right:

Bull markets are born on skepticism, grow on pessimism, mature on optimism and die on euphoria.

He also said, and this one's irrefutable:

There will always be bull markets followed by bear markets followed by bull markets.

Which means, next up is a bear market. The question is, are you feeling euphoric?

Friday, January 17, 2014

Blow blows me away...

What are the issues? What are the polls saying? Seems like inequality is a hot button. Minimum wage. Helping the poor. Middle class stagnation. What's our strategy? Whose support can we buy?

Of course you know where this is headed. Yep, it's an election year. Politicians will be doing what they do 100% of the time, yet with greater brashness. And of course the media's there to oblige. I just read Charles Blow's NY Times OP-ED titled Pro-Progressive Is Better Than Anti-Christie. I think he titled it before he wrote it. I can relate---sometimes you start writing, thinking in one direction, then your writing takes you elsewhere. From the title I figured I'd read a piece on how "progressives" ought to focus on their worthwhile issues. Save for his last paragraph, however, Blow---after recommending a pause for the evidence before condemnation on Bridgegate---devoted his message to labeling Chris Christie a needle-threading flip-flopper.

And, you know, I'm sure he's right. That's right, despite having paid very little attention to the New Jersey governor, I have no doubt that Blow has hit the nail right on Christie's head. How can I say such a thing? You ask. How can I agree, without the evidence, that Christie's a flip-flopper? You're kidding, right? Shoot me an email, if that's truly your thinking, and give me 10 minutes, I'll shoot you back enough links to keep you up till midnight (and I'd be starting completely from scratch). C'mon, he's a career politician!

Now, my sympathizing notwithstanding, I find Blow's point utterly laughable. Oh, and you gotta love this line:

Of course he accurately nailed Romney as well (I wrote on that myself). But the thing is, Blow has the gall to call out Christie and Romney, and make reference to Republicans' preferred dance genre, while suggesting that this gives "progressives" some political advantage---as if "progressive" politicians don't cuff their jeans and flip flop all over the dance floor as well.

Give me a name on the left, any name. The President for crying out loud! His dance has been a show-stopper---but that's because he's presently the dancer with the flashiest outfit, and he's very comfortable out there on the floor. I don't know that he has any more moves than the competition who ache for that spotlight---I suspect he doesn't. And how about Senator Elizabeth Warren---she just popped into my head. Here's a hard-core "progressive" who thinks minimum wage should be like $22 an hour, who clearly believes we should be redistributing, big-time. Except, that is, when her state is home to medical device makers who would get hit with an ACA surtax. All of a sudden, she understands economics. In her own words:

My goodness!! If a 2.3% surtax is a threat to small companies, what do you think a 38% hike (going to $10) in the minimum wage (let alone Ms. Warren's number) would do to them??

See what I mean? When I started typing I had no intent whatsoever to highlight the flip-flopping of Elizabeth Warren. I only meant to express how the intellectual dishonesty of the likes of Charles Blow blows me away...

Of course you know where this is headed. Yep, it's an election year. Politicians will be doing what they do 100% of the time, yet with greater brashness. And of course the media's there to oblige. I just read Charles Blow's NY Times OP-ED titled Pro-Progressive Is Better Than Anti-Christie. I think he titled it before he wrote it. I can relate---sometimes you start writing, thinking in one direction, then your writing takes you elsewhere. From the title I figured I'd read a piece on how "progressives" ought to focus on their worthwhile issues. Save for his last paragraph, however, Blow---after recommending a pause for the evidence before condemnation on Bridgegate---devoted his message to labeling Chris Christie a needle-threading flip-flopper.

And, you know, I'm sure he's right. That's right, despite having paid very little attention to the New Jersey governor, I have no doubt that Blow has hit the nail right on Christie's head. How can I say such a thing? You ask. How can I agree, without the evidence, that Christie's a flip-flopper? You're kidding, right? Shoot me an email, if that's truly your thinking, and give me 10 minutes, I'll shoot you back enough links to keep you up till midnight (and I'd be starting completely from scratch). C'mon, he's a career politician!

Now, my sympathizing notwithstanding, I find Blow's point utterly laughable. Oh, and you gotta love this line:

We've been to this Republican sock hop before --- in 2012 with Mitt Romney.

Of course he accurately nailed Romney as well (I wrote on that myself). But the thing is, Blow has the gall to call out Christie and Romney, and make reference to Republicans' preferred dance genre, while suggesting that this gives "progressives" some political advantage---as if "progressive" politicians don't cuff their jeans and flip flop all over the dance floor as well.

Give me a name on the left, any name. The President for crying out loud! His dance has been a show-stopper---but that's because he's presently the dancer with the flashiest outfit, and he's very comfortable out there on the floor. I don't know that he has any more moves than the competition who ache for that spotlight---I suspect he doesn't. And how about Senator Elizabeth Warren---she just popped into my head. Here's a hard-core "progressive" who thinks minimum wage should be like $22 an hour, who clearly believes we should be redistributing, big-time. Except, that is, when her state is home to medical device makers who would get hit with an ACA surtax. All of a sudden, she understands economics. In her own words:

When Congress taxes the sale of a specific product through an excise tax, as the Affordable Care Act does with medical devices, it too often disproportionately impacts the small companies with the narrowest financial margins...

My goodness!! If a 2.3% surtax is a threat to small companies, what do you think a 38% hike (going to $10) in the minimum wage (let alone Ms. Warren's number) would do to them??

See what I mean? When I started typing I had no intent whatsoever to highlight the flip-flopping of Elizabeth Warren. I only meant to express how the intellectual dishonesty of the likes of Charles Blow blows me away...

Thursday, January 16, 2014

Market Commentary (audio)

Click the play button below for today's commentary. If this doesn't work on your device, please email me at marty@pwadvisorsinc.com and I'll send you the audio file:

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-16-14.m4a"][/audio]

[audio m4a="http://www.betweenthelines.us/wp-content/uploads/1-16-14.m4a"][/audio]

Blog was down yesterday evening...

In case you couldn't get these yesterday's, here are links to my last two blog posts:

THE COLOSSAL, INCALCULABLE COST OF PROTECTIONISM...

EVERYONE WANTS A CORRECTION. THAT IS, UNTIL THEY GET IT...

THE COLOSSAL, INCALCULABLE COST OF PROTECTIONISM...

EVERYONE WANTS A CORRECTION. THAT IS, UNTIL THEY GET IT...

Wednesday, January 15, 2014

The colossal, incalculable cost of protectionism...

Here's Harold Meyerson in today's column, Free Trade and the Loss of U.S. Jobs ,worrying about President Obama's self-negating act of bemoaning rising inequality while promoting a free-trade agreement.

Two out of three displaced workers took lower-paying jobs. Okay, but let's ponder for a moment what else resulted from the relocation of U.S. factories. For sure, U.S. consumers benefited directly from lower cost goods---freeing up income to enjoy elsewhere (like with local, people-employing, merchants) and to save and invest (providing capital for the expansion of job-producing U.S. businesses). Also, for sure, U.S. exporters (employers) benefited from the investment of U.S. dollars those relocating U.S. corporations made abroad (only someone desiring U.S.-made products and services would trade for green-colored paper claims against U.S.-made products and services). One more: What is all too often overlooked is the fact that a major reason U.S. factories relocate abroad is to more efficiently serve those markets---remember, we're merely 4% of the world's population. Investments made in serving the markets---and improving the lot---of those whom we trade with ultimately come back, manifold, as those folks evolve into future customers for U.S. businesses, and, as importantly, suppliers of whatever future goods and services will be best produced on their shores. And, besides, what are the chances that the next world-changing genius will be born on American soil, 4% (I suppose a little higher given our resources)? Shouldn't we, in the PRIVATE SECTOR---for our own future's sake---be doing everything we can to engage our kids' and grandkids' future business partners?

The benefits of protectionism are easy to see because they're showered upon select, identifiable, individuals: The BLS, for example, was able to track manufacturing workers from '09 to '12. Had their previous employers lacked the freedom to relocate those factories, they might still have their old jobs. The costs, on the other hand---the individual not having the discretionary income, the small local businesses not seeing the extra business, the budding entrepreneurs not seeing the added investment, the exporters not seeing the growth abroad, and our future trading partners not having the opportunity to grow better lives and become greater contributors to the world marketplace---while colossal, are less visible, diffuse, and, therefore, incalculable.

Trade agreements that promote the relocation of U.S. corporations’ factories to nations like China and Mexico have played a central role in the evisceration of American manufacturing and the decline in U.S. workers’ incomes. Two out of three displaced manufacturing workers who got new jobs between 2009 and 2012, the Bureau of Labor Statistics reports, experienced wage reductions — most of them greater than 20 percent.

Two out of three displaced workers took lower-paying jobs. Okay, but let's ponder for a moment what else resulted from the relocation of U.S. factories. For sure, U.S. consumers benefited directly from lower cost goods---freeing up income to enjoy elsewhere (like with local, people-employing, merchants) and to save and invest (providing capital for the expansion of job-producing U.S. businesses). Also, for sure, U.S. exporters (employers) benefited from the investment of U.S. dollars those relocating U.S. corporations made abroad (only someone desiring U.S.-made products and services would trade for green-colored paper claims against U.S.-made products and services). One more: What is all too often overlooked is the fact that a major reason U.S. factories relocate abroad is to more efficiently serve those markets---remember, we're merely 4% of the world's population. Investments made in serving the markets---and improving the lot---of those whom we trade with ultimately come back, manifold, as those folks evolve into future customers for U.S. businesses, and, as importantly, suppliers of whatever future goods and services will be best produced on their shores. And, besides, what are the chances that the next world-changing genius will be born on American soil, 4% (I suppose a little higher given our resources)? Shouldn't we, in the PRIVATE SECTOR---for our own future's sake---be doing everything we can to engage our kids' and grandkids' future business partners?

The benefits of protectionism are easy to see because they're showered upon select, identifiable, individuals: The BLS, for example, was able to track manufacturing workers from '09 to '12. Had their previous employers lacked the freedom to relocate those factories, they might still have their old jobs. The costs, on the other hand---the individual not having the discretionary income, the small local businesses not seeing the extra business, the budding entrepreneurs not seeing the added investment, the exporters not seeing the growth abroad, and our future trading partners not having the opportunity to grow better lives and become greater contributors to the world marketplace---while colossal, are less visible, diffuse, and, therefore, incalculable.

Everyone wants a correction. That is, until they get it...

Here's a little update on how I see the current state of the equity markets:

Some of the good news (assuming you view continued rising stock prices from here as a good thing):

Some of the bad news (assuming you would view a correction or bear market here as a bad thing):

I see rising interest rates as the most obvious potential headwind for stocks this year:

The economy picking up will result in higher long-term interest rates. That could be a good thing for banks, in that---assuming short-term rates remain low---they'll access money very cheaply and lend it out at higher rates: If loan demand doesn't wane with higher rates, that bodes well for margins.

However, higher interest rates will bring equity valuations into question (price to earnings ratios tend to expand in low-rate environments and contract as interest rates rise). Earnings, in that event, will definitely have to improve to justify present, or higher, stock prices from here. Meaning higher interest rates have to be the result of a better economy, resulting in higher corporate earnings. If they come as a result of investors fleeing the bond market out of fear of higher rates (for example), that would be bad news for the stock market.

Corrections are those things everyone says they want (they're healthy phenomena)---that is until they come:

Ten percent corrections have historically been annual events. Last one, however, occurred in the fall of 2011 (over 2 years ago). Everyone says we need one, but just wait till it happens. While 10% may not sound like much (because it's not), we're talking roughly 1,640 Dow points from here, which would take us back down to spring 2013 levels ---and fall 2007 levels (almost) before that. That'll feel terrible to a lot of folks, except of course those who've beenwaiting suffering (big-time) for that event before finally getting in.

Bear markets are those inevitable things that nobody (save for shorts) wants (but, yes, they're healthy) --- "inevitable" being the operative word:

A 20% decline is the definition of a bear market. While they are rarer phenomena than your annual 10% correction, they happen. They always happen. They generally come when they're least expected. That's the thing about the sentiment indicators: when folks are way bullish, they're in the market. In that event, therefore, there's no marginal buyer in-waiting to bid prices yet higher. As I hinted above, recent surveys point to the highest optimism (on the stock market) we've seen in several years. We'll see how attitudes evolve going forward---I suspect that the early January selloff (as modest as it was) might have quelled that cheeriness a bit for now, we can only hope. The fact that Monday delivered a 170+ point decline in the Dow, and Tuesday and Wednesday saw a 200+ point rebound, tells you that---sentiment surveys aside---there's still real money out there looking to buy the dips. At least for the moment...

Some of the good news (assuming you view continued rising stock prices from here as a good thing):

- December retail sales up...

- Business inventories and sales up...

- Industrial Production up...

- NFIB (small business) survey positive...

- Europe expected to grow (albeit tepidly) this year...

- GM paying a dividend (just threw that one in)...

Some of the bad news (assuming you would view a correction or bear market here as a bad thing):

- December jobs number was terrible...

- Bullishness on the market is very high (that's a legitimate contra indicator)...

- Margin debt (folks borrowing against their stocks to buy more stocks) is very high (" " ")...

- Valuations, while not, in my view, terribly expensive, are full (i.e., not cheap either)...

- Interest rate risk is clearly to the upside...

I see rising interest rates as the most obvious potential headwind for stocks this year:

The economy picking up will result in higher long-term interest rates. That could be a good thing for banks, in that---assuming short-term rates remain low---they'll access money very cheaply and lend it out at higher rates: If loan demand doesn't wane with higher rates, that bodes well for margins.

However, higher interest rates will bring equity valuations into question (price to earnings ratios tend to expand in low-rate environments and contract as interest rates rise). Earnings, in that event, will definitely have to improve to justify present, or higher, stock prices from here. Meaning higher interest rates have to be the result of a better economy, resulting in higher corporate earnings. If they come as a result of investors fleeing the bond market out of fear of higher rates (for example), that would be bad news for the stock market.

Corrections are those things everyone says they want (they're healthy phenomena)---that is until they come:

Ten percent corrections have historically been annual events. Last one, however, occurred in the fall of 2011 (over 2 years ago). Everyone says we need one, but just wait till it happens. While 10% may not sound like much (because it's not), we're talking roughly 1,640 Dow points from here, which would take us back down to spring 2013 levels ---and fall 2007 levels (almost) before that. That'll feel terrible to a lot of folks, except of course those who've been

Bear markets are those inevitable things that nobody (save for shorts) wants (but, yes, they're healthy) --- "inevitable" being the operative word:

A 20% decline is the definition of a bear market. While they are rarer phenomena than your annual 10% correction, they happen. They always happen. They generally come when they're least expected. That's the thing about the sentiment indicators: when folks are way bullish, they're in the market. In that event, therefore, there's no marginal buyer in-waiting to bid prices yet higher. As I hinted above, recent surveys point to the highest optimism (on the stock market) we've seen in several years. We'll see how attitudes evolve going forward---I suspect that the early January selloff (as modest as it was) might have quelled that cheeriness a bit for now, we can only hope. The fact that Monday delivered a 170+ point decline in the Dow, and Tuesday and Wednesday saw a 200+ point rebound, tells you that---sentiment surveys aside---there's still real money out there looking to buy the dips. At least for the moment...

Today's TV Segment (video)

This morning Zara and I discussed the economy, the stock market and what a 10% correction looks like. Click here to view...

Tuesday, January 14, 2014

"How can we redistribute if there's no wealth?" French President Hollande, of all people...

May today's Wall Street Journal Article Hollande Courts Business With Economic Revival Plan be a lesson to us on the economic realities of socialism---and the duplicity of politicians. I can almost make my entire point by excerpting the article. Here goes:

Yes, promising the moon wins elections---we've witnessed that a lot of late. But, like I said the other day, the moon is---fortunately, ironically, for the promiser's political career (and the promisees' livelihoods)---unreachable. Although, as France's president is discovering, the air can get mighty thin even as you head in that direction---particularly in a country that was half way there to begin with. Ah, but Hollande, like all politicians, is of the family Chamaeleonidae: while campaigning in 2012 he donned his socialist colors and slid his way to office. Today, he senses danger. Survival going forward means blending with the folks whose vilification was so effective on the stump. I.e., he has come to understand that the economy will break him if he doesn't break his government's stranglehold over French businesses...

Speaking at a news conference designed to relaunch his presidency that—like France's economy—has been stuck in the doldrums, Mr. Hollande said he would tackle France's chronically high payroll taxes, addressing a long-standing demand of French business leaders.

Mr. Hollande is striving to repair relations with France's business community, which has voiced anger about climbing taxes and alarm that the euro zone's second–largest economy is losing ground to Germany.

Since his election in May 2012, Mr. Hollande has relied largely on tax increases to fix France's finances with only marginal efforts to pare expenditures. The economy has barely grown since he took power while unemployment has risen.

Business leaders say this has hampered their efforts to compete internationally. France stands out among European peers for its relatively high labor costs, which eat into profit margins necessary to invest and recruit. For nonfinancial corporations in France, gross profit share—a standardized measure of profit margins—stood at just over 28% at the end of 2012, compared with 38% in the wider euro zone and 40% in Germany, according to Eurostat.