Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Wednesday, May 31, 2023

Market Snapshot: Volatility and Breadth Signals (video)

Tuesday, May 30, 2023

Charts of the Day: Yet Another Tech Bubble Breadth Illustration

I know, I keep pounding on the same topic, but still, I feel compelled to emphasize why -- on top of our general macro concerns -- broad diversification, and some outright hedging, feels smart right here:

"Not (sincerely not) suggesting that things have to play out as they did in the early 2000s, just illustrating what a resoundingly unhealthy breadth setup looks like."

Morning Note: Debt Deal Impact, Asset Class/Sector/Regional Results Update and Tech Bubble Breadth

From what I'm gathering initially, should the proposed debt ceiling deal pass, Mark Zandi seems to capture the perceived ramifications:

Saturday, May 27, 2023

Quote of the Day: The Difference Between "Strong" and "Tight"

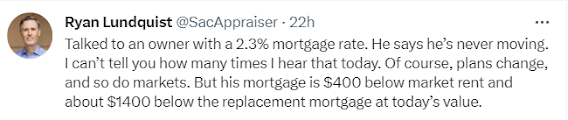

In this week's economic update we touch briefly on housing with data that somewhat conflicts with what I believe many buyers are experiencing as they bid on homes, and what some on Wall Street characterize as a "strong market."

And while different locations/regions can experience notably different residential real estate setups, we think in general a more apt characterization, for the moment, is a "tight market."

I.e., given today's dynamics, there's presently a difference between "strong" and "tight."

Here's an appraiser telling of his experience:

Friday, May 26, 2023

Economic Update: "It's OK Until It Isn't" - And - Beyond the Deal Ceiling Deal (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Quote of the Day: "What's Odd Here"

Despite the poopooing of the importance of breadth I'm hearing from a number of market commentators, we keep harping on it herein because, as I illustrated in yesterday's video (posted this morning), it's historically relevant.

Thursday, May 25, 2023

Market Snapshot: Nvidia, SP500, NDQ100 and Challenging a Bullish Narrative (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Chart and Quote OF THE DAY!!: Just sayin...

While parallels can indeed be drawn comparing today's stock market setup to the late-innings tech bubble, and recognizing that, indeed, this time may be different, well, let's just say that we absolutely have to pay attention!

Here's Nvidia's current price to sales ratio... Note that even before today's spike it was trading at nearly 30 times sales:

Morning Note: Morning Breadth and Key Highlights

Before we take a look at some key highlights from our recent content herein, let's take a peek at overall breadth, as the stock market (the Nasdaq and the S&P cap-weighted indexes) rallies this morning.

The S&P 500 is up .60% as I type, while 60% of its members are actually declining as the session gets underway... As for the Nasdaq Comp, it's up a whopping 1.7%, while just over half of its constituents are in the red as well.... Essentially a reflection of last Thursday's second highlight below.

A few key highlights from our latest messaging:

Wednesday, May 24, 2023

Market Snapshot: Stocks, VIX, Copper/Gold Ratio, Transportation and Patience (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, May 23, 2023

Troubling Chart of the Day: Busy Q1 for US Bankruptcies

While we'd love to join the crowd and call bear-market-over -- and it's certainly not all doom and gloom in the data right here -- we think investors are just a bit too sanguine given underlying trends.

Case in point:

Morning Note: Tough Spot

While we get the market narrative that big tech is "long duration," and, therefore, amenable to declining interest rates, and that AI is long-term special, I think "the market" is forgetting that, at the end of the day, big tech is ultimately tethered to the economic cycle.

Here's the tech sector action throughout the current bear market:

Monday, May 22, 2023

Morning Note: Results

Trying something new here on the blog for Monday mornings.

Each week we perform an extensive exercise that captures everything from performance across equity sectors, fixed income and commodities, to fundamental and technical looks at currencies and select asset classes, to assessments of market breadth, correlations, intermarket relationships, positioning, flows, sentiment, financial stress, and, frankly, to lots more... And while I'm tempted to load up all of the updated charts, I'm fairly certain (based on much feedback over the years) that would take too many readers into complex depths they'd prefer we'd, on their behalf, plumb on our own.

But I am thinking that a Monday morning look across asset class results would indeed be of interest to most clients and regular readers.

So here you go:

Saturday, May 20, 2023

Economic Update: Retail Sales, Housing, etc., and Another Look at the Equity Mkt Setup (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, May 19, 2023

Market Snapshot: SP500, QQQ, Amazon, Apple and a peek at Nvidia (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, May 18, 2023

Quote of the Day: Looming Standoff

This from BCA Research emphasizes that "catch-22" we keep referring to herein:

"Economic growth will weaken in the coming months, yet monetary authorities worldwide will be reluctant to ease policy.

This state of affairs foreshadows a clash between markets and policymakers in the months ahead."

"...weak growth yet still high inflation. Due to the latter, the Fed will not cut rates until financial conditions tighten considerably and employment contracts. Such a stance from monetary authorities is bound to produce another bout of volatility in financial markets this year."

Again, makes for a very messy risk/reward setup right here!

Morning Note: Thank Inflation - And - Not Your Typical Bull Market Setup

A couple of observations on Q1 corporate earnings.

The first being positive, as 68% of S&P 500 members bested analysts sales expectations, while 77% beat on earnings!

The second being positive in terms of actual sales growth (top panel) but negative in terms of actual earnings growth (bottom panel):

Wednesday, May 17, 2023

Market Snapshot: Debt Ceiling Bullish???

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, May 16, 2023

Morning Note: Trilemma

In our opinion, Bloomberg columnist and Queen's College Cambridge President Mohamad El-Erian made nothing but sense this morning... The following (bolded phrases in particular) should sound very familiar to clients and our regular readers/video watchers:

Monday, May 15, 2023

Morning Note: The Habitual Fed

In a client discussion last Friday over recession odds and the Fed, I mentioned that the Fed's own staff economists forecast recession (albeit mild) in the back half of the year, while the respective talking heads (FOMC [Federal Open Mkt Committee]) seem too eager to reject that probability.

Hmm.... So what gives? Well, perhaps the Fed has grown ever-so accustomed to leveraging their "guidance" tool (attempt -- through jawboning -- to set consumer and market expectations in the manner they'd like them to be) to keep folks actively transacting throughout the economy... Folks feel good about the Fed when they feel good about the economy!

Friday, May 12, 2023

Economic Update (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Stock Market and Dollar Snapshot -- and the "quality" of the rally... (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, May 11, 2023

Morning Note: Global "Tiredness"

In client review meetings, and herein, of late, we're painting an optimistic picture of what we view as the macro-rich setup that awaits when the next bull market gets underway, while, at the same time, we’re explaining why we do not believe now is the time to express (in our core allocation) our longer-term thesis to the extent we ultimately expect to.

You see, global general conditions presently reflect what, in our opinion, can only be viewed as uncomfortably high recession risk.

Wednesday, May 10, 2023

Market Snapshot: S&P 500, QQQ, the Dollar and the VIX

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, May 9, 2023

Morning Note: Banks Bracing For, and Bolstering, Recession

While apparently many anticipated worse, yesterday's release of the Fed's Senior Loan Officer Opinion Survey offered little to feel relieved over.

Here's from the report (HT Peter Boockvar).

With regard to commercial real estate:

Monday, May 8, 2023

Morning Note: Simply, Risk Remains Elevated Right Here

In our latest economic update I mentioned that our base case (which has us presently cautious) stems from the reading of our own economic index, along with "an abundance of data that we parse day in, day out."

Below are a handful of credit market examples.

Saturday, May 6, 2023

Economic Update: Jobs, Cars, Copper, etc.

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, May 5, 2023

Stock Market Snapshot: SP500, NDQ 100, Apple, Lalaland Maybe?

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, May 4, 2023

Morning Note: Pardon My Skepticism

Wednesday, May 3, 2023

Market Snapshot: Stocks, the VIX, and The Problem With Natural Forces

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, May 2, 2023

Morning Note: How Best to Clear "Muddy Water"

In our weekend video update I made mention of the manufacturing sector being already in the throes of a several month-long recession.

Yesterday's release of the ISM's April Manufacturing survey, while a titch improved (less contractionary vs March), essentially confirmed it. Here's from the report (I'll highlight the glaring UH OH!):

Monday, May 1, 2023

Morning Note: Equity Market Conditions Not Okay Right Here

While of course anything can happen in markets, the following speaks to why we continue to hedge portfolios.

Here's the intro to our latest Equity Market Conditions report: