In our latest economic update I mentioned that our base case (which has us presently cautious) stems from the reading of our own economic index, along with "an abundance of data that we parse day in, day out."

Below are a handful of credit market examples.

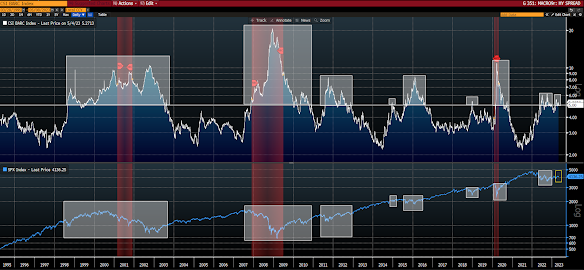

The top panel in each chart features the indicator, the bottom the S&P 500 Index... Each captures the timeframe available for its respective data point... Red shaded areas reflect recessions.

Investment Grade Credit Default Swap Spread (the price of insuring high-quality corporate debt against default):

2-yr Treasury Yield (orange)/Fed Funds Rate (white):

With one exception (the early-'15 blip above 5% for the HY Spread), those past highlighted occurrences captured at least one double-digit decline for the S&P 500.

"The earnings miss comes as some consumers have been purchasing less meat to combat soaring food costs. Softer consumer demand is coming as costs for animal feed remain elevated, pressuring meat companies and farmers."

European markets are trading up as I type, with 13 of the 19 bourses we follow in the green so far this morning.

US equity averages are lower to start the session: Dow by 35 points (0.10%), SP500 down 0.10%, SP500 Equal Weight down 0.16%, Nasdaq 100 down 0.39%, Nasdaq Comp down 0.36%, Russell 2000 down 0.23%.

As for last Friday's session, US equity averages (save for small caps) rallied strong: Dow up 547 points (1.7%), SP500 up 1.8%, SP500 Equal Weight up 1.7%, Nasdaq 100 up 2.1%, Nasdaq Comp up 2.2%, Russell 2000 up 2.4%.

This morning the VIX sits at 17.82, up 3.66%.Oil futures are up 2.79%, gold's up 0.029%, silver's down 0.14%, copper futures are up 1.02% and the ag complex (DBA) is down 0.28%.

The 10-year treasury is down (yield up) and the dollar is down 0.10%.

Among our 37 core positions (excluding options hedges, cash and money market funds), 20 -- led by Albemarle, MP Materials, Disney, OIH (oil services stocks) and HACK (cyber security stocks) -- are in the green so far this morning... The losers are being led lower by TLT (long-term treasuries), AT&T, XLK (tech stocks), Amazon and JNJ.

"That’s where opportunity is. Whether there’s crisis, or threat, or things that are high risk, that means there’s opportunity."

--Blas, Javier; Farchy, Jack. The World for Sale

No comments:

Post a Comment