Just a brief note this evening…

Huge global data dump today, and, without giving you the details, as you no doubt suspect I’m seeing some of the worst economic data of my nearly 36-year career. More on that in our macro update in the next day or two…

Thursday, April 30, 2020

Quotes of the Day

Quoting myself from last November:

"The fact that CLOs didn't implode like CMOs did in 2008 is "a key driver of their recent popularity" offers me zero solace! Frankly, that's the sort of magical thinking ('home prices won't go down') that led to the 2008 disaster."

This Week's Message: What Others Think Others Are Going To Do...

Keynes suggested circa a century ago that trading (as opposed to, I'll say, investing in) markets is not about assessing fundamentals, it's about what traders think other traders are going to do. And for the more savvy traders, it's about what they think other traders think other traders are going to do.

Wednesday, April 29, 2020

Evening Note

Q1 data released today came in much worse than expectations. Even though the real COVID hit didn’t materialize until March, today’s releases confirm what of course we already knew about how tough this recession is going to be.

Morning Note

For a third day in a row U.S. equity futures are rallying hard in the pre-market, in the face of some dire headlines:

Tuesday, April 28, 2020

Evening Note

Just a quick note this evening:

A 400-pt open for the Dow this morning turned into a 33-pt decline at the close. The Nasdaq rolled over bigger and closed down 1.4%. That’d be -336 points if the Dow had matched it.

A 400-pt open for the Dow this morning turned into a 33-pt decline at the close. The Nasdaq rolled over bigger and closed down 1.4%. That’d be -336 points if the Dow had matched it.

Morning Note

Could almost cut and paste yesterday's morning note: Although this morning it's not GM and Tyson, it's:

Monday, April 27, 2020

Evening Note

The prospects for unrelenting stimulus, the willingness to “believe”, per the quote below, and no doubt some substantial short-covering, per my morning note, continue to keep the S&P 500 hovering at levels that many thoughtful/experienced analysts (yours truly included) see as dangerous, given real general conditions. As you'll see in the chart below, the results for the S&P 500 don’t necessarily tell the broader market story.

Question of the Day: "Why Is Tech So Strong?"

In his morning macro presentation Hedgeye's Keith McCullough was singing our tune as he fielded the following question:

"If we are in deep Quad 4 why is tech so strong?"

Morning Note

GM announced this morning that it’s suspending its dividend as well as its share buyback plan, Tyson foods says “the food supply chain is broken”, oil tumbled to below $13, Deutsche Bank “warns of loan defaults”, Apple delays production of 2020 iPhones on “supply woes” and economists Tom Orlik and Jamie Rush say that “a $6 trillion global recession is the optimistic scenario”. But wait, last night the Bank of Japan announced “more stimulus steps”.

Sunday, April 26, 2020

The Responsible Investor's Narrative

So we get the bull's narrative; STIMULUS!

Okay, but, ultimately, or I should say, responsibly, we really need to see more by way of developments -- other than how the Dow's doing -- to justify flipping to a bullish posture, don't you think?

Okay, but, ultimately, or I should say, responsibly, we really need to see more by way of developments -- other than how the Dow's doing -- to justify flipping to a bullish posture, don't you think?

Saturday, April 25, 2020

Quote of the Day

Daniel Coyle, in his insightful and, frankly, delightful book The Talent Code points to how the world's most talented individuals approach their specialties.

Macro Update (video)

Bringing you our macro update once again via video this week.

While editing, it occurred to me toward the end that I was at that point just rambling on about the stuff I've been rambling on a lot about lately. So if it seems a bit choppy it's because I cut out a bunch of what felt even more redundant than the content I left in 😎.

Hope you enjoy.

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

While editing, it occurred to me toward the end that I was at that point just rambling on about the stuff I've been rambling on a lot about lately. So if it seems a bit choppy it's because I cut out a bunch of what felt even more redundant than the content I left in 😎.

Hope you enjoy.

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, April 24, 2020

Evening Note

Wow, what a week! Ironically, there's so much going on out there, while there's not much going on out there (if you know what I mean), that I find myself late on a Friday afternoon ill-prepared to give you the kind of pithy, eye-opening data and context that would do justice to the financial market/economic circumstances we presently find ourselves in.

I.e., I'm going to give you the "good stuff" -- my macro view of the world (literally) -- over the weekend, after I organize and prioritize the data for your consumption.

In the meantime, for this evening's note -- which I'm compelled to bring you, now that I've formed this habit, and because it gets a good number of hits -- I'll just think on paper for a few minutes and leave this one at that...

I.e., I'm going to give you the "good stuff" -- my macro view of the world (literally) -- over the weekend, after I organize and prioritize the data for your consumption.

In the meantime, for this evening's note -- which I'm compelled to bring you, now that I've formed this habit, and because it gets a good number of hits -- I'll just think on paper for a few minutes and leave this one at that...

Morning Note

In yesterday’s cash session stocks surrendered a 2% rally on news that Gilead’s drug disappointed in human trials.

US equity futures are rallying in the pre-market this morning against a sea of red across Asia and Europe, against yesterday’s PMI releases showing some of the worst prints on record, and against news this morning that US durable goods orders plunged 14% in March, vs -11% expected. Not to mention against abysmal outlooks emerging from Q1 earnings reports.

US equity futures are rallying in the pre-market this morning against a sea of red across Asia and Europe, against yesterday’s PMI releases showing some of the worst prints on record, and against news this morning that US durable goods orders plunged 14% in March, vs -11% expected. Not to mention against abysmal outlooks emerging from Q1 earnings reports.

Thursday, April 23, 2020

This Week's Message: Our Moves So Far This Year (video)

We're devoting this week's message to a complete rundown of all of the adjustments we've made thus far this year to our core portfolio allocation.

Morning Note

Weekly jobless claims came in at 4.4 million this morning and of course equity futures are trading higher in the pre-market session.

Ironically, a headline that crossed my screen just a few minutes before the jobless number was released pretty much explains how stocks continue to reflect a rate of earnings that is unfathomably detached from reality:

Ironically, a headline that crossed my screen just a few minutes before the jobless number was released pretty much explains how stocks continue to reflect a rate of earnings that is unfathomably detached from reality:

Wednesday, April 22, 2020

Evening Note

A notification just crossed my phone from Bloomberg advertising a podcast titled “How the Crisis Pushed the Fed Into New Territory”.

Well, my immediate thought was uhh…. no, let’s do one titled “How the Fed Fostered Yet Another Credit Bubble That, Like the Last Two, Has Them Charting New Territory To Try and Circumvent the Consequences of Their Own Doing.”

Yeah, I know, that title is too big to fit anywhere. But I digress....

Yeah, I know, that title is too big to fit anywhere. But I digress....

Quote of the Day

While much of Wall Street focuses on the prospects for stimulus ultimately saving the day -- could happen, although ultimately saving our portfolios from the saving will be a whole other something to manage -- we're (along with stimulus prospects) focusing on stuff a bit deeper below the surface.

Morning Note

US equities are trading nicely in green this morning, boosted in the pre-market by a surprise pop in oil prices (and, per the below, by some serious short covering). Asian equities, save for Japan, rose across the board last night. Europe’s trading solidly in the green. Bonds are selling off (yields higher) a bit (2-yr+ maturities). The dollar’s down in Asia, but mostly up in Europe. Commodities (ex-ag), save for palladium, are trading higher.

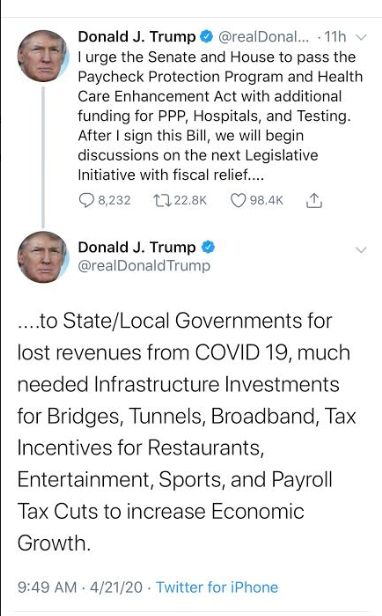

The pre-market jump in oil corresponded precisely with this tweet:

This tweet yesterday morning, however, didn’t provoke the hoped-for market response (at least not yesterday). Although, combined with the pop in oil, I suspect it isn’t hurting at all this morning.

In terms of the fundamentals, nothing’s changed. I.e., conditions remain ugly with no letup in trend at this point.

The above comments no doubt largely explain this morning’s move in equities, exacerbated markedly I strongly suspect by some serious short-covering: Futures traders came into this week with the highest net short exposure on SPX in years, while SPY short interest was hugely elevated as well.

SHORT-COVERING = buying borrowed shares

SPX = S&P 500 Index

SPY = ETF that tracks the S&P 500 Index

The pre-market jump in oil corresponded precisely with this tweet:

This tweet yesterday morning, however, didn’t provoke the hoped-for market response (at least not yesterday). Although, combined with the pop in oil, I suspect it isn’t hurting at all this morning.

In terms of the fundamentals, nothing’s changed. I.e., conditions remain ugly with no letup in trend at this point.

The above comments no doubt largely explain this morning’s move in equities, exacerbated markedly I strongly suspect by some serious short-covering: Futures traders came into this week with the highest net short exposure on SPX in years, while SPY short interest was hugely elevated as well.

SHORT-COVERING = buying borrowed shares

SPX = S&P 500 Index

SPY = ETF that tracks the S&P 500 Index

Tuesday, April 21, 2020

Evening Note

US equities closed lower again today: SPX -3.1%, Dow -2.7%, Nasdaq -3.48%, Russell 2000 -2.33%. Europe sold off across the board to a similar extent as well.

Quote of the Day

Hedgeye's Keith McCullough hints at what has some folks -- like some of the ones you see on financial networks -- totally missing the mark(et) in terms of the present state of general conditions:

Morning Note

Asian equities tanked last night, across the board. The rest of the world’s equity markets are notably in the red this morning as well. Oil continues to get trounced (June WTI contract down 27%), taking pretty much the entire commodity complex with it. Our two positions, gold (unintuitively) and silver* are seeing 0.80% and 3.52% declines respectively.

Monday, April 20, 2020

Evening Note

Oil got absolutely hammered today; the contract expiring tomorrow closed at -$37/barrel (yes that’s a minus sign, and, yes, they’ll pay you to come pick some up) -- a phenomenon that has never occurred.

I.e., while stocks (SPX -1.76% today) remain disconnected from economic reality, oil -- while there are technical aspects to today’s historic move* -- is accurately reflecting it.

Morning Note: Oil, Stocks, and what they're reflecting...

US equities opened lower this morning and have been volatile (VIX back above 40) within a -1.5% to -.5% range for SPX. Bonds are up (yields down), gold’s up, silver’s up, the dollar’s up and oil is getting utterly hammered. Europe opened lower but most countries have now moved into positive territory. China traded higher overnight, while Japan traded off 1% and Australia tanked 2.5%.

Sunday, April 19, 2020

Messy

As part of our weekly scoring of general conditions we record the 1-week, 1-month and year-to-date performance of major U.S. sectors, as well as regions, long-term treasury bonds, gold, silver and copper.

This Morning's Log Entry: We Can Only Imagine!

Note: To the extent that I express my short-term outlook on markets, a sector or a commodity in my log entries, these are not to be the least bit construed as trade recommendations for the reader. They are, under present conditions in particular, subject to change without notice. What might appear to the reader as a viable trade idea today, could be something I'll do an about face on -- as new information presents itself -- tomorrow, with no prior warning. I share excerpts from my notes only when I deem them useful in terms of helping our clients maintain proper perspective.

Betting markets have the Dow going from high double-digit red to slightly green on news this morning that Mnuchin and Pelosi are close to a deal to add cash to the small business loan program.

Saturday, April 18, 2020

Macro and Market Update (video)

Here's history's greatest trader on bear market retracements. His "paper profits" refer to what he had made on his short position at that point during the bear market he was trading. He held his ground because he was certain that what he was about to experience was simply a bear market rally/retracement. He turned out to be correct. It was all about his study of "general conditions":

Quote of the Day

I've learned, at times the hard way, over the past 35 years that there's so much more to assessing probabilities for financial markets than securities' price movements themselves. I'd argue, despite the fact that we do our share of technical analysis, that, of the things we analyze in our daily course of business, securities' price movements are the least telling.

Friday, April 17, 2020

Bonus Quote of the Day

Hedgeye's Keith McCullough, like yours truly, intimately experienced the past two historic bear markets (he's younger, and smarter btw, so I go back a ways further).

In his morning note he confessed that he needed to rewind to the tech bubble to confirm what he already knew about early bear market action:

In his morning note he confessed that he needed to rewind to the tech bubble to confirm what he already knew about early bear market action:

Pre-market note

US Equity futures trading are rallying hard this morning (+2.2%), although off of their overnight highs.

Quote of the Day

The following by macro analyst Cameron Crise should sound very familiar to those of you who've reached out to me in recent days soliciting my view on wading (unhedged) into this market:

Wary of the Rally

In last evening's note I pointed out the suspiciously weak volume experienced during the impressive (price-wise) rally in stocks we're currently experiencing. Suggesting that we should be, well, suspicious about its sustainability.

Thursday, April 16, 2020

Facts and Opinions

Can't resist sharing the following quote from an interview I'm listening to this evening with Grant Williams, the author of the widely read Things That Make You Go Hmmm, and relating it to our messaging herein, as well as to the work we do for clients:

This Evening's Notes

News after the close is that Gilead’s COVID treatment is showing very encouraging early results. Equity futures are screaming higher (3+% as I type). That’s hugely encouraging news that is absolutely worth celebrating!!

Pre-market note

US Equity futures trading moderately higher pre-market, going from red to green on the 5.5 million jobless claims number. Remarkable! Both the number and the fact that the market traded higher on the news. Clearly, this remains a market mesmerized by the belief in stimulus and lulled by 11 years of buy-the-dip success.

Wednesday, April 15, 2020

Quote of the Day

FX Weekly in their article The Flipside of Oprahnomics echoed the concerns I laid out in this morning's Weekly Message:

The Week's Message: Will The Fed's Actions "Work"? And What Would "Work" Look Like?

In a RealVision interview aired Monday former Kansas City Fed chief Thomas Hoenig expressed his support for the methods his former employer is resorting to in the midst of what will be the greatest recession since the Great Depression. While at the same time he voiced his concerns about the ultimate exit strategy, and the unfortunate precedent it all sets. I share his concerns!

Quote of the Month

In his morning macro presentation Keith McCullough plain and simply nails the Pavlovian (after a long bull market) buy-the-dip instinct that can be (is) a killer during true, and inevitable, bear markets:

Pre-market note

U.S. equity futures are tanking this morning on poor earnings and economic data. Europe is getting hammered while Asia was mixed overnight, although China was off across the board. Dollar rallying, bonds rallying, commodities selling off.

Tuesday, April 14, 2020

Digging for Clues

Beyond the traditional bear market technical profile -- that would see the first selloff retraced by at least 50% (like now) -- for the current rally in stocks to make fundamental sense the macro setup has to have either stopped deteriorating, or is deteriorating at a measurably slower pace. And of course an economic rebound would have to be in the not-too-distant offing.

The Great "Shadow-Banking" Crisis

Massive loan loss provisions -- JPMorgan today -- notwithstanding, the current crisis is not likely to be in retrospect deemed a banking crisis. However "shadow-banking crisis" may ultimately fit the bill...

Quote of the Day: Keeping Sight of the Diamond

Skimming through some of my highlights in past readings last night I stumbled across this from Vizi Andrei's Economy of Truth.

Pre-Market Note, And The Headline of the Day (maybe of the year)

Equity futures are rallying hard this morning. Headlines say on better COVID news. JPM reported a big miss on earnings, and announced it's set aside $8.29 billion for bad loans (twice expectations), but booked better than expected trading revenue (no surprise given market volume/volatility in Q1).

Monday, April 13, 2020

Quote of the Day (maybe of the crisis)

Pardon the cut and paste and sloppy highlighting, but you gotta read this. It'll sound familiar to regular readers.

This is from a 2015 speech by one of history's great (I'd say he's in the top 3-4 of all-time) investors, Stan Druckenmiller.

Anything I might add would simply be repeating the same mantra we've been chanting herein from before the day we began hedging portfolios late last summer.

Yes, the speech was given 5 years ago, but we did see back-to-back double-digit stock market corrections in 2015/16. They didn't morph into something worse because we were able to skirt recession in both instances, not the case this time.

Where he asks the question regarding the state of the economy ("worst in last 102 years?"), he was being entirely facetious; as the Fed was conducting monetary policy in 2015 as if the economy were still in recession:

This is from a 2015 speech by one of history's great (I'd say he's in the top 3-4 of all-time) investors, Stan Druckenmiller.

Anything I might add would simply be repeating the same mantra we've been chanting herein from before the day we began hedging portfolios late last summer.

Yes, the speech was given 5 years ago, but we did see back-to-back double-digit stock market corrections in 2015/16. They didn't morph into something worse because we were able to skirt recession in both instances, not the case this time.

Where he asks the question regarding the state of the economy ("worst in last 102 years?"), he was being entirely facetious; as the Fed was conducting monetary policy in 2015 as if the economy were still in recession:

Sour Grapes Only For The Taxpayer

Sure, I'm tempted to complain about the Fed chasing us out of our best position of the year (the ETF that shorts junk bonds) last week (although they made its replacements "gold and, yes, cash" look more attractive) but it is what it is. Better to just manage the risk within whatever cards we're dealt.

Futures Traders Ain't Buying It

Last week I featured the now net short interest among futures traders who speculate on the S&P 500 Index, along with short interest on SPY and in the NYSE.

Pre-Market Note

US equity futures have erased most of their steep overnight losses. Asia had a rough night.

Saturday, April 11, 2020

Quotes of the Day

Foreign exchange macro strategist James Aitken, in an excellent RealVision interview published yesterday, speaks to much of what we've been speaking to herein of late. Which is the reality that the system was essentially strained to the hilt prior to the arrival of this "exogenous shock" to markets:

Things Just Got Messier!

You clients who are new to our process should know that the number of adjustments we've made during the past 3 months equal what, during bull market conditions, normally occurs over the course of years.

Thursday, April 9, 2020

Macro Update, And More On Bear Market History

Just completed the weekly scoring of our proprietary macro index. As you'd expect, it's not pretty.

All The Fed Can 'Safely' Chew, And Our Short Junk Bond Position

The notion that the US Federal Reserve would actually buy any corporate debt whatsoever would've been virtually unheard of (well, maybe) just a few months ago.

The Multi-Trillion Dollar Question

In my pre-market note this morning I stated what I view as the "multi-trillion dollar question":

Pre-Market Note

Equity futures saw violent swings between green and red on the 6.6 million jobless claims number released this morning.

Wednesday, April 8, 2020

This Week's Message: Some History, And a Test of the Most Basic Investing Concept

While the stock market bounce off the lows to this point seems big on a percentage basis, considering the depth of the original selloff and the level of retracement thus far, it’s, at best, run of the mill compared to other such bounces historically.

Below the Surface: Hope Springs Eternal

Monday saw stocks up a whopping 7%! Yesterday was huge as well, until it all fell apart late in the day. Today's looking good (it's 11:04am) with the S&P up 2.23%.

Well, dang!, if it were only about the price action...

Well, dang!, if it were only about the price action...

Pre-Market Note: Present States of Mind

Equity futures are up 1.2% as I type; they traded nearly that much lower at times during the overnight session. Yesterday’s session saw the kind of action that, once again, isn’t seen outside of bear markets.

Tuesday, April 7, 2020

Bonus Quote of the Day

I'll finish today's onslaught on your email inbox with something short and, well, not so sweet.

Reasons to be sanguine, and reasons not to be...

Bloomberg's Ye Xie points out in the first paragraph below what no doubt has recent stock buyers feeling sanguine. In the rest he points out why they may need to check those feelings.

Quotes of the Day

Hedgeye's Keith McCullough in his morning macro update echoed our recent messaging herein:

Pre-market notes: Stocks are extremely dangerous right here...

Note: To the extent that I express my short-term outlook on markets, a sector or a commodity in my log entries, these are not to be the least bit construed as trade recommendations for the reader. They are, under present conditions in particular, subject to change without notice. What might appear to the reader as a viable trade idea today, could be something I'll do an about face on -- as new information presents itself -- tomorrow, with no prior warning. I share excerpts from my notes only when I deem them useful in terms of helping our clients maintain proper perspective.

Equity futures are once again in serious rally mode this morning. The stated catalysts being an improving covid-curve, prospects for additional government stimulus and the perceived certainty of an OPEC/Russia oil deal this Thursday.

Equity futures are once again in serious rally mode this morning. The stated catalysts being an improving covid-curve, prospects for additional government stimulus and the perceived certainty of an OPEC/Russia oil deal this Thursday.

Monday, April 6, 2020

This Evening's Log Entry

Note: To the extent that I express my short-term outlook on markets, a sector or a commodity in my log entries, these are not to be the least bit construed as trade recommendations for the reader. They are, under present conditions in particular, subject to change without notice. What might appear to the reader as a viable trade idea today, could be something I'll do an about face on -- as new information presents itself -- tomorrow, with no prior warning. I share excerpts from my notes only when I deem them useful in terms of helping our clients maintain proper perspective.

Another classic bear market rally today:

Watching some of the headlines as they pass by, it's easy to tell who was caught levered-long, or just long, at the top -- the hedge fund gurus and the Wall Street firms who are right now advising folks to back up their trucks and load em up with stocks.

Watching some of the headlines as they pass by, it's easy to tell who was caught levered-long, or just long, at the top -- the hedge fund gurus and the Wall Street firms who are right now advising folks to back up their trucks and load em up with stocks.

Charts of the Day

I completely understand if you're wondering how I can come across so confident with my labeling recent spikes in stock prices, today's included, "bear market rallies". Suggesting that the worst is yet to come.

Well, of course I've been pounding you with the macro, which -- despite what you're hearing from many on Wall Street -- screams tough times ahead, record stimulus notwithstanding. But then there's human nature, with all its fears, hopes and biases, and the way it tends to push markets around under various circumstances.

For example, here's a graph of the VIX Index (white), nicknamed the "Fear Index", which tracks implied volatility in S&P 500 options contracts, along with the S&P 500 itself (yellow); capturing the first big spike in the VIX of the 2008 bear market:

And here's the same for the current bear market:

Yeah, WOW!

Even more wow is the fact that stocks were down ~25% at precisely this (vix/s&p) point in '08, just like today...

So, bear-market human nature:

Humans panic on the realization that recession looms, the VIX spikes and stocks fall. Then, shortly thereafter, the Pavlovian buy-the-dip response of the previous bull market takes over on any shred of good news, the VIX falls and stocks rise.

Thing is, recessions simply don't work themselves out that quickly...

Here's the rest of the 2008 experience:

Yep, the vix calmed down, but settled within a 40 to 60 range (that's high), while the S&P 500 fell another 32% (-57% peak to trough).

Now, the above stated, make no mistake, while the history is compelling, it doesn't have to repeat. Thus, we continue to crunch the data and measure the trends, day in and day out, and remain open to all possibilities.

Well, of course I've been pounding you with the macro, which -- despite what you're hearing from many on Wall Street -- screams tough times ahead, record stimulus notwithstanding. But then there's human nature, with all its fears, hopes and biases, and the way it tends to push markets around under various circumstances.

For example, here's a graph of the VIX Index (white), nicknamed the "Fear Index", which tracks implied volatility in S&P 500 options contracts, along with the S&P 500 itself (yellow); capturing the first big spike in the VIX of the 2008 bear market:

And here's the same for the current bear market:

Yeah, WOW!

Even more wow is the fact that stocks were down ~25% at precisely this (vix/s&p) point in '08, just like today...

So, bear-market human nature:

Humans panic on the realization that recession looms, the VIX spikes and stocks fall. Then, shortly thereafter, the Pavlovian buy-the-dip response of the previous bull market takes over on any shred of good news, the VIX falls and stocks rise.

Thing is, recessions simply don't work themselves out that quickly...

Here's the rest of the 2008 experience:

Yep, the vix calmed down, but settled within a 40 to 60 range (that's high), while the S&P 500 fell another 32% (-57% peak to trough).

Now, the above stated, make no mistake, while the history is compelling, it doesn't have to repeat. Thus, we continue to crunch the data and measure the trends, day in and day out, and remain open to all possibilities.

Pre-Market Note

Here's from my pre-market log entry this morning (recall from our videos that being "short" means selling borrowed shares on a bet that the market's going to drop. If you're wrong you can lose a ton. Closing a short position means buying back the shorted stock, which -- when short interest is high -- will add substantial oomph to a rally):

Sunday, April 5, 2020

Quote of the Day

Ironically (per the quote below), just after posting an excerpt from my weekend notes (where I questioned the prospects for a V-shaped recovery) I read a recent study titled "Longer-Run Economic Consequences of Pandemics" by economists Oscar Jorda, Sanjay Singh and Alan Taylor.

From This Weekend's Notes

Note: To the extent that I express my short-term outlook on markets, a sector or a commodity in my log entries, these are not to be the least bit construed as trade recommendations for the reader. They are, under present conditions in particular, subject to change without notice. What might appear to the reader as a viable trade idea today, could be something I'll do an about face on -- as new information presents itself -- tomorrow, with no prior warning. I share excerpts from my notes only when I deem them useful in terms of helping our clients maintain proper perspective.

While this too shall pass, the longer present circumstances remain the more I consider the realities of, for example, nearly 10 million Americans filing for unemployment over the course of 2 weeks, the less convinced I am that we come out of this with anything remotely resembling a V-shaped economic recovery (stock market rallies notwithstanding) as many continue to predict.

While this too shall pass, the longer present circumstances remain the more I consider the realities of, for example, nearly 10 million Americans filing for unemployment over the course of 2 weeks, the less convinced I am that we come out of this with anything remotely resembling a V-shaped economic recovery (stock market rallies notwithstanding) as many continue to predict.

Friday, April 3, 2020

Macro Update: Historic

Note: Once again, I'm tempted to skip this week's macro update altogether. You and I know it's going to be ugly, and it's only going to get worse before it gets better. That said, these updates rival our weekly message as our most-hit blog posts, so I'm compelled to keep featuring our findings herein, even though they'll simply reflect what we already know...

Well, even though still much of the data are dated -- i.e., pre-U.S. shutdown -- enough of what we track is sufficiently current to deliver the lowest score (-50) for our proprietary macro index since the heart of the Great Financial Crisis of 2008 (back-tested). Our lowest-ever (back-tested) score came during the Tech Bubble Recession of 2001.

Well, even though still much of the data are dated -- i.e., pre-U.S. shutdown -- enough of what we track is sufficiently current to deliver the lowest score (-50) for our proprietary macro index since the heart of the Great Financial Crisis of 2008 (back-tested). Our lowest-ever (back-tested) score came during the Tech Bubble Recession of 2001.

Headline of the Year!

Clients and regular readers know that our view had been that the next recession and bear market was likely to rival 2008, largely due to the underlying corporate credit bubble. That was before we ever dreamed of COVID-19.

Quote of the Year!

Speaking to the gyrations the market's experiencing presently on promises of oil production cuts and, as I touched on earlier, the prospects for small business stimulus running smoothly, or ultimately -- along with everything else being thrown at markets -- defying economic gravity, here's Hedgeye Risk Management's Keith McCullough singing our tune:

Morning Note

Pre-market:

Equity futures have literally been all over the place this morning. Going from notably red to slightly green on news that Russia agrees to cut oil production, then back and forth on the -701,000 jobs print. The remarkable thing about the hugely negative jobs number is that it covered the early part of March, before the government-mandated shutdown. Expectations were for -100,000.

Equity futures have literally been all over the place this morning. Going from notably red to slightly green on news that Russia agrees to cut oil production, then back and forth on the -701,000 jobs print. The remarkable thing about the hugely negative jobs number is that it covered the early part of March, before the government-mandated shutdown. Expectations were for -100,000.

Thursday, April 2, 2020

This Evening's Notes

The 6.6 million weekly jobless claims number reported this morning was 10 times the number during the worst week of the 2008 recession. And, lo and behold, stocks finished the day on a high note.

Charts of the Day: Credit Risk Says Be Careful

While folks focus on the incredible gyrations in stocks, the kind of which are absolutely the norm -- for bear markets -- it's really the under the surface stuff that we need to keep watch over. If, that is, we're to assess more than simply whatever headline of the day happens to be pushing the market one way or the other.

Quick Note on This Morning's Action

Stocks are bolting higher this morning on the following:

Energy stocks up 14%, oil itself up 21% as I type...

- President Trump says opec could cut 10 million barrels a day...

- OPEC calls for emergency meeting...

- China plans to increase oil reserves...

Energy stocks up 14%, oil itself up 21% as I type...

Wednesday, April 1, 2020

This Week's Message: We've A Long Ways To Go

Considering even the best case GDP projections going forward, the notion that stocks have already priced in the economic reality to come is, in my opinion, the definition of faulty. If the market doesn’t leg down to, at a minimum, the recent lows over the next few days/weeks, I suspect we’ll see it when the data that will truly reflect current conditions begin to hit late-April, early-May.

Quote of the Day: Beware the conflicts of interest...

If while watching, say, CNBC, or any other financial network/news of your choice, some Wall Street bigwig says the bottom's in and it's time to start grabbing those big-name stocks you always wanted to own -- while you look outside and see empty streets and shops, and, well, you get the picture -- causing you to say "huh?" out loud to yourself, you'd be wise to wonder if Bigwig's firm maybe already holds a few shares of those big-name stocks itself.

Subscribe to:

Posts (Atom)