Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Saturday, December 30, 2023

Those Santa Rally Signals Now Flipped On Their Heads (video)

Thursday, December 28, 2023

PWA 2023 Year-End Letter, Part 6: What's Next?

Wednesday, December 27, 2023

PWA 2023 Year-End Letter, Part 5: More On the Current Cycle

"...if we apply some insight regarding cycles, we can increase our bets and place them on more aggressive investments when the odds are in our favor, and we can take money off the table and increase our defensiveness when the odds are against us." --Marks, Howard

What I'll call my broken-record line of the past several months has been:

"While you and I may or may not appreciate the world we'll be living in during the next cycle, it'll be rich with macro investment opportunities, once we're through whatever's left in the current cycle."

So let's break that down:

My implication that there's more to play out before we can declare coast is clear to allocate for the early-cycle phase of what's to come stems from, frankly, 39 years of intimacy with the economy and with global markets.

Friday, December 22, 2023

PWA 2023 Year-End Letter, Part 4: The Dollar

"The reports of my death are greatly exaggerated."

--The US Dollar

Among the factors that influence the asset mix of a thoughtfully designed global macro portfolio, the manager’s long-term dollar thesis is key.

Wednesday, December 20, 2023

Late Cycle Environment

Numera Analytics just published their year-end macro strategist commentary... If you've been keeping up with our year-end message to this point -- Part 2 and the recent video update, where we delved into yield curve dynamics, in particular -- the following from the aforementioned commentary will ring very familiar.

I.e., while we're not consensus right here (which, frankly, only emboldens our conviction), per the below, we're not the only ones seeing what we see:

Tuesday, December 19, 2023

Market Update: Major Indices, Nvidia, Yields, the Dollar and Sentiment (video)

Dear Clients, here's another one to be sure to take in...

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, December 14, 2023

Fed Surprise, Recession Outlook Update, And a Look at Markets and the Yield Curve (video)

Attention clients, this is an important one to take in, start to finish 😎.

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, December 12, 2023

Market Snapshot: What a Greedy Setup Looks Like, & an Update on Stocks, Yields, the Dollar and Gold (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

PWA 2023 Year-End Letter, Part 3: Mitigating Risk, While Capturing Some Upside

In last year's year-end message we expressed the following go-forward view of equity market conditions:

"As for our present view of conditions, while we don't believe we're out of the icy water just yet -- and, for the moment, we anticipate that'll it'll get even colder before things begin to warm up -- we indeed see bluer skies on the not-too-distant horizon... Although, as you'll read in the remainder of this year-end message, we think the skating will be far better on ponds the vast majority of investors neglected during the previous bull run."

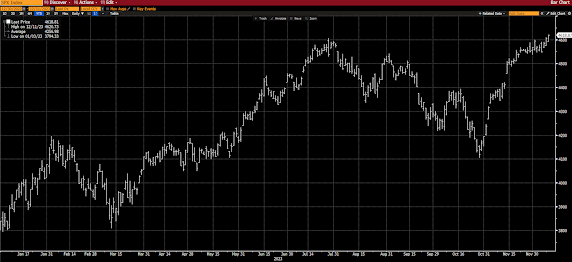

Here's the S&P 500 year-to-date:

Sunday, December 10, 2023

PWA 2023 Year-End Letter, Part 2: The Economy and the Stock Market

Thursday, December 7, 2023

Market Update: Seasonality vs The Technicals, plus Yields, The Dollar and Gold (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Wednesday, December 6, 2023

PWA 2023 Year-End Letter, Part 1: If A Blizzard Hits, Characteristics of The Best Portfolio Managers, and An Invaluable, Timely, Quote-Fest

As you (clients) know, I enjoy using analogies to explain our view of market and economic general conditions... In the past I've associated our macro analysis with the flight path of an eagle affixed with electrodes, etc., that allow us to monitor its vital functions as it glides across blue skies, sores to high altitudes, and flaps its way through the storms that occasionally cross its path.

Fishing, basketball and ice skating have also inspired some storytelling that has helped me drive home how we approach the task of preserving, protecting and growing our clients' wealth in a manner that has them satisfying their objectives while, ideally, feeling comfortable amid the inevitable ups and downs delivered by world markets.

Monday, December 4, 2023

Morning Note: Equity Market Conditions Remain Challenged

Here's the intro to our internal monthly equity market conditions analysis, including our technical view of the current US dollar setup:

11/30/2023 PWA EQUITY MARKET CONDITIONS INDEX (EMCI): -41.67 (-16.67 from 10/31/2023)

SP500 Index November 2023, +8.92%:

SP500 Equal Weight Index November 2023, +8.87%:

November turned out to be the best month of 2023.

While the EMCI score was still net negative, it had risen an unusually large 33 points by the star of the month.

Saturday, December 2, 2023

Economic Update: Classic Late Cycle, Copper & China, Bullish Sector Signal, Stocks, Sentiment, Gold (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, December 1, 2023

Novembers Past, Santa Headwinds, yada yada (video)

The following quote (and video), along with our own models, speaks to our stubbornness around remaining hedged right here:

"Stock investors should hope for the best but prepare for the worst when it comes to gauging the outlook of the US economy. Soft-landing optimists have a case to make, yet the historical evidence is overwhelmingly bearish when it comes to the end of previous Fed hiking cycles. Equities face steep losses if the economy sees a “softish” or hard landing.

In the 11 times when the Fed has tightened monetary policy to combat inflation since 1965, stocks escaped largely unscathed only about three times. The other occurrences saw average peak-to-trough losses of nearly 30% in the years after interest rates peaked."

-- Tatiana Darie (Bloomberg)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust: