In last year's year-end message we expressed the following go-forward view of equity market conditions:

"As for our present view of conditions, while we don't believe we're out of the icy water just yet -- and, for the moment, we anticipate that'll it'll get even colder before things begin to warm up -- we indeed see bluer skies on the not-too-distant horizon... Although, as you'll read in the remainder of this year-end message, we think the skating will be far better on ponds the vast majority of investors neglected during the previous bull run."

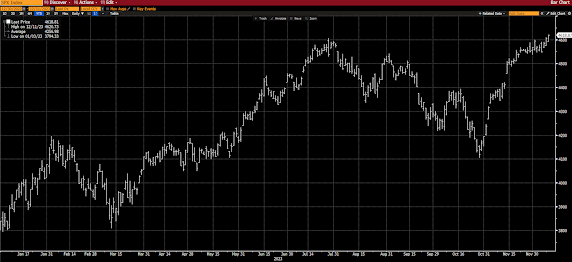

Here's the S&P 500 year-to-date:

While that February/March cold snap was indeed threatening, as we stated in Part 2, the Fed's $400 billion regional bank rescue served to heat things right back up... Then, from May to July, the AI-driven "Magnificent 7" phenomenon (just a handful of stocks doing all the heavy lifting) boosted the headline index virtually straight up to the end of July.

And what about that Q3 double-digit drawdown, was that the cold snap we were looking for? Nope, our concern lies in the fact that the market seems utterly unconcerned with the prospects for recession on the horizon, which, in that event, exposes itself to consequential downside risk... I.e., that cold snap, should it come, will be in response to the reality that the earnings estimates currently baked into stock prices simply cannot hold up amid an economic contraction.

As we spelled out in Part 2, the excess "pandemic" savings that remains on consumer balance sheets, and their propensity to spend them, has in-effect kept recession at bay to this point... And it seems that, in the eyes of the market, the longer we go without recession, the less likely one is to arrive... That, mind you, is a most dangerous assumption.

Also mentioned in Part 2, the length of time separating yield curve inversion (considered a most-reliable recession indicator) and recession ranges from 7 months to 2 years, the current stint being just over 20 months.

The white circles below -- capturing the S&P 500 during the recessions of the past 60 years -- is what makes the assumption that recession's been averted a potentially dangerous one:

And one that we're not willing to make, given the current overall setup --which includes the fact that last October's bottom came amid valuations (yellow circle) that simply do not comport with bear market bottoms past (white circles).

SP500 Price to Sales Ratio:

SP500 Price to Earnings Ratio:

Price to Book Value Ratio:

Granted, valuation measures are terrible market timing tools -- as stocks can stay "overvalued" for a very long time -- however, they can indeed be quite useful when considering longer-term upside vs downside potential.

So, while there's much more we can throw at you to justify our current thinking, I think you get the picture... While we continue to invest in a manner that can capture some upside as the stock market rallies, the fundamental macro backdrop demands that we continue to exhibit a fair amount of caution while the current cycle finishes itself out.

So what does that look like in the context of a properly diversified global macro portfolio?

Presently our core asset mix is as follows:

Note that we're presently just over half in stocks... Which, I assure you, is not an example of a typical portfolio right here.

Within our stock market exposure, here's how we're spread out among sectors:

Which, per the below, expresses our present tilt toward value:

In terms of regions, while North America carries just over half the weight, we're nevertheless globally diversified:

As for commodities, that allocation is presently divided as follows:

Gold: 46%

Ag Futures: 41%

Silver: 13%

You might be wondering why we're not presently allocating any of the portfolio to industrial commodities (other than silver)... Especially since, as clients know, we're long-term bulls on the metals.

Well, in fact, we do have some indirect exposure through equities, specifically to metals miners stocks (see "materials" in the sector mix above)... However, to reduce our overall industrial commodities exposure, we recently exited our metals futures position, as they stand to take notable hits if indeed recession arrives in the not-too-distant future.

Now, again, make no mistake, beyond either recession, or an abatement of the conditions that point in that direction, we are indeed bullish industrial commodities -- we'll expound on that in a following section of this letter.

And, lastly, we're also currently hedged... I.e., in addition to managing what we view to be a prudent asset mix, given present circumstances (the downside risk in a recession scenario is not small), we're also hedging our equity exposure through the use of S&P 500 put options, which stand to further limit the potential downside hit, meaningfully, particularly during swift declines.

Bottom line: While we won't pretend for a moment that we know the future -- believe me, 39 years in markets makes one humble and, therefore, inspires relentless deep analysis -- we will submit, with conviction, that we do know how to assess macro risk/reward setups... Hence, our current, relatively-conservative, strategy.

In Part 4 we'll explore the go-forward setup for the all-important US dollar.

No comments:

Post a Comment