In this year's Part 2 we're updating the data and our narrative (recession risk remains elevated) on the state of the economy, using a format similar to last year's Part 2.

Yes, our recession light was lit last December, and it remains lit a full year later... And, while I state, ad nauseum, in the videos that our model is not a timing indicator, but rather a risk measure, we nevertheless need to get our heads around what's held the economy up amid such dire signals from too much of the data.

Now, before we go there, I should mention that what is widely viewed as the most reliable of all recession signals -- when the 2s/10s treasury yield curve goes inverted -- comes (historically) with a lag of 7 months to 2 years between initial inversion and the onset of recession .

I should also mention that in October 2022, Bloomberg Economics literally assigned a 100% probability that we'd be in recession within the ensuing 12 months... Well, that didn't happen.

Well, while we could no doubt find ourselves in multiple weed patches with such a question, we'll yield to Occam's Razer and go with the simplest explanation:

Actually, two factors come to mind... One being the general state of the consumer who found him/herself with a still-high balance of "pandemic savings" coming into the year, and a burning desire to spend it, along with (for homeowners) a debt composition that was pretty much locked in at historically-low interest rates, making him/her somewhat immune to what has been a dramatically higher rates backdrop.

The other being far less intuitive; which would be the March banking scare... Amid a cracking of several regional banks that had the Fed -- who was on a campaign to make things tougher in an attempt to rein in inflation -- coming swiftly to the rescue with some $400 billion... And, in the process, reigniting the animal spirits that were momentarily quelled by the event…We simply can't understate the message (the interpretation) therein that, when push comes to shove, the dear old Fed simply won't let things get too bad.

Regarding the latter, if you've been around the block a few times, you've likely come to believe that, when it's all said and done, a constant kicking of the can ultimately results in a far more painful resolution than had policymakers let markets do their thing along the way... In essence, the moral hazard engendered in the belief that policymakers can forever control real economic forces inspires ever-higher risk-taking that tends to take things far beyond where long-term fundamental reality ultimately allows.

I.e., ultimately, fundamentals do matter!

In June 2017, after decades of parsing volumes of economic data, constructing our attendant views and applying them, we decided to create our own index and formally track the data we felt were most telling in terms of giving an on-the-ground, real-time assessment of general conditions.

We then ran it back a ways to determine how revealing it would have been over the past couple of cycles.

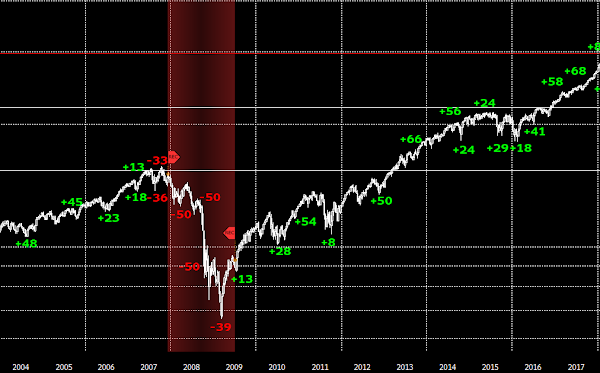

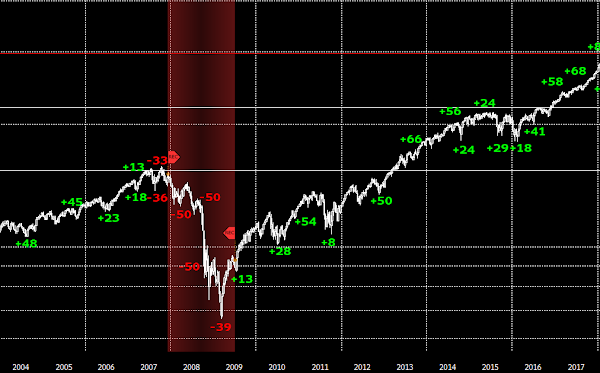

The white line in the graph below represents the S&P 500 Stock Index, the numbers plotted along the line represent the PWA Index's score at the time, the red shaded areas represent recessions:

Let's zoom in.

Here's February 1998 through December 2003:

Here's January 2004 through December 2017:

Here's January 2018 to present:

Therefore, odds that favor a somewhat lower low before this bear market ultimately plays itself out are still, in our view, on the table...

But of course we remain open to all possibilities!

Uh, yeah, still very much a bear market.

Brick and Mortar Retail Sales:

Online Retail Sales:

Personal Income:

Various Consumer Debt Metrics:

Consumer Savings Ratio:

Mortgage Purchase Applications:

Housing Starts:

Housing Permits:

Homebuilder Sentiment:

Weekly Unemployment Claims:

Non-Farm Payrolls, etc.:

Job Openings:

Labor Market Conditions Index:

ISM Manufacturing Index:

ISM Services Index:

Small Business Sentiment:

Industrial Production:

Capital Expenditures:

Commercial and Industrial Loans:

Heavy Truck Sales:

Truck Tonnage:

Cass Freight Index:

Caterpillar Global Sales:

Global Purchasing Managers Index:

Leading Economic Indicator/Coincident Economic Indicator Ratio:

Chicago Fed National Activity Index:

Citigroup US Economic Surprise Index:

Various Inflation Metrics:

Inflation Swaps:

Employment Cost Index:

Bloomberg Commodity Index:

CRB Raw Industrials Index:

We then ran it back a ways to determine how revealing it would have been over the past couple of cycles.

The white line in the graph below represents the S&P 500 Stock Index, the numbers plotted along the line represent the PWA Index's score at the time, the red shaded areas represent recessions:

Let's zoom in.

Here's February 1998 through December 2003:

Here's January 2004 through December 2017:

Here's January 2018 to present:

As you can see, our index went into the red ahead of each of the previous 3 recessions and "official" bear markets in stocks (the covid bear market, frankly, as I've explained in video commentaries, didn't satisfy our bear market criteria).

In our most recent experience, our index was not signaling recession ahead of the current bear market, which is why, as it got underway, we -- per the technical analysis I shared on multiple videos during the spring of last year, and since -- established ~3,500 as our downside bear market target.

As it turns out, so far, that looks to have been a good call (bounced hard off of 3492 intraday on October 13th and hasn't looked back):

Like I said, "our index was not signaling recession" when we established that downside target for equities... So I was, thus, very careful at the time to provide the caveat that, should our economic assessment deteriorate to the point where recession odds trump further expansion odds going forward, our downside target would, in all likelihood not hold... Here's from our June 17, 2022 blog post:

In our most recent experience, our index was not signaling recession ahead of the current bear market, which is why, as it got underway, we -- per the technical analysis I shared on multiple videos during the spring of last year, and since -- established ~3,500 as our downside bear market target.

As it turns out, so far, that looks to have been a good call (bounced hard off of 3492 intraday on October 13th and hasn't looked back):

"While our 3,500 S&P 500 downside target continues to make sense to us, suffice to say that global macro conditions are waning to the point that could have us seriously re-thinking that scenario over the coming weeks/months..."Well, alas, within 2 months, our assessment indeed deteriorated to that point, and, per below, remains below that point as I type:

Therefore, odds that favor a somewhat lower low before this bear market ultimately plays itself out are still, in our view, on the table...

But of course we remain open to all possibilities!

Now, before moving on, I want to address the S&P 500 chart above... Here I am, referring to the present state of affairs as the "current bear market" while the index is just a stone's throw from its all time peak back in January 2022, and more than 20% up off that October 2022 low.

Make no mistake, a not-small number of Wall Streeters have already claimed victory over the bear and assure us that a new bull market is well under way!

Well, let's take a look at the S&P 500 from a different angle... Rather than cap-weight it (the larger companies largely move the needle), as the headline index does, we'll consider it on an equal-weight (all companies receive equal measure) basis:

Pretty much stuck in a trading range, with still a fair bit of room between the current level and the all time high.

And how about the universe of small cap stocks captured by the Russell 2000 Index:

Uh, yeah, still very much a bear market.

So now let's take a quick run through our general conditions index's components... I'll highlight according to their respective signals (as we [subjectively] see them)… The red-shaded areas highlight past recessions... You'll be able to eyeball in many of the charts why we highlight (score) each as we do... This will have you understanding where we're coming from:

Brick and Mortar Retail Sales:

Online Retail Sales:

Auto Sales:

Consumer Spending:

Consumer Spending:

Personal Income:

Various Consumer Debt Metrics:

Consumer Savings Ratio:

Consumer Confidence:

Mortgage Purchase Applications:

Housing Starts:

Housing Permits:

Homebuilder Sentiment:

Weekly Unemployment Claims:

Non-Farm Payrolls, etc.:

Labor Market Conditions Index:

ISM Manufacturing Index:

ISM Services Index:

Small Business Sentiment:

Industrial Production:

Capacity Utilization:

Capital Expenditures:

Commercial and Industrial Loans:

Heavy Truck Sales:

Truck Tonnage:

Caterpillar Global Sales:

Global Purchasing Managers Index:

Leading Economic Indicator/Coincident Economic Indicator Ratio:

Chicago Fed National Activity Index:

Citigroup US Economic Surprise Index:

Various Inflation Metrics:

Inflation Swaps:

Employment Cost Index:

Bloomberg Commodity Index:

CRB Raw Industrials Index:

Copper Price:

Baltic Dry Index:

1-Month Sector/SP500 Ratios.

Baltic Dry Index:

1-Month Sector/SP500 Ratios.

Tech:

Financials:

Consumer Discretionary:

Materials:

Energy:

Industrials:

Consumer Staples (economically-defensive sector):

Utilities (economically-defensive sector):

Healthcare (economically-defensive sector):

YTD Consumer Staples/Consumer Discretionary

Ratio:

Treasury Yield Curve:

Presently, a mere 15% of our inputs score positive, while 43% score negative, 42% neutral... Not the ideal forward-looking setup for asset prices.

Ratio:

YTD Stock/Bond Ratio:

Treasury Yield Curve:

Presently, a mere 15% of our inputs score positive, while 43% score negative, 42% neutral... Not the ideal forward-looking setup for asset prices.

So, as stated above, in our view, excess consumer savings, and the propensity to spend them, largely explains the resilience of the US economy throughout 2023.

Not that such data are easy to measure, but those who do tell us that by the end of Q1 of next year, for all intents and purposes, it (in the hands of those who move the economic needle) will have been all spent... Which, if that's the case, makes for an increasingly vulnerable economic backdrop going forward.

Here's a bit of evidence gleaned from statements emerging out of retail and the financial sector last week (HT Peter Boockvar):

"From Dollar General: "During our most recent survey work, our customer continues to tell us they are feeling significant pressure on their spending, which is supported by what we see in their behavior. Based on these trends and what we see in the macroeconomic environment, we anticipate customer spending may continue to be constrained as we head into 2024, especially in discretionary categories.""

"From Chewy: "the softness that we called out last quarter that we started seeing in the July-August timeframe has persisted. We're seeing the impact of this softness most materially in the non-Autoship portion of our business (Autoship is a subscription service sending non-discretionary consumables and health products)...And primarily across highly discretionary components, some consumable components, this is related...making forecasting a little bit difficult across the macro that is keeping discretionary soft and overall spending patterns a little bit opportunistic.""

"From AutoZone: "We do feel the low end consumer started pulling back on discretionary purchases...For the 2nd quarter, we expect our DIY sales to remain more difficult and our commercial sales trends to improve.""

"From Box: "Our guidance also accounts for the continued pressure on seat growth that we anticipate due to the macroeconomic environment as well as lower professional services revenue vs our prior expectations.""

"From Amex: "If you just go back in the 2nd quarter, we had 8% overall billings growth. Third quarter, it came down to 7%. And in October, everybody got a little bit skittish, and I think other people have said the same thing that growth wasn't as strong in October. And we didn't see growth in October like it was in the third quarter." He did say though after that November he saw "sort of what we looked like in the third quarter.""

"From BofA: After talking about Black Friday and Cyber Monday spend, "it's much more consistent with that money moving out of customer accounts with a lower growth, low inflation economy. And that's what you're seeing...The year to year growth rate ticking down, which doesn't sound good because it's still going up, but it's going up at a less high rate. You're seeing the way customers are spending, their money has leveled out." He referred to this as 'normalization.'"

"From Truist Financial: "End clients are generally...on the commercial side, generally more cautious, so no doubt about that. You can see some of that caution reflecting in loan demand. So a little more careful about the next addition to the truck fleet or the next warehouse of data center or whatever it may be in terms of those decisions. And I'm not so sure it's as much financing driven as it's just cautionary note about where the economy is." On the consume side, "it's also bifurcated. And the higher end consumer is still spending and still lots of discretionary activity, and you see that in hotel and air traffic and destination experiences, all those type of things. But the lower end consumer, however, we might define that, let's call it, $100,000 income and below...I think that consumer is going to start feeling a little more stress. You're seeing a little more credit card utilization, a little more delinquency. We saw some of the buy now-pay later come into some of the holiday sale. So that consumer is starting to feel that stress, and I think that's going to manifest itself in some way to what degree we can all speculate, but into next year.""Now, somewhat in contrast to the above warning signs, last week's commentaries also offered up something for those in the no-recession camp:

"From Lulu: "this Black Friday was the single biggest day in company history with strength across our store and e-commerce channels… Despite an uncertain macro backdrop, our teams are executing at a high level, which contributed to our upside in Q3...we're happy with our start to the holiday season, but with nearly two-thirds of the quarter still in front of us, we remain prudent in our planning.""

"From Signet Jewelers: "Jewelry continues to be an important gifting category particularly among Gen Z with Black Friday weekend results in line with our expectations…Google searches for engagement rings are now 10% higher than last year, the first time they've exceeded the prior year in nearly two years. The percentage of couples moving to the engagement phase has improved by 5 points, a statistically significant movement over the last 18 months.""

"From Toll Brothers: "We have continued to see solid demand through our fourth quarter... Based on our non-binding deposit activity through the first five weeks of our first quarter, demand remains solid and consistent with normal seasonality. As we approach the start of the spring selling season in January, we are encouraged by the recent 75 bps drop in mortgage rates. With resale inventories at historic lows, buyers continue to be drawn to new homes, and we expect lower rates with lower inflation to add to this already solid demand.""

Of course the recession camp would argue that when we're talking athleisure, jewelry and homes we're talking the "higher end consumer" Truist cites above; whom they feel is "going to start feeling a little more stress." Which jibes with our current go-forward assessment.

Oh, and by the way, one of our premium research providers who actually predicts the timing of things like recessions, and who (being spot on) gave zero odds of recession this year, says this about next year:

“We assign 50% odds to the recession starting in the second half of 2024, 25% odds to it starting before then, and 25% odds to it starting in 2025 or later.”

—Peter Berezin, BCA Research

Stay tuned…

In the following sections we'll discuss how we're expressing our still-cautious view within our core portfolio, then we'll go exploring the global macro environment beyond whatever's left in the present cycle, and how we intend to exploit it.

No comments:

Post a Comment