Trying something new here on the blog for Monday mornings.

Each week we perform an extensive exercise that captures everything from performance across equity sectors, fixed income and commodities, to fundamental and technical looks at currencies and select asset classes, to assessments of market breadth, correlations, intermarket relationships, positioning, flows, sentiment, financial stress, and, frankly, to lots more... And while I'm tempted to load up all of the updated charts, I'm fairly certain (based on much feedback over the years) that would take too many readers into complex depths they'd prefer we'd, on their behalf, plumb on our own.

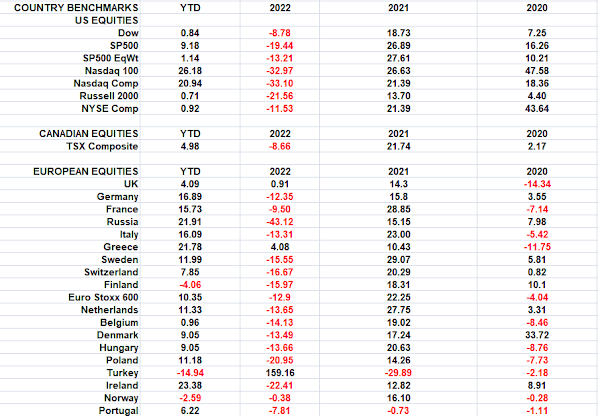

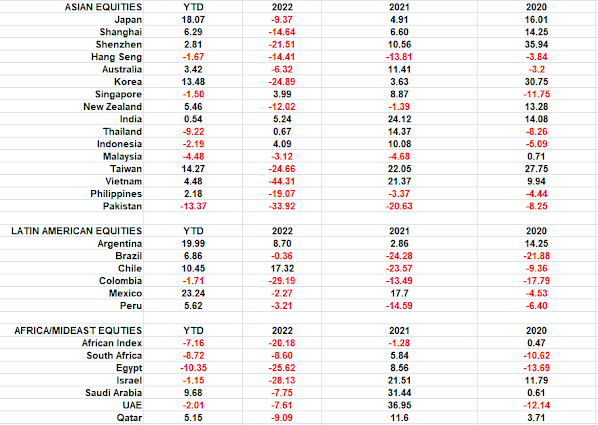

But I am thinking that a Monday morning look across asset class results would indeed be of interest to most clients and regular readers.

So here you go:

Europe, on the other hand, is mostly red, with all but 11 of the 19 bourses we follow trading down so far this morning.

US equity averages are mostly (save for the Dow) higher to start the session: Dow down 78 points (0.23%), SP500 up 0.13%, SP500 Equal Weight up 0.10%, Nasdaq 100 up 0.36%, Nasdaq Comp up 0.42%, Russell 2000 up 0.70%.

As for Friday's session, US equity averages closed lower: Dow by 0.3%, SP500 down 0.1%, SP500 Equal Weight down 0.3%, Nasdaq 100 down 0.2%, Nasdaq Comp down 0.2%, Russell 2000 down 0.6%.

This morning the VIX sits at 17.26, up 2.68%.

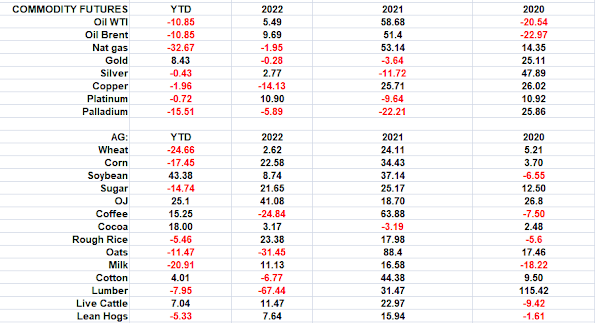

Oil futures are up 0.35%, gold's down 0.24%, silver's down 0.62%, copper futures are down 1.14% and the ag complex (DBA) is down 0.26%.

The 10-year treasury is down (yield up) and the dollar is up 0.01%.

Among our 34 core positions (excluding options hedges, cash and money market funds), 23 -- led by MP Materials, URNM (uranium miners), Albemarle, OIH (oil services stocks) and EZA (South African equities) -- are in the green so far this morning... The losers are being led lower by XLP (staples stocks), DBB (base metals futures), Johnson & Johnson, SLV (silver) and XLI (industrial stocks).

"...when credit is created, buying power is created in exchange for a promise to pay back, so it is near-term stimulating and longer-term depressing."

--Dalio, Ray. Principles for Dealing with the Changing World Order

Have a great day!

Marty

No comments:

Post a Comment