For this morning's message we'll start by reposting Friday and Saturday's video commentaries... Both of these are we think very timely and should be viewed by anyone who’s at all interested in the current risk/reward setup for markets, and in what the latest consumer data say about the present stage of the economic cycle:

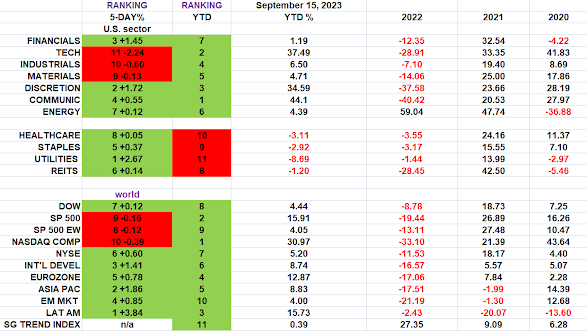

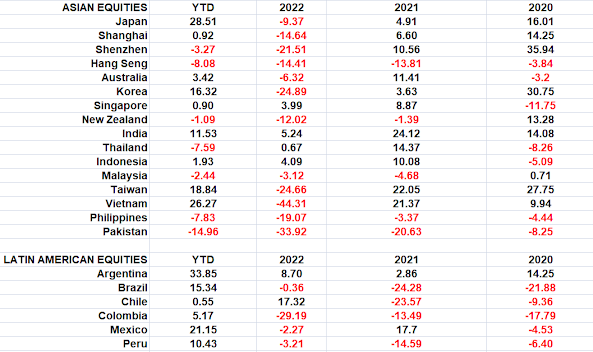

And here's your weekly sector, region and asset class results update:

Asian stocks traded down overnight, with 13 of the 16 markets we track closing lower.

Same for Europe so far this morning, with 17 of the 19 bourses we follow trading down as I type.

US equity averages are mixed to start the session: Dow down 14 points (0.04%), SP500 up 0.04%, SP500 Equal Weight down 0.63%, Nasdaq 100 up 0.22%, Nasdaq Comp up 0.09%, Russell 2000 down 0.15%.

As for Friday’s session, US equity averages traded lower: Dow by 0.8%, SP500 down 1.2%, SP500 Equal Weight down 0.9%, Nasdaq 100 down 1.8%, Nasdaq Comp down 1.6%%, Russell 2000 down 1.1%.

This morning the VIX sits at 14.32, up 3.84%.

Oil futures are up 1.16%, nat gas futures are up 2.99%, gold's up 0.14%, silver's up 0.17%, copper futures are down 0.64% and the ag complex (DBA) is down 0.65%.

The 10-year treasury is down (yield up) and the dollar is down 0.12%.

Among our 34 core positions (excluding options hedges, cash and money market funds), 10 -- led by EWZ (Brazil equities), OIH (oil services companies), GLD (gold), XLE (energy stocks) and SLV (silver) -- are in the green so far this morning... The losers are being led lower by MP Materials, VWO (emerging mkt equities), FEZ (Eurozone equities), XLP (consumer staples stocks) and VNM (Vietnam equities).

Once again, the ultimate risk being:

"...the future we encounter is likely to be very different from what most people expect." --Ray Dalio

Have a great day!

Marty

Marty

No comments:

Post a Comment