This jibes with recent evidence that the consumer is slowing down:

Although weather has been a factor:

But, overall, the delinquency rate trend continues to support the weaker-consumer narrative:

The US equity market remains very individual company-centric (and concentrated), which is a warning sign:

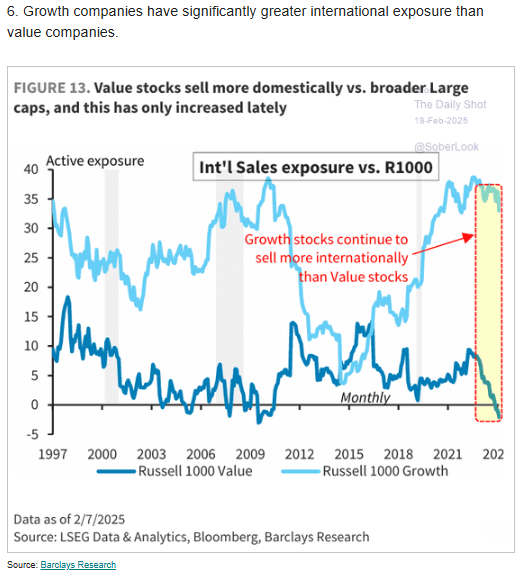

And those doing the heavy lifting are very exposed to geopolitical risk:

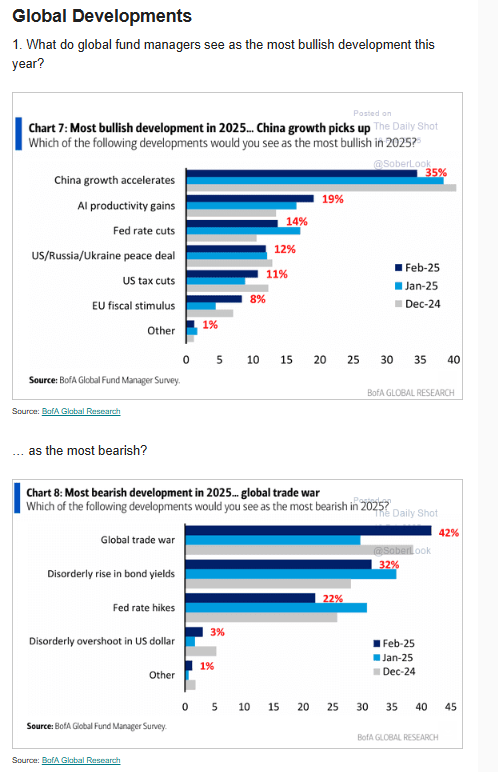

The following pretty well lists the bullish and bearish potential developments -- globally-speaking -- going forward... However, Fed rate cuts right here would likely push long-end yields higher and, thus, exacerbate a notable headwind for US equities.

While I’m concerned enough about the short-term setup for Eurozone equities to hedge them a bit, I sympathize with P. Boockvar’s view that long-term this recent uptrend "likely has legs:"

The following pretty well lists the bullish and bearish potential developments -- globally-speaking -- going forward... However, Fed rate cuts right here would likely push long-end yields higher and, thus, exacerbate a notable headwind for US equities.

While I’m concerned enough about the short-term setup for Eurozone equities to hedge them a bit, I sympathize with P. Boockvar’s view that long-term this recent uptrend "likely has legs:"

“...as part of this potential shift, Europe's impressive stock market performance year to date might not be a flash in the pan either. It seems European leaders, and highlighted by a Mario Draghi editorial over the weekend in the FT titled 'Europe Has Successfully Imposed Tariffs on Itself' saying that "High internal barriers and regulatory hurdles hurt growth far more than anything the US might do", finally get the economic ineptitude they have created for themselves via excessive regulation and bureaucracy. Also, they are on the cusp of spending a huge amount of money on upgrading and adding to their defensive capabilities. Their stock market rally likely has legs.”He also points to the potential durability of the commodities’ rally… I see near-term risk here as well, but I don’t disagree in general with his thinking, particularly with regard to “depressed regions:”

“We also have the likely rebuild of Ukraine and Gaza and just imagine the demand for building materials that this will bring. Commodity prices are likely going higher and bond yields are going to take another leg up as well as inflationary pressures will be well bid.

What this all possibly means is that market attention is in the midst of changing I believe, economic life in depressed regions is about to come alive and it will not all be about 7 stocks anymore.”

No comments:

Post a Comment