This morning's Q4 GDP estimate was net positive; above expectations growth with tame inflation. The Fed is safe to sit back and watch as 2019 unfolds, which bodes well for stocks.This week's dip in equities has been notably tame thus far considering the resistance zone the market presently sits in.

Thursday, February 28, 2019

Wednesday, February 27, 2019

Just Because It's Interesting OR Intermarket Relationships Are Key!

"So why was Caterpillar up today if it just got seriously downgraded?" asked our crazy-smart, inquisitive, CCO (Chief Compliance Officer) Jeannette this afternoon. I said "well, could be because there's evidence out there that maybe global construction isn't about to go rolling off into the abyss after all. In fact, copper, (that ubiquitous construction input) is painting an altogether different picture."

The Trade War's Doing A Number On Business Investment!

When questioned before Congress this morning on the impact of the "trade war" with China, Fed Chair Powell confirmed that respondents to the many surveys the Fed performs have major concerns, and that in some cases it is indeed influencing their expansion plans.

This Morning's Log Entry

2/27/19

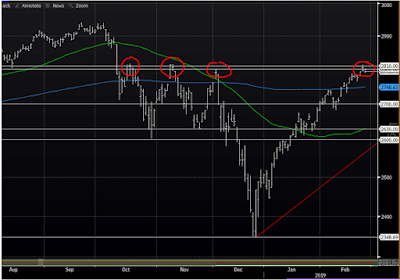

Domestic politics, geopolitics and the Fed are providing some push/pull for the market this week; while the S&P bumps up against what has been very strong technical resistance during the current correction:

Domestic politics, geopolitics and the Fed are providing some push/pull for the market this week; while the S&P bumps up against what has been very strong technical resistance during the current correction:

Tuesday, February 26, 2019

This Morning's Log Entry

2/26/19

The strong near-term setup is getting tested by Trump’s “maybe there’ll be no deal” (on China) statement yesterday, as well as on China’s followup comments which expressed a somewhat muted optimism. Neither commentary, however, suggests that there’s any credible growing threat to an ultimate deal, at this point.

Despite the strong near-term underpinnings, given the speed of the move off of the 12/24 low, traders might very well take any excuse to take some profit right here.

The strong near-term setup is getting tested by Trump’s “maybe there’ll be no deal” (on China) statement yesterday, as well as on China’s followup comments which expressed a somewhat muted optimism. Neither commentary, however, suggests that there’s any credible growing threat to an ultimate deal, at this point.

Despite the strong near-term underpinnings, given the speed of the move off of the 12/24 low, traders might very well take any excuse to take some profit right here.

Monday, February 25, 2019

Brief Market Update (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Sunday, February 24, 2019

This Morning's Log Entry

2/24/19

This coming week will be

interesting, if not telling. Trump appears to be at odds with Lighthizer; this

has been a long time coming. Lighthizer’s history, and utter lack of economic

tutoring (by his own admission) always made him a strange, and dangerous, pick

for the top trade post. Up to him, the negotiations would drag on and tariffs

would likely rise in the meantime. I.e., if it were up to him we’d be staring

down stronger odds of a near-term global recession;

although he – as his words and actions dictate -- would be oblivious to the

risk.

Friday, February 22, 2019

This Morning's Log Entry and This Week's Message: Europe's Trade Negotiation Strategy, If....

2/22/19

A consensus seems to be

growing that since a trade deal with China is a virtual certainty, it’s already

in the market. If that’s the case, we should anticipate a sell-on-the-news

scenario.

Thursday, February 21, 2019

Quote of the Day

This, from the President this morning (on 5g), should be music to every investor's, and consumer's, ear: emphasis mine...

This Morning's Log Entry

2/21/19

U.S. equity futures and

Asian stocks rallied notably last night on news that the U.S. and China are drafting

a multi-point plan to end the trade war. That rally, however, completely

reversed on followup news suggesting there remains a marked lack of detail.

News that China is banning Australian coal imports seemed to shake global

markets a bit as well.

Wednesday, February 20, 2019

Market Update (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Monday, February 18, 2019

Freight data say the economy is still okay... However, there is this threat...

Last year we added the Cass Freight Shipment and Expenditures reports to our proprietary macro index because:

Sunday, February 17, 2019

My two cents on "millennial socialism"

The following from this week's issue of The Economist speaks to what my study and observations of the past 30+ years has me concluding:

Saturday, February 16, 2019

This Morning's Log Entry

2/16/19

Stocks maintained strong gains

throughout the day yesterday, then rallied hard into the close; traders were

more than comfortable being long into the weekend. This pattern of late day

buying during the current rally is hugely bullish.

Friday, February 15, 2019

This Morning's Log Entry

2/15/19

Optimism from U.S./China talks and positive

earnings news out of Europe have stocks rallying hard this morning.

This Week's Message: All You Need To Know About the Latest Market Action

While the following is no doubt our shortest weekly message ever, it tells you all you need to know about the latest market action.

From Steven Drobney's extremely instructive Inside the House of Money: emphasis mine...

From Steven Drobney's extremely instructive Inside the House of Money: emphasis mine...

"Sometimes speculators add to volatility, other times they dampen it. The important point is, they don't influence the trend; underlying pressures along with policy decisions drive market events."

Thursday, February 14, 2019

Quotes of the Day: Too Much Emphasis on Trade??

If it seems like we're beating the global trade issue to death here on the blog, well, I just read the transcript from today's Coca-Cola (that great American brand) earnings conference call.

Headline of the Day

Confirming what we've been preaching herein ad nauseam, just when the major averages were on the verge of green this morning, this headline hit:

This Morning's Log Entry

2/14/19

Dow and S&P futures this morning went from nicely positive to flat on higher than expected weekly jobless claims and lower than expected m/m PPI, then completely rolled over on hugely worse than expected December retail sales.

Dow and S&P futures this morning went from nicely positive to flat on higher than expected weekly jobless claims and lower than expected m/m PPI, then completely rolled over on hugely worse than expected December retail sales.

Wednesday, February 13, 2019

My Two Cents on the Share Buyback Debate

A hot topic, among many others, today is the push to regulate share buybacks by our iconic U.S. brands. Surprisingly, even some on the right (Marco Rubio anyway) find it to be (please pardon my cynicism) politically expedient to join the chorus.

Market update, and what we're looking out for going forward (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, February 12, 2019

This Evening's Log Entry

2/12/19

The latest BofA/ML mutual fund manager survey shows a presently high level of bearishness among respondents and cash positions at their highest since 1/09.

The latest BofA/ML mutual fund manager survey shows a presently high level of bearishness among respondents and cash positions at their highest since 1/09.

No Need To "Bring Back the Jobs" -- And Quote of the Day

This morning's Job Opening and Labor Turnover Survey (JOLTS) for December (1 million+ more job openings than there are folks looking for work), once again tells us that, contrary to popular political opinion, the U.S. labor market is in no way hurting from the strategic movement of some production to the world's lower-cost labor markets.

Chart of the Day: Foreclosure & Delinquency Data Say Something

In a weekend blog post I illustrated the market's view of the present state of U.S. housing (bullish). Keeping with that theme -- by way of foreclosure and mortgage delinquency rates -- here's more evidence from this telling sector that the U.S. consumer-driven economy, not to mention the financial condition of the U.S. consumer him/herself, remains in pretty decent shape:

Monday, February 11, 2019

Today's Log Entry

2/11/19

Big overnight gains in Asia and Europe didn’t translate to gains in the U.S..

Quote of the Day

As I stated on Saturday (and a zillion times previously), trade is THE global issue of the day -- and is utterly huge in terms of the direction of the economy and the markets going forward.

Sunday, February 10, 2019

Charts of the Day: Housing Stocks Say Something

Each week I perform a detailed technical analysis of the equities that make up the key sectors of the economy. While these analyses help me gauge to what extent, if at all, we should be exposed to a given sector, I'm also looking for any and all signals pointing to the state of the overall economy.

Saturday, February 9, 2019

This Week's Message: Strong Internals, Worrisome Externals (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, February 8, 2019

Chart of the Day: Nothing Panicky At This Point

While 500ish points of Dow downside (yesterday and so far this morning) is an attention getter, at this point, it's been pretty blah.

Last Night's Log Entry

2/7/19

The

market fell apart today when Larry Kudlow suggested that the U.S. and China are

essentially nowhere near a trade deal. This is yet another instance where Trump

and another adviser or two (in this case Mnuchin), literally hours before Kudlow’s comment, touted great progress and

a deal in the near-term offing – only to see the resulting rally quashed by

conflicting signals coming literally from someone on the same team.

Thursday, February 7, 2019

Trade Wars: The Pain and the "Gain" (video)

If you're interested in understanding the cold realities of protectionism, this short clip touches on the long-term commonsense of the issues of the day, as well as where all of the short-term thinking comes from.

Headline of the Day

This headline speaks directly to the closing message of this morning's video commentary:

"Dow drops 250 points after Larry Kudlow says US and China still far away on trade deal"

Brief Look At This Week's Action (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Quotes of the Day: No Surprises Here

Reuters this morning speaks to the point I made in yesterday's log entry, as well as to the roiling markets have taken due to the trade war. None of this should be of any surprise to anyone who remotely understands modern-day economies and markets.

Wednesday, February 6, 2019

This Morning's Log Entry

2/6/19

Clearly, as the Australian central bank joined the flock of doves this week, the world’s central bankers are, on balance, in anything but a tightening mood these days. While, global growth has definitely slowed, Q4’s near bear market in global equities is what truly captured the world’s monetary policy makers' attention.

Tuesday, February 5, 2019

Brief Look At The Latest Action (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Monday, February 4, 2019

Tracking our dollar thesis...

In our latest annual message I made the case for a weaker-trending dollar this year partly based on the prospects for a rotation away from U.S. equities into non-U.S. equities; those found in the Eurozone in particular:

Sunday, February 3, 2019

My Two Cents On The Tax Debate

While, like most folks who pay taxes, I'm never one to turn down a tax cut, I often find myself explaining to clients how a recession in the near-term would be unusually tough to combat using conventional fiscal and monetary means.

Friday, February 1, 2019

This Week's Message: Still Ample Fear Out There (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

So, Is The Fed Suddenly Back In Play?

In a log entry this week I predicted that the jobs number would be good this morning "but not a repeat of last month's 300+k." Boy was I wrong! The January number was +304k!

Subscribe to:

Comments (Atom)