2/27/19

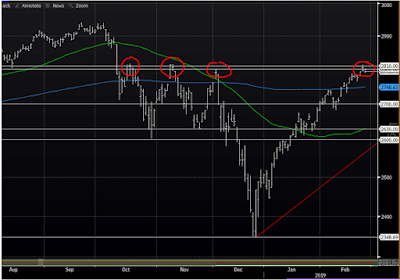

Domestic politics, geopolitics and the Fed are providing some push/pull for the market this week; while the S&P bumps up against what has been very strong technical resistance during the current correction:

Domestic politics, geopolitics and the Fed are providing some push/pull for the market this week; while the S&P bumps up against what has been very strong technical resistance during the current correction:

Any profit taking reversal of the recent surge

should find support at the 200-day moving average, then at 2700 if breached.

Despite the stiff resistance, as well as the

potentially negative headline influence, the pause this week so far feels like your garden variety consolidation

of recent gains; the volume character suggests the same (remaining more

constructive vs previous attempts at this level):

The latest economic

sentiment data (globally) -- while certainly not stellar -- hint that the latest batch of concerning hard data

may begin to improve over the coming months. That, along with optimism over a

U.S./China trade deal, clearly – at this

juncture – has traders nibbling at the dips. That said, the current level

is the most precarious between here and the September ‘18 high. We could easily

see volatility pick up markedly over the next few days/weeks…

No comments:

Post a Comment