Now you'd think that with this week's wake-up call we'd be seeing those snoozers on the bullish (short-term sentiment) side of the boat begin to, well, wake up.

Well, some have, some haven't at all, some haven't enough, and some I won't know till tomorrow:

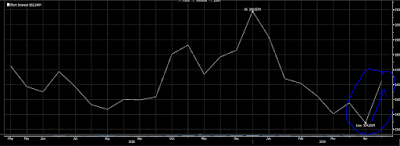

Clearly, short sellers have! I illustrated for you the recent remarkably low short interest in the largest index-tracking ETF (SPY), and the danger inherent therein if a little bad news hits the headlines. They're reacting accordingly: click each insert below to enlarge...

As for individual investors, while the bearish crowd did add a few members, the bulls picked up a larger number of converts. While the bulls aren't at excessive levels (although their numbers are above average), their big jump, and the still low number of bears, is not what you want to see when you're looking for a market bottom.

As for investment advisors, the bulls are fewer in number, but still high enough to remain in the "caution" zone. Also not indicative of a selloff bottom.

As for VIX shorts (a record number betting on lower volatility last week), I won't have their latest numbers until tomorrow. Looking at the big spike in the VIX this week, however, if it doesn't reflect tomorrow (the data will be as of Tuesday), I'm certain next Friday's reading will show that a good number have covered.

All in all, it's a better picture than a week ago, but there's not nearly enough fear out there (by itself) to signal that the worst is over.

That last sentence said, we should absolutely expect a strong rally off of today's lows if we hear overnight that U.S. and Chinese negotiators came to terms that averted the scheduled tariff hike at midnight tonight. If, however, they conclude that existing tariffs will remain as part of a deal (hard to see China agreeing to that, but that's what the U.S. wants), all bets are off.

No comments:

Post a Comment