If we're reading between the Fed lines correctly, and they're indeed getting a bit nervous about cracks forming in credit markets, and, therefore, are looking for excuses to walk back their tough talk, this morning's data releases were a gift:

Case-Shiller Home Price Index Month-On-Month % Change:

Conference Board Consumer Confidence*:

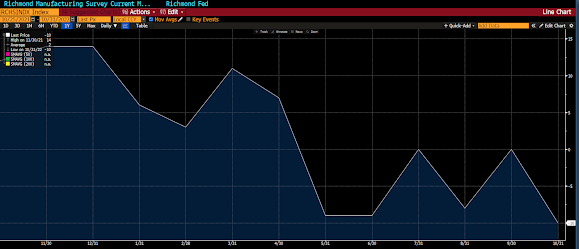

Richmond Fed Manufacturing Index:

That said, the consumer sentiment read poses a bit of a conundrum for the Fed.

On the one hand:

"Consumer confidence retreated in October, after advancing in August and September," said Lynn Franco, Senior Director of Economic Indicators at The Conference Board. "The Present Situation Index fell sharply, suggesting economic growth slowed to start Q4. Consumers' expectations regarding the short-term outlook remained dismal. The Expectations Index is still lingering below a reading of 80—a level associated with recession—suggesting recession risks appear to be rising."On the other:

"Notably, concerns about inflation—which had been receding since July—picked up again, with both gas and food prices serving as main drivers. Vacation intentions cooled; however, intentions to purchase homes, automobiles, and big-ticket appliances all rose. Looking ahead, inflationary pressures will continue to pose strong headwinds to consumer confidence and spending, which could result in a challenging holiday season for retailers. And, given inventories are already in place, if demand falls short, it may result in steep discounting which would reduce retailers' profit margins."

I like this header: Gifts for a Maybe Nervous Fed. :)

ReplyDeleteI finally understand why PWA cares so much about the macroeconomy (the world is one big market as a Whole!) Big Tech companies, like Alphabet and Microsoft, are being hit with slow growth. For example, Alphabet Youtube has the slowest growth in a 13-year period in Q3 2022 because of the current macroeconomic environment. The same story is true at Microsoft. As a result, I like PWA's picks of the Emerging Market, Mexico, and Brazil.

I have a question about the digital currency in Latin America in which that part of the world has invested heavily in it. What is your opinion of the stock ticker Nu in Brazil? (Buffet has already invested $1billion in the company).

Yes, Sam, we do take a global macro approach to markets. And, yes, going forward we like Mexico and Brazil.. I suspect we'll add to these positions over time...

DeleteWith regard to central bank digital currencies (cbdc), I suspect we'll see adoption across many countries in the years ahead. It would/will be particularly advantageous for Latin America given, among other things, the importance of remittances across those economies...

As for NU, I just took a quick look at the profile, and while it's yet to turn a profit (expected to next year), the fact that Warren B has recently added to Berkshire's position there certainly says something... Otherwise, I, at this point, don't have an opinion (fundamentally)... In terms of the technicals, the chart paints a somewhat ambiguous picture -- could break out of that $4 to $5 range (since July) in either direction.. A strong move above its 50-day moving average (20 cents from here) would I suspect see it bounce into resistance at ~$5...Next resistance would be right around $5.90... A break below $3.95 would probably have it testing support around $3.60, then $3.25...