While markets await mid-term election results tonight/tomorrow/?, and CPI on Thursday, I'm thinking today's a good day to touch on some key highlights from our recent messaging herein:

Yesterday:

Friday saw quite the rally, particularly in asset classes and regions that sit prominently in our core portfolio mix.Last Friday:

While the jobs number was billed to be a big needle-mover come last Friday, the rally -- across primarily commodities and foreign equities -- in our view can be mostly explained by persistent rumors that China is diligently crafting a plan to exit its economy-stifling "covid-zero" policy over the next few months.

...an abundance of anecdotal data of late points to a potentially marked slowdown in job creation in the months to come... I.e., multiple firms have announced layoffs and hiring freezes over the past several days, while surveys are beginning to hint of a weakening employment picture (the October Services ISM employment component dipped into contraction territory, while the Manufacturing ISM came in right on the expansion/contraction dividing line)...

Last Thursday:

Asian equities were mixed overnight, with 8 of the 16 markets we track closing lower.

Europe mostly green so far this morning, with 15 of the 19 bourses we follow trading up as I type.

US stocks are mixed to start the session: Dow up 52 points (0.16%), SP500 down 0.06%, SP500 Equal Weight down 0.02%, Nasdaq 100 up 0.21%, Nasdaq Comp down 0.02%, Russell 2000 down 0.22%.

The VIX sits at 24.61, down 1.07%.

Oil futures are down 0.32%, gold's up 0.05%, silver's up 0.46%, copper futures are up 0.78% and the ag complex (DBA) is down 0.35%.

The 10-year treasury is up (yield down) and the dollar is up 0.15%.

Among our 35 core positions (excluding options hedges, cash and short-term bond ETF), 22 -- led by Albemarle, Sweden equities, Asia-Pac equities, long-term treasuries and materials stocks -- are in the green so far this morning. The losers are being led lower by Dutch Bros, Amazon, uranium miners, healthcare stocks, energy stocks and base metals miners.

...the language in the statement was more telling in the grand scheme of things... Meaning, yes, if something systemic begins to break, the Fed will swoop in to attempt to mitigate the damage... They indeed fear that they’ll be (or be perceived to be) the cause of the very break they’ll be scrambling to fix.Last Wednesday:

In the meantime, they see room to nudge their benchmark rate higher and to continue to talk more or less* tough on inflation.

*The official statement -- and the market's reaction to Powell's presser -- says we should anticipate soft(ish) talk from select Fed members over the coming weeks.

As you'll see below, indeed, October reflected those somewhat improved conditions... But note that overall conditions remain negative -- supporting our short-term thesis which, at present, has odds favoring a Q4 rally, but then a yet lower low as this bear market plays itself out.

Here's from our latest report:

10/31/2022 PWA EQUITY MARKET CONDITIONS (EMCI) INDEX: -25 (no change from 9/30/2022)

SP500 past 30 days +7.99%:

After scoring a 25-pt improvement during September, our EMCI showed no overall change in October (although there was movement among its components), remaining at -25, reflecting still on-balance negative equity market conditions.

Inputs that showed improvement:

SPX Technical Trend (from neutral to positive)

Breadth (from negative to neutral)

Inputs that deteriorated:

US Dollar (from positive to neutral) -- (based solely on our technical analysis)

Economic Conditions (from neutral to negative)Inputs that remained bullish:

Sector Leadership

Sentiment (net fear. I.e., contrarian indicator)

Inputs that remained bearish:

Interest Rates

Fed Policy

Valuation

Geopolitics

Credit Market ConditionsInputs that remained neutral:

Fiscal Policy

EMCI since inception:

SP500 since EMCI inception:

Last Tuesday:

I don't mean to say that the Fed wants to crash the stock market, but I do mean to say that they don't want it barreling into new all-time-high territory right away either... I.e., that's akin to easing financial conditions, which may be how you avert financial crisis, but it's definitely not how you go about fighting inflation... Moderation in markets is more to their liking right here.

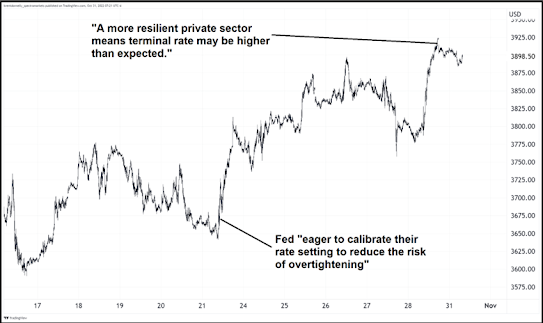

So, here, per the chart below (offered up by trader and author extraordinaire Brent Donnelly), we are -- a nice ways above where we were on the day of that "risk of overtightening" tweet... Hence, Mr. Timiraos threw this one out late last week:

"A more resilient private sector means terminal rate may be higher than expected."

SP500:While the latter, in my view, isn't as hawkish as the former is dovish, it does suggest that the recent rally, and improvement in some key financial stress indicators we track, has the Fed feeling a little less fearful heading into this week's meeting...

------------------------------------------------------

Asian equities were mixed overnight, with 8 of the 16 markets we track closing lower.

Europe mostly green so far this morning, with 15 of the 19 bourses we follow trading up as I type.

US stocks are mixed to start the session: Dow up 52 points (0.16%), SP500 down 0.06%, SP500 Equal Weight down 0.02%, Nasdaq 100 up 0.21%, Nasdaq Comp down 0.02%, Russell 2000 down 0.22%.

The VIX sits at 24.61, down 1.07%.

Oil futures are down 0.32%, gold's up 0.05%, silver's up 0.46%, copper futures are up 0.78% and the ag complex (DBA) is down 0.35%.

The 10-year treasury is up (yield down) and the dollar is up 0.15%.

Among our 35 core positions (excluding options hedges, cash and short-term bond ETF), 22 -- led by Albemarle, Sweden equities, Asia-Pac equities, long-term treasuries and materials stocks -- are in the green so far this morning. The losers are being led lower by Dutch Bros, Amazon, uranium miners, healthcare stocks, energy stocks and base metals miners.

"The lesson of the last two centuries is that liberty and welfare march hand in hand with prosperity and trade."

--Ridley, Matt. The Rational Optimist

Have a great day!

Marty

Thanks!

ReplyDelete