Before we jump to this week's results update, let's take a look at this morning's release of the May ISM Services Survey.

In Friday's economic update I mentioned that I expected it to come in at a still-expansionary score (above 50)... Well, it did, but just by a hair (yellow line [white is manufacturing]):

And, by the way, those red-shaded areas you see there are recessions... Hmm...

Here's from the report; note the direction and rate of change columns for each component:

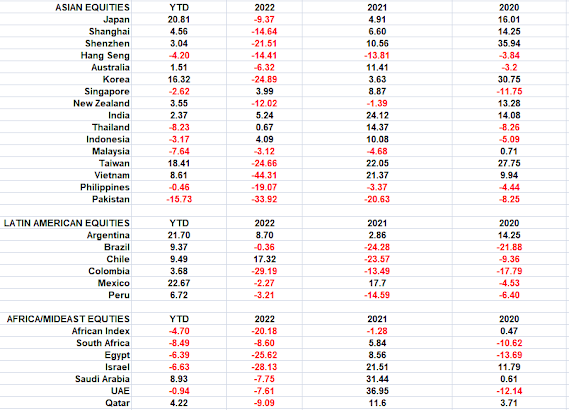

Here's your weekly look across asset class results:

Asian stocks were mostly green overnight, with 10 of the 16 markets we track closing higher.

Europe's leaning red so far this morning, with all but 10 of the 19 bourses we follow trading down as I type.

US equity averages are mixed to start the session: Dow down 83 points (0.25%), SP500 up 0.18%, SP500 Equal Weight down 0.19%, Nasdaq 100 up 0.61%, Nasdaq Comp up 0.42%, Russell 2000 down 1.38%.

As for Friday's session, US equity averages closed higher: Dow by 2.0%, SP500 up 1.5%, SP500 Equal Weight up 2.2%, Nasdaq 100 up 0.7%, Nasdaq Comp up 1.1%, Russell 2000 up 3.6%.

This morning the VIX sits at 14.97, up 2.53%.

Oil futures are up 1.37%, gold's up 0.49%, silver's down 0.23%, copper futures are up 0.77% and the ag complex (DBA) is down 0.29%.

The 10-year treasury is down (yield up) and the dollar is up 0.03%.

Among our 34 core positions (excluding options hedges, cash and money market funds), 14 -- led by AT&T, EZA (South African equities), URNM (uranium miners), XLC (communications stocks) and EWW (Mexican equities) -- are in the green so far this morning... The losers are being led lower by OIH (oil services stocks), MP Materials, PHO (water resource stocks), FEZ (Eurozone stocks), XME (base metals miners) and ITA (defense stocks).

“A man must study general conditions, to seize them so as to be able to anticipate probabilities.”

--Jesse Livermore

Marty

No comments:

Post a Comment