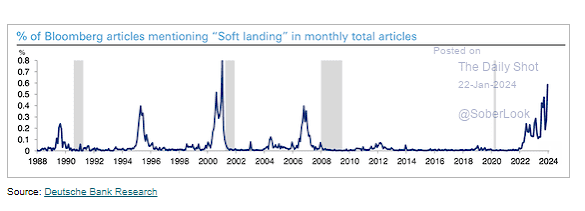

The number of Bloomberg articles mentioning soft landing has reached a level not seen since the early 2000s -- as represented by the blue line in the chart below.

Per the chart, this doesn't necessarily paint a comforting picture (grey areas highlight past recessions) -- call it, save for the one exception, a contrarian indicator: HT Daily Shot

As we've pointed out recently herein, after an impressive, broad-based, stock market rally in November and December, the breadth setup has quickly morphed right back to what we'll call unsettling.

Here's BCA research on that topic, as well as on the overall economic setup as we move into the new year:

"...the latest rally is still relatively narrow with seven of the S&P 500’s 11 equity sectors ending the week in the red. Indeed, the share of stocks trading above their 200-day moving average – which rose to nearly 70% in late-December – has been steadily declining, signaling a deterioration in breadth. Similarly, the advance-decline lines for both the Nasdaq and the NYSE have declined since the start of the year.

These dynamics raise the question whether AI optimism will boost the broad index again this year. While an improvement in risk sentiment could continue to benefit these sectors over the near term, they are not immune to a deterioration in the macroeconomic backdrop if – as we expect – a recession hits later this year. Especially given that they are now richly valued after last year’s surge."

And on what, in their view, explains last year's resilience, why they don't see it lasting, and why they're not constructive on stocks going forward:

"...restrictive monetary policy bodes ill for economic activity. Yet this cycle, the downturn has been delayed due to the mountain of excess savings arising from the extraordinary fiscal stimulus during the pandemic. Indeed, according to the Atlanta Fed’s GDPNow model, real GDP growth will clock in at 2.4% in Q4. Yet, we expect the economic backdrop to deteriorate as these excess savings are exhausted and labor demand continues to soften. As such, we believe the risk/reward balance is unfavorable for stocks over a 12-month horizon."

Stay tuned...

Asian equities leaned green overnight, with 7 of the 16 markets we track closing lower.

Europe, on the other hand, is leaning red so far this morning, with 12 of the 19 bourses we follow trading down as I type.

US equity averages are mixed to start the session: Dow down 94 points (0.20%), SP500 up 0.08%, SP500 Equal Weight up 0.22%, Nasdaq 100 up 0.03%, Nasdaq Comp up 0.16%, Russell 2000 up 0.48%.

This morning the VIX sits at 13.15.

Oil futures are down 0.51%, nat gas futures are down 0.66%, gold's up 0.10%, silver's up 0.94%, copper futures are up 1.00 and the ag complex (DBA) is up 0.76%.

The 10-year treasury is down (yield up) and the dollar is up 0.19%.

Among our 33 core positions (excluding options hedges, cash and money market funds), 18 -- led by AT&T, XME (base metals miners), SLV (silver), XLC (communication stocks) and Dutch Bros -- are in the green so far this morning... The losers are being led lower by Johnson & Johnson, LTPZ (long-term TIPs), EIDO (Indonesia equities), SPTL (long-term treasuries) and FEZ (Eurozone equities).

While this morning's quote may not be the most inspiring, when it comes to managing risk, I sympathize with the last line:

"Let's be honest. We don't know for sure what makes us successful. We can't pinpoint exactly what makes us happy. But we know with certainty what destroys success or happiness. This realization, as simple as it is, is fundamental: Negative knowledge (what not to do) is much more important than positive knowledge (what to do)."--Rolf Dobelli

Have a great day!

Marty

No comments:

Post a Comment