While what immediately follows supports that notion, it’s, indeed, like today, not always the case.

Our base case:

Our base case:

The setup for the US dollar, for the next several years, lends very high odds to a declining trend.

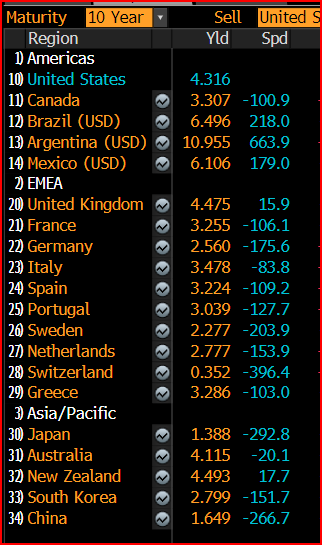

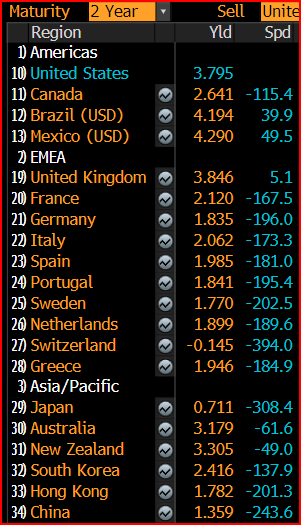

Now, in contrast to the yields-drive-the-dollar thesis, when we fast forward to the present we have a scenario where the dollar is weakening even though – save for Latin America – the US sports among the highest sovereign yields on the planet.

Our view stems from the fact that despite the US’s historically-high national debt (as a % of GDP), the federal government will continue to run a budget deficit as far as the eye can see -- thus, further bolstering structural inflation forces that are to-no-small-extent the product of populist regimes (which embody the present and go-forward global zeitgeist).

Ultimately, we see the US resorting to what amounts to the post-WWII strategy of what is essentially "debt monetization" via yield curve control (YCC).

Back then – beginning during the war (in 1942) and ending in March 1951 – the Fed bought up sufficient treasury issuance to keep the long-end of the curve at 2.5%; allowing the government to refinance its maturing debt pile at accommodatingly low rates – all the while allowing inflation to run notably hotter.

Essentially, the US inflated its way out of its debt burden by intentionally refinancing it with de-valued dollars.

Back then – beginning during the war (in 1942) and ending in March 1951 – the Fed bought up sufficient treasury issuance to keep the long-end of the curve at 2.5%; allowing the government to refinance its maturing debt pile at accommodatingly low rates – all the while allowing inflation to run notably hotter.

Essentially, the US inflated its way out of its debt burden by intentionally refinancing it with de-valued dollars.

The average annual inflation rate from the end of WWII (1945) to the end of the YCC strategy (1951) was 5.5%... Thus, the average real yield on treasury bonds was -3%, with the dollar declining by roughly 25% during that stretch.

Allowing the economy to run “hot” while capping the rate on treasury debt worked (as intended) to reduce the US debt to GDP ratio from 119% in 1946, to a very manageable 73% in 1951.

We’re presently at 124%."

Allowing the economy to run “hot” while capping the rate on treasury debt worked (as intended) to reduce the US debt to GDP ratio from 119% in 1946, to a very manageable 73% in 1951.

We’re presently at 124%."

Now, in contrast to the yields-drive-the-dollar thesis, when we fast forward to the present we have a scenario where the dollar is weakening even though – save for Latin America – the US sports among the highest sovereign yields on the planet.

I.e., conventional wisdom says the dollar should be getting stronger, but it's not, it's getting weaker.

So what gives?

Well, frankly – as we’ve highlighted on this blog aplenty of late – it speaks to what amounts to a serious re-think about the attractiveness of the dollar and of dollar-assets going forward:

10-year sovereign yields:

2-year:

US Dollar Index:

In summary, when we combine present dynamics with our YCC narrative we have all the makings of a trending lower dollar far into the future… Which, by the way, is the ideal backdrop for our global macro style of investing.

(PS: Just a heads up... Don’t be surprised if a near-term counter-trend rally emerges… As I’ve been suggesting on recent video updates, the dollar looks due – technically-speaking – for an upside pop any time now).

So what gives?

Well, frankly – as we’ve highlighted on this blog aplenty of late – it speaks to what amounts to a serious re-think about the attractiveness of the dollar and of dollar-assets going forward:

10-year sovereign yields:

2-year:

US Dollar Index:

In summary, when we combine present dynamics with our YCC narrative we have all the makings of a trending lower dollar far into the future… Which, by the way, is the ideal backdrop for our global macro style of investing.

(PS: Just a heads up... Don’t be surprised if a near-term counter-trend rally emerges… As I’ve been suggesting on recent video updates, the dollar looks due – technically-speaking – for an upside pop any time now).

Fascinating

ReplyDelete