Following up on this morning's note about the stinky breadth the stock market can't seem to rid itself of.

Well, it improved a bit by the end of the day, but still nothing remotely to feel confident about. That is, nothing allowing us to declare that the character of this epic rally embodies the broad-based action that typically hints of sustainability.

In keeping with this morning's theme we'll pick on the Nasdaq Composite Index:

The tech-heavy benchmark finished the day up an impressive 1.39%. And, unlike yesterday, advancing members outnumbered those declining on the day, although not by much: 1,380 to 1,292.

In terms of members reaching new highs, on a 4-week basis, more members actually hit new lows (389) versus new highs (249). On a 52-week basis, however, more did reach new highs (99) vs lows (39). But still, an index that itself continues to rip to new highs, while a good number of its members languish is, believe me, anything but inspiring. In fact, less than half (47%) are trading above their technically-significant 200-day moving averages, while the % flashing momentum buy signals sits at a mere 14%, versus 31% signaling sell.

So, more of the same readings that certainly do not guarantee that the market's on the verge of rolling over, just that the risk is elevated...

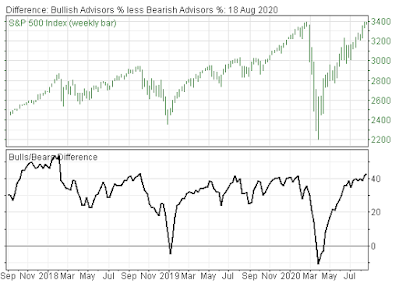

To sneak in a few other items that have me stubbornly cautions, here's the latest from my "charts that trouble me file": click each insert below to enlarge...

Note the international air travel line:

Gamma exposure (relates to options dealers) at a historically-risky level:

Permanent job losses:

Next up, tomorrow's weekly message; where we'll revisit our dollar thesis and what it means for risk going forward.

Thanks for reading,Marty

No comments:

Post a Comment