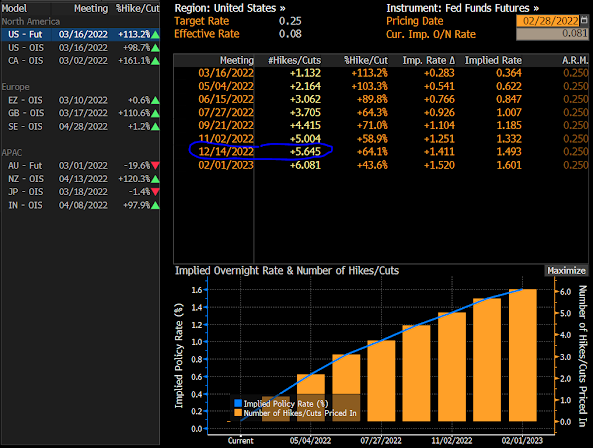

Amid all of the volatility of late, curiously, one area that hasn't moved much is Fed Funds Futures; they're still pricing in 5-6 rate hikes by December:

This reflects expectations that Russia/Ukraine will not ultimately inflict measurable strain on the global economy, or, if it does, that the strain will not sufficiently quell inflationary pressures.

In any event, with regard to the Fed, it implies that they won't leverage current events as an excuse to delay the start of their monetary tightening plans come next month.

I.e, inflation, as opposed to asset prices, is now their chief concern.

We'll see.... At some point (as, presumably, bear markets are inevitable phenomena) in the future we'll see how wide they'll allow markets to crack before reversing the course they're yet to start...

In the meantime, clients, we're liking our commodities exposures (although we'll see continued volatility there as well), including, if not especially, gold and silver, and we'll continue to actively manage those options hedges in our goal of mitigating a major ('08-style) drawdown, should one occur. All the while carefully scouring the world for opportunity amid all the angst...

As I've expressed, the ice, as it was coming into 2022, remains thin...

Asia, catching up to Friday's big rally in the West, leaned green overnight, with all but 3 of the 16 markets we track closing higher.

Europe's of course down across the board so far this morning. 18 of the 19 bourses we follow are trading lower as I type.

Same for US equities: Dow down 428 points (1.26%), SP500 down 0.98%, SP500 Equal Weight down 1.19%, Nasdaq 100 down 0.52%, Nasdaq Comp down 0.56%, Russell 2000 down 0.45%

The VIX sits at 30.71, up 11.31%.

Oil futures are up 4.13%, gold's up 1.13%, silver's up 0.84%, copper futures are up 0.19% and the ag complex (DBA) is up 0.87%.

The 10-year treasury is up (yield down) and the dollar is up 0.06%.

Among our 38 core positions (excluding cash and short-term bond ETF), 13 -- led by solar stocks, uranium miners, wind stocks, gold and base metals futures -- are in the green so far this morning. The losers are being led lower by carbon credits, Eurozone equities, MP (rare earth miner), emerging market equities and financial stocks.

"If you can keep your head when all about you are losing theirs... If you can wait and not be tired by waiting... If you can think--and not make thoughts your aim... If you can trust yourself when all men doubt you... Yours is the Earth and everything that's in it."--Rudyard Kipling

Have a great day!

Marty

No comments:

Post a Comment