Just a little thinking on my keyboard this morning...

Listening to the US equity strategist for one of our research resources yesterday, I found myself amazed at his unabashed bullishness over the stock market for the next 12 to 18 months. He cited the "2.3 trillion dollars" that currently rests in US consumers' savings accounts, the still-historically (although higher than recent) low home mortgage rates, his expectations that the Fed will take its time at getting rates to what he believes is "neutral", and will, therefore, not spark a recession within the next 12 to 18 months and, therefore, stocks will likely trend higher over that timeframe.

Also took in a podcast yesterday featuring a highly-respected global macro analysts. His near-term market take on equities was one of notable caution. In a nutshell, he characterized current conditions as demanding a cautious approach to asset allocation. He cited the Fed's quest to tighten financial conditions and essentially made the case that the punchbowl that the market's been gulping from these past many years is about to be pulled (my words, not his).

This morning I read competing notes from two other platforms whose research we subscribe to on the earnings report from trucker JB Hunt. One devoted a half-page to several bullish bullet points, such as:

- Today trucking company JB Hunt (JBHT) beat revenue estimates by 6% and delivered EPS 18% above forecasts.

- The strong results suggest that the trucking market remained strong through Q1 at least.

- As shown at right, prices received per truck in the company’s truck division continue to soar, while intermodal revenues per load are similarly ripping.

- Intermodal load volumes beat by 4% on top of the 4% per-load revenue beat. • We also note that JBHT is rapidly expanding capacity as measured by a number of metrics including tractors available, trailers available, and containers available.

Nothing whatsoever negative in their assessment.

But then I'm reading from the other source on the same earnings report, and, well, let's just say that they chose to extract whatever they could that might pour some cold water on trucking's outlook from here, such as:

"...we’ve seen a lot of transportation data over the past few weeks with us all trying to glean what is going on, it’s not completely clear how widespread some of the weakness is. JB Hunt in their earnings call last night specifically said that they think this right now is a spot market thing and added “If you look across all of our five segments, you would see differing viewpoints inside the segments overall” as to what is going on. And, “I think it’s too early to say if there is anything happening with the customer over the long term.”

JB Hunt did confirm the softness that we’ve seen in a variety of stats in the spot market as stated above. “We have seen a moderation in spot opportunities as of late, which we attribute partly to more customer shifting freight out of the spot market into published or contractual business but also recognizing a movement in the market toward more balance."

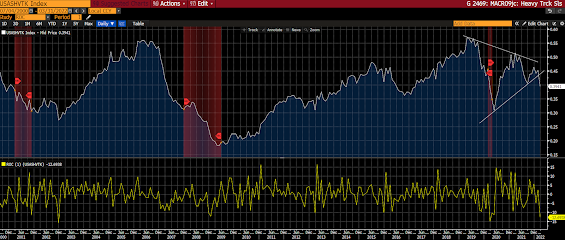

In a recent economic update we pointed to weakness in heavy truck sales:

Asia got battered overnight, with 11 of the 16 markets we track closing lower.

Europe's mixed this morning, with 9 of the 19 bourses we follow trading lower as I type.

The VIX sits at 21,13, down 4.69%.

Oil futures are down 4.20%, gold's down 1.25%, silver's down 1.27%, copper futures are down 2.01% and the ag complex (DBA) is down 0.70%.

The 10-year treasury is down (yield up) and the dollar is up 0.17%.

Among our 38 core positions (excluding cash and short-term bond ETF), 27 -- led by AMD, Disney, Albemarle, Nokia and bank stocks-- are in the green so far this morning. The losers are being led lower by silver, gold, base metals futures, ag futures and Latin American equities.

This quote sits atop the spreadsheet where we record our weekly technical analyses of markets and of every position we hold:

"If you do not change direction, you may end up where you are heading."

--Lao Tzu

I.e., at times, conditions demand that we change direction, at others, they instruct us to stay the course (i.e., in the latter instances we like where we're heading). It's always about underlying conditions!

Have a great day!

Marty

No comments:

Post a Comment