Amid an otherwise sour start to the week, a handful of European markets are catching a bid this morning on market-friendly first-round French presidential election results (read Macron over Le Pen), while Asian equity futures are following through on a rough overnight cash session, apparently in response to the utterly draconian Covid lockdown measures China is enforcing on millions of its people.

US equities are lower, presumably coming to grips with a Fed who sounds like they mean it with their whip inflation talk, and, I suspect, growing angst over the corporate outlooks soon to be expressed as Q1 earnings season gets underway. Not to mention, per this weekend's video, the technical setup for US equities ain't that pretty... Oh, and tomorrow US CPI for March gets reported; consensus has it that inflation rose 8.4% over the past year...

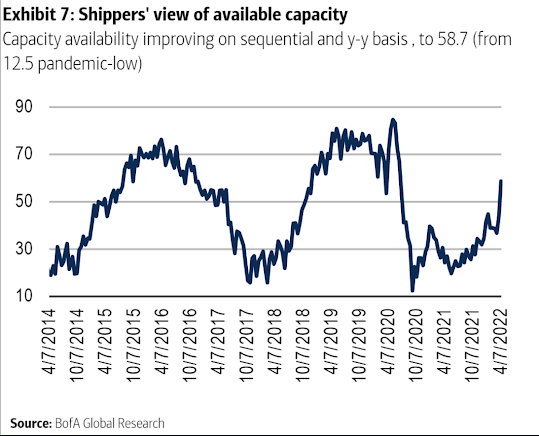

We touched on the trucking space in our weekly economic update, I mentioned that recent weakness therein may be "more about demand right here than it is capacity."

The graph below -- suggesting that shippers are indeed finding trucking capacity -- supports that notion:

Per the above, Asian equities suffered overnight, with 14 of the 16 markets we track closing higher.

Europe's leaning red so far this morning, with all but 12 of the 19 bourses we follow trading lower as I type.

US major averages are (save for small caps) mostly lower: Dow Down 161 points (0.45%), SP500 down 1.09%, SP500 Equal Weight down 0.22%, Nasdaq 100 down 1.79%, Nasdaq Comp down 1.55%, Russell 2000 up 0.24%.

The VIX sits at 23.52, up 11.15%.

Oil futures are down 3.97%, gold's up 0.18%, silver's up 1.01%, copper futures are down 1.29% and the ag complex (DBA) is up 0.65%.

The 10-year treasury is down (yield up) and the dollar is up 0.19%.

Among our 37 core positions (excluding cash and short-term bond ETF), 13 -- led by Paramount Global, US banks, Verizon, silver and ag futures-- are in the green so far this morning. The losers are being led lower by MP Materials, semiconductor stocks, Albermarle, Latin American equities and US tech stocks.

While we can't help but have our opinions, my, when it comes to investing, how we can't afford to ever, under any circumstances, identify with them (I, alas, see that all the time, btw):

"But in fact, the world changes, and as the facts of the world change, you have to amend your opinions." --Bill Blain

Marty

No comments:

Post a Comment