"While Powell may indeed come off tough tomorrow, his tenure thus far has been synonymous with the term “pivot.” And, make no mistake, pivot he will (but not tomorrow mind you) when he and his crew are staring down whatever breaks first..."

In terms of that "whatever" breaking; while one would think it'd be the credit markets the Fed fears the most, when we're talking investor opinion, suffice to say that all eyes are presently on the equity market.

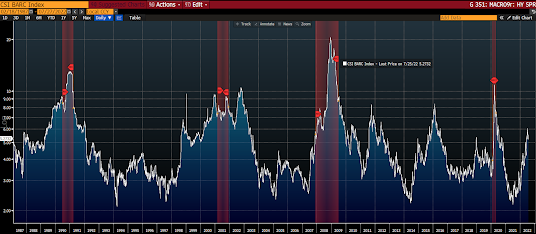

And, you know, considering how "successful" the Fed was in its swooping into credit markets amid the 2020 Covid quake, it very well could be that the precedent, and the facilities, established back then has Powell and company feeling somewhat sanguine amid the unfriendly signaling from the likes of the following (red shaded areas denote past recessions):

The MOVE (treasury bond volatility) Index:

"…let's take a step back -- and, by the way, recall that we are in the inflation will be higher for much longer camp -- and chart the truly troubling items, and consider the fact that the inflation data was collected via thousands of calls on thousands of businesses throughout the entire month of June.

I red-Xed June 15th on each graph:

US average gasoline price:

Bloomberg Agriculture Spot Index:

CRB Spot Foodstuff Index:

So, as you can see, the trend for the second half of June strongly suggests July's month-on-month headline number is going to come substantially off the boil. Assuming that trend continues, that is...

Now let's update those graphs:

US average gasoline price:

Bloomberg agricultural spot index:

CRB spot foodstuffs index:

So, all three have continued their descent since the latest CPI print. Note, however, and alas, that the stuff we eat is presently seeing a spike off the recent lows!

My point: Higher prices are indeed the cure for higher prices, but, unfortunately, we're a very long ways from acceptable (in real life, and in political, terms) levels on the essential items folks consume the most.

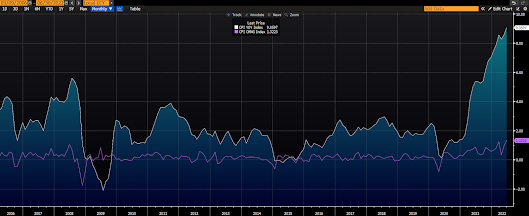

As it stands consumer sentiment is in the gutter:

"...since the June CPI report, shipping costs, commodity and used car prices have been declining and supplier delivery times have been improving, suggesting that an easing of supply-side price pressures is currently underway. Our US Bond strategists have highlighted that over the next few months core CPI inflation could fall to a range of 4%-5% from the unwinding of the pandemic-induced supply-side effects alone.And yet acknowledged that the road back to 2% may be treacherous, as, in their view, the Fed will likely have its pedal to the metal further out than market actors seem to be presently pricing in:

"The path down from 4%-5% to the Fed’s 2% target will be harder to achieve, given that it most likely represents stickier inflation. Notably, shelter which represents 40% of the CPI basket, has accounted for a large share of the changes in monthly CPI this year. It must fall in order for overall core CPI to reach the central banks’ target.

Shelter inflation is a function of the unemployment rate, as well as rental vacancies and home prices. Thus, lowering shelter inflation will require significant Fed tightening, and potentially a recession. The current extreme inflation backdrop means that the Fed will likely tolerate a higher unemployment rate than in the past (and what bond markets are discounting) and will not be swift to ease policy."

Asian equities leaned green overnight, with 11 of the 16 markets we track closing higher.

As is Europe so far this morning, with 14 of the 19 bourses we follow trading up as I type.

US stocks are rising to start the session*: Dow up 170 points (0.53%), SP500 up 0.89%, SP500 Equal Weight up 0.55%, Nasdaq 100 up 1.45%, Nasdaq Comp up 1.42%, Russell 2000 up 0.67%.

The VIX sits at 24.17, down 2.11%.

Oil futures are up 1.51%, gold's up 0.04%, silver's up 0.12%, copper futures are up 0.45% and the ag complex (DBA) is up 0.61%.

The 10-year treasury is up (yield down) and the dollar is down 0.15%.

Among our 35 core positions (excluding options hedges, cash and short-term bond ETF), 30 -- led by uranium miners, tech stocks, semiconductor stocks, Dutch Bros and Nokia -- are in the green so far this morning. The losers are being led lower by materials stocks, base metals futures, consumer staples stocks, metals miners and MP Materials.

“When nothing is for sure we remain alert, perennially on our toes.”

--Don Juan Matus

Have a great day!

Marty

Good Morning Marty, thanks for today's updates!

ReplyDeleteGood morning Sam! My pleasure

Delete