A common theme/concern among market pros of late has been the prospects for corporate earnings destruction amid the presumably looming recession. This is a concern we've voiced ourselves herein the past few months.

However, note that while our base case is indeed recession, we, as we sit here today, see odds favoring something along the mild variety. Therefore we wonder if earnings will be decimated to the degree the most ardent bears are suggesting.

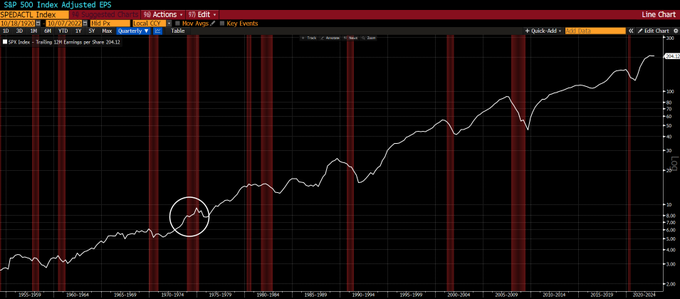

Another worthy point to make, in our view, is the historic relationship between inflation and corporate earnings.

Here's my comment/reply this morning to the assertions of one of those ardent bears who anticipates severe earnings destruction over the coming quarters:

"May want to go log chart? And, maybe consider the 73/74 recession -- the last time we had a contraction coincide with high inflation... I.e., inflation can make a difference when we're talking earnings. Up 25% in '73 and another 17% in '74..."

Later following up with:

"Correction, let's say "rising" inflation, rather than "high" (applies to 73/74). In which case the 79/80 recession would be the last where we had both. EPS rose that year as well."

Absolutely, the aforementioned bear may be spot on, but if we do this right, we have to consider all possibilities... Digging below the surface of what seems to be a generally dire consensus (aside from it becoming too consensus for my blood), there's empirical evidence that demands that we stay on our toes right here.

Thank you for the Chart!

ReplyDelete