Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, March 31, 2023

Economic Update (video)

SP500, NDQ100, Apple, Msft, Gold, Ag Snapshot (video)

Correction, I mentioned that the Nasdaq 100 has just completed the best quarter since Q2 2020, which is the case, but then I confused myself, and no doubt the viewer, and referenced the 2000 tech bubble bursting... In reality, the current Q1 rally echoes, in terms of gain, Q1 of 2000, just before the bottom fell out... Hence my confusion... Sorry about that...

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, March 30, 2023

Morning Note: "A Vector of Vulnerability"

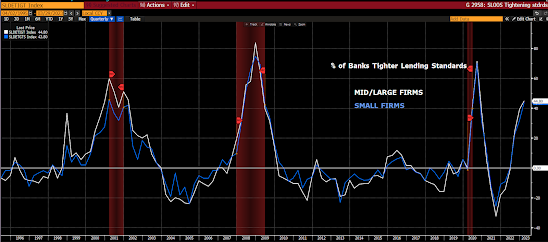

By the way, the above was the picture before the world knew the banking sector had issues.

Wednesday, March 29, 2023

SP500, Nasdaq 100, Apple, MSFT, Gold and Ag Snapshot (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Monday, March 27, 2023

7 Indicators That Warrant Caution Right Here (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Morning Note: Scenarios

"Been thinking about scenarios that could erupt as a result of the period of high volatility and uncertainty we are in.

Humbled by the vast number of outcomes in a chaotic cycle.

More I read, the more I am humbled. Some scenarios float to the top:

Sunday, March 26, 2023

Economic, Stocks, Gold and Ag Snapshot (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Friday, March 24, 2023

S&P, Dollar, Nasdaq 100, Apple and Microsoft Snapshot (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, March 23, 2023

Morning Note: Careful What You Wish For!

As I mentioned yesterday, our PWA Index presently scores a recessionary -33.33; with 20% of its inputs scoring positive, 53% negative and 27% neutral.

One of its current negative influencers is the Sectors-to-SP500 ratio -- each week we take a 30-day lookback at how each major sector is fairing against the broader market.

Here's last week's look (a below-100 score denotes the sector underperforming the S&P 500):

Wednesday, March 22, 2023

Morning Note: An Air of Desperation

Watching from a distance the past few days (on vacation), I found myself thinking how desperate "the market" (equity market actors) seems these days... And while indeed early-stage 2023 has seen its share of downs (recently wiping out all of January's impressive gains), it's, frankly, the ups that, for me anyway, have that air of desperation (fear of missing out) to them.

Thursday, March 16, 2023

Morning Note: Near-Term Irony -- And -- A Future Rich in Macro Opportunities

Clients, you may have noticed that we paired back our metals mining exposure recently... FYI, this is purely a tactical call that jibes with our near-term economic thesis... To be sure, we remain very bullish on the metals and miners space beyond what the present bear market has left in it... I.e., we expect to be back with a full position in the not-too-distant future.

Ironically, per BCA's latest research, the factors that have us near-term cautious stand to ultimately exacerbate the bullish longer-term setup:

Wednesday, March 15, 2023

Market Snapshot, And a Few Other Things (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, March 14, 2023

Morning Note: February Inflation, Banking Scare Basics, and "Mess-Making"

CPI (headline) came in inline with economists' expectations, at .4% month-on-month, 6.0% year-on-year... Core inflation (ex-food and energy) came in a titch above expectations, at .5% (vs .4% expected) m-o-m, 5.5% y-o-y.

Again (as I stated over the weekend), at this point, in contrast to what now a whole host of major WS firms are thinking pleading, we see very low odds of a bank stress-induced immediate pause in the Fed's rate-hiking campaign.

Now, make no mistake, we do believe that odds not only favor a Fed pause over the next few months, but that, given our recession thesis, they may actually find themselves cutting their benchmark rate later in the year... Just, given the, albeit lagging, latest data, not right here.

Sunday, March 12, 2023

Stock and Gold Market Snapshot, the Weekend Bailout, etc. (video)

(Update: Monday 3/13, 6:42am pdt) When I mentioned "bull trap" in last evening's video (featured below), I certainly wasn't thinking that last night's big rally in the futures market would be all she wrote, and of course the day's still very young.

As stocks reverse last evening's not-small upside move, gold (in particular), treasuries, staples and healthcare (we very recently upped our weighting in the latter 3) are holding up nicely. And of course our put hedges are moving notably higher as I type.

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Saturday, March 11, 2023

Economic Update: Recession Risk, Inflation, and a Failed Bank (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, March 9, 2023

Stock Market Snapshot (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Morning Note: Inflationary Energy Inputs -- And -- Key Highlights From Our Recent Messaging

Below are some key highlights from our latest messaging herein... Although, before we go there, I thought I'd share some commentary I caught yesterday evening on Bloomberg... This should sound familiar, as it jibes with one of the themes that underlies our structural inflation thesis:

Wednesday, March 8, 2023

Stock Market Snapshot (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Tuesday, March 7, 2023

Morning Note: Key Macro Highlights

I color-coded each based on how I see its signal, either with regard to overall general conditions, or, in the case of data related to a specific country or region, with regard to what it says specifically about a particular item... I also parenthetically defined the acronyms.

The on-balance message from the color-coding will give you a feel for why we remain guarded over present general conditions.

Monday, March 6, 2023

Morning Note: Equity Market Conditions Update

Here's the intro to our internal report:

Friday, March 3, 2023

Economic Update (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Stock Market Snapshot (video)

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust:

Thursday, March 2, 2023

Morning Note: That's a Risky 'MOVE'

While investors generally associate the VIX Index (tracks SP500 options' volatility) with stock market volatility, turns out the MOVE Index (tracks treasury options volatility) is every bit (if not more so, these days) as serious a tell on the risk setup for stocks.

When (top panel) it's lived above 100 (particularly during sustained periods) during this 21st Century, stocks (bottom panel) were living dangerously: