Clients, you may have noticed that we paired back our metals mining exposure recently... FYI, this is purely a tactical call that jibes with our near-term economic thesis... To be sure, we remain very bullish on the metals and miners space beyond what the present bear market has left in it... I.e., we expect to be back with a full position in the not-too-distant future.

Ironically, per BCA's latest research, the factors that have us near-term cautious stand to ultimately exacerbate the bullish longer-term setup:

Emphasis mine...

"Keep An Eye On Copper Availability

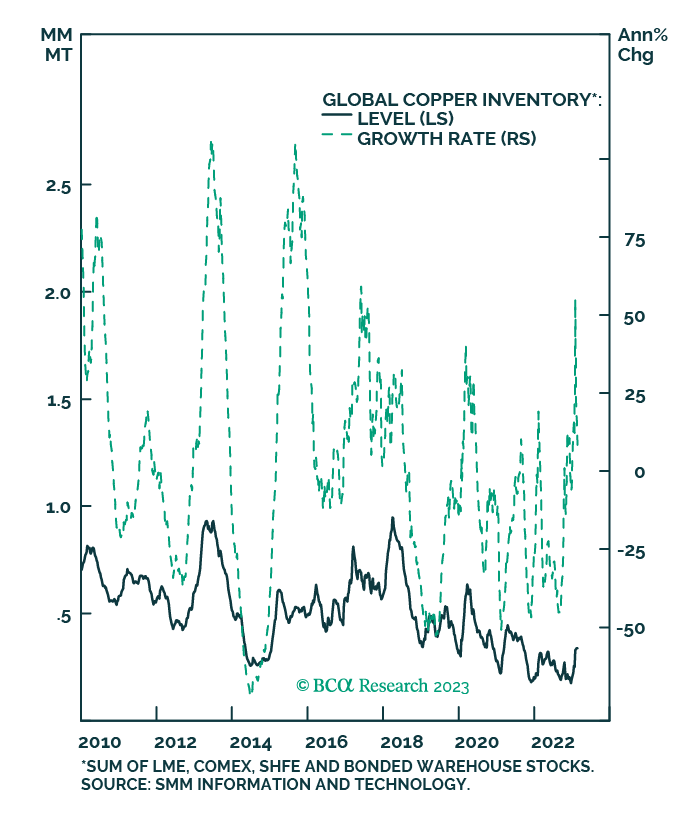

We have noted frequently the critical role of copper in a hypo-globalizing world. It arguably is the preeminent metal required for the green-energy transition. Copper supplies and inventories are exceptionally tight globally (Chart 5).

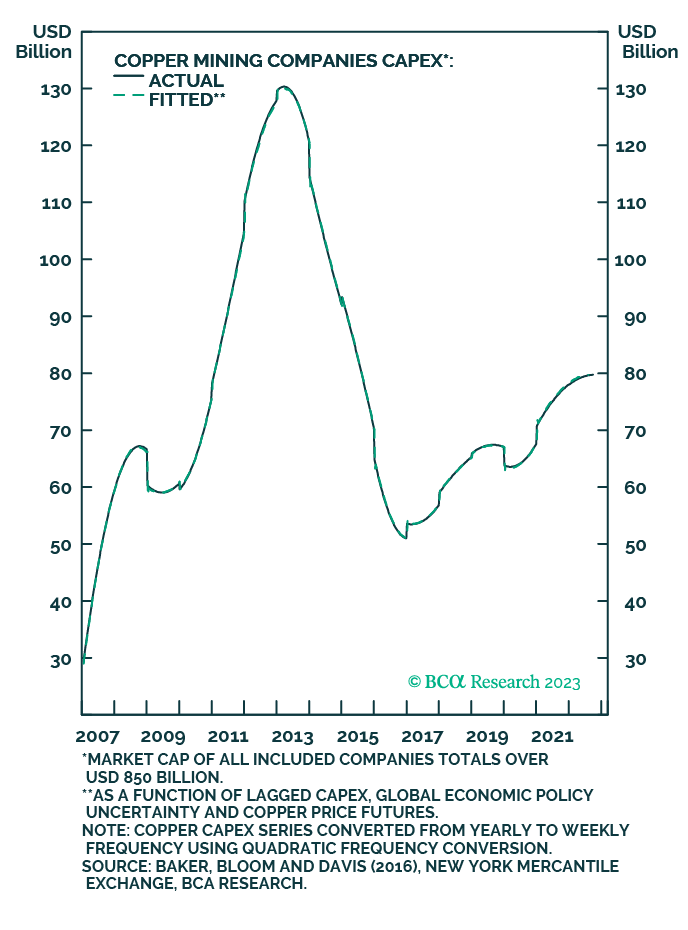

The risk of chronically tight copper markets will increase if Fed and ECB monetary policies succeed in crushing aggregate demand with higher interest rates, in order to bring down core inflation. Tight monetary policy conditions and elevated economic policy uncertainty will weigh on miners’ CAPEX decisions, affecting long-run copper availability, given the 15+-year lead times to develop a greenfield copper mine (Chart 6). Falling metals prices in the wake of monetary-policy tightening will delay investment.

Chart 5 Global Copper Inventories Low..

Chart 6 Low CAPEX Suggests It Will Remain That Way

In our base case, we expect physical copper markets will post deficits of 550K and 315K tonnes in 2023 and 2024, respectively (Chart 7). Geopolitical risk also remains elevated, particularly in mineral-rich states of Chile and Peru. In our view, future refined copper output will need to grow well in excess of the 3-4% p.a. rates currently expected by the International Copper Study Group, to ensure supply can double over the next 10-15 years to keep up with demand, as governments ramp funding.

If future availability of copper and other minerals does not keep pace with demand as states throw ever-more support toward meeting net-zero emissions targets, the cost of the green-energy transition will inevitably be prolonged and will rise. High energy and metals prices will feed into the price of clean-energy technologies. This also will be inflationary.

Chart 7 Copper Supply Has To Rise for Green Energy Transition

"

Again:

"Tight monetary policy conditions and elevated economic policy uncertainty will weigh on miners’ CAPEX decisions, affecting long-run copper availability, given the 15+-year lead times to develop a greenfield copper mine."

And:

"If future availability of copper and other minerals does not keep pace with demand as states throw ever-more support toward meeting net-zero emissions targets, the cost of the green-energy transition will inevitably be prolonged and will rise. High energy and metals prices will feed into the price of clean-energy technologies."

Like I keep saying, present conditions have us near-term guarded, while the longer-term, global, structural setup is utterly rich in macro investment opportunities.

Stay tuned...

Breaking News: The European Central Bank, to the surprise of many, didn't flinch -- in the face of their own banking sector concerns -- and raised their benchmark interest rate by .50% this morning... I.e., they see banking issues as containable, and not a deterrent (at this point) to their inflation fighting campaign, despite the fact that, in general, rising interest rates are (on balance) the problem.

Asian stocks struggled again overnight, with 13 of the 16 markets we track closing lower.

Europe's feeling some pain this morning as well, with 15 of the 19 bourses we follow trading down as I type.

US equity averages are down to start the session: Dow by 162 points (0.51%), SP500 down 0.36%, SP500 Equal Weight down 0.55%, Nasdaq 100 down 0.08%, Nasdaq Comp down 0.16%, Russell 2000 down 0.83%.

The VIX sits at 26.73, up 2.26%.

Oil futures are down 1.89%, gold's down 0.45%, silver's down 0.46%, copper futures are down 0.28% and the ag complex (DBA) is down 0.19%.

The 10-year treasury is up (yield down) and the dollar is down 0.15%.

Among our 35 core positions (excluding options hedges, cash and short-term bond ETF), 9 -- led by AMD, TLT (long-term treasuries), Amazon, EWZ (Brazil) and DBA (ag futures) -- are in the green so far this morning... The losers are being led lower by Albemarle, MP Materials, OIH (oil services), XME (metals miners) and Disney.

"In order to see color my eye has to be free of color."

--Meister Ekhart

Have a great day!

Marty

No comments:

Post a Comment