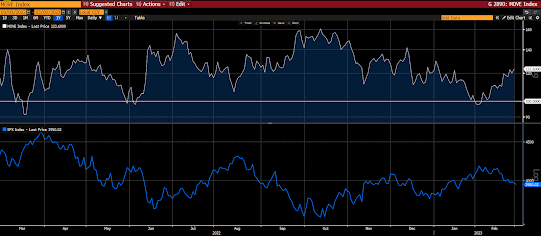

While investors generally associate the VIX Index (tracks SP500 options' volatility) with stock market volatility, turns out the MOVE Index (tracks treasury options volatility) is every bit (if not more so, these days) as serious a tell on the risk setup for stocks.

When (top panel) it's lived above 100 (particularly during sustained periods) during this 21st Century, stocks (bottom panel) were living dangerously:

Especially when it's on the rise (and above 100), like now:

Here's from Spotgamma's yesterday afternoon note: emphasis mine...

"In a rare moment from the Fed, Minneapolis Federal Reserve President Kashkari broke character and commented on how and why they must keep up hawkish pressure with their comments. He said, “If we declare victory too soon, there will be an outpouring of exuberance, and we will have to do even more work.” The implications of this are that if the Fed starts making relaxed or dovish comments, then the market would rally. And this would reverse the effects of wealth destruction and therefore increase general buying power in the economy, which would be inflationary."

Oof!

Asian stocks were mostly red overnight, with 11 of the 16 markets we track closing lower.

Same for Europe so far this morning, with 11 of the 19 bourses we follow trading down as I type.

Same (save for the Dow) for US equity averages to start the session: Dow up 127 points (0.39%), SP500 down 0.23%, SP500 Equal Weight down 0.36%, Nasdaq 100 down 0.41%, Nasdaq Comp down 0.50%, Russell 2000 down 0.70%.

The VIX sits at 20.69, up 0.53%.

Oil futures are up 0.63%, gold's down 0.06%, silver's down 0.69%, copper futures are down 1.96% and the ag complex (DBA) is down 0.38%.

The 10-year treasury is down (yield up) and the dollar is up 0.53%.

Among our 36 core positions (excluding options hedges, cash and short-term bond ETF), 8 -- led by consumer staples stocks, energy stocks, cyber security stocks, emerging market equities, Nokia and utilities stocks -- are in the green so far this morning. The losers are being led lower by MP Materials, Albemarle, base metals futures, uranium miners and base metals miners.

“...the thing to determine is the speculative line of least resistance at the moment of trading; and what he should wait for is the moment when that line defines itself, because that is his signal to get busy.”

“…the intelligent trader who has patiently waited to determine this line will enlist the aid of fundamental trade conditions and also of the force of the trading of that part of the community that happened to guess wrong and must now rectify mistakes. Such corrections tend to push prices along the line of least resistance.”

--Jesse Livermore

Marty

No comments:

Post a Comment