I've heard it said recently that there's never been a bear market rally that's lasted longer than the initial bear market decline (correcting my earlier statement)... Suggesting, therefore, that this isn't a bear market rally at all, that it's indeed a new sustainable bull market.

I also read that strings of consecutive up days for the Dow, the likes of which just ended late last week, have historically been met with positive returns over the ensuing 12 months, save for only one occurrence, in 1987.

And I'm certain there are a whole host of other never-happened-in-a-bear-market statistics that suggest indeed that the road ahead is clear and that we should all be backing up our trucks to the stock market and loading em up, right this minute!

Now, and make no mistake, it's not our desire to pour cold water on anyone's bullish narrative... That -- by definition -- would be an utter breach of our commitment to maintaining open minds and objectivity at all times...

In fact, our cautiousness aside, we welcome them... While we may not be bullish on the overall (we indeed own some stocks) equity market, we definitely want to explore legitimate narratives that don't necessarily jibe with our own.

Thing is, as we dip a layer or two below the surface, we happen to be identifying macro data (plenty of it) — the likes of which have never occurred without a recession following in the dangerously near future.

So what gives? How can it be that the on-the-surface price action signals high odds of rising stocks into the horizon, while the underlying economics, and the fundamentals, suggest that a massive bull trap may very well be underway?

Well, I guess we should ask ourselves, is there anything truly unique about current conditions, or what has led to them? I mean, are there factors in play that have never happened before that might indeed culminate in market or economic phenomena that have never happened before?

Well, in terms of bear market rallies, let's first acknowledge that… well… the previous record stretch never happened before, I mean, before it actually happened... What a bummer for the folks who jumped on that bandwagon, thinking that a never-happened-before phenomenon could therefore never happen!

Back to the question: Well, yes, what's truly unique about current conditions is that they're coming off of the most massive stimulus measures the US has ever seen -- multiple times over, no less!

So, next question: Where would such previously unthinkable stimulus likely result in never-before-seen phenomena -- in equity market price trends, or in economic data trends?

Of course the answer could be both.

So, I suppose we should be asking, where might gargantuan stimulus result in the sending of dangerously false signals?

Of course, both, yet again, is entirely possible… And, alas, therein lies the dilemma:

1. A false bull market signal would end in substantial pain, particularly for the folks who’ve been overcome by acute FOMO (fear of missing out) of late.

2. False recession signals, as we come down off of said stimulus, would result in slim chances that inflation abates to a level that allows the Fed to come down off of what ultimately amount to un-bull-market-sustainable policy rates.

Hmm.... Don't know that we should be adding additional risk right here...

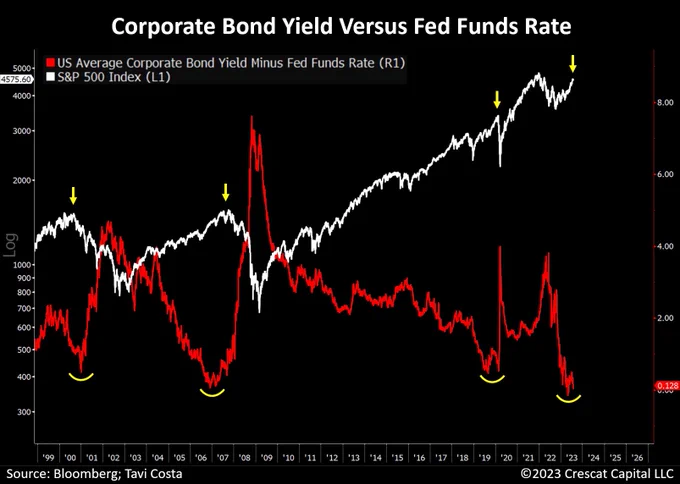

As for the latter, while I’ve illustrated multiple recession signals, virtually ad nauseam, on our weekly video updates, here’s Crescat Capital’s Tavi Costa giving it a shot:

"Corporate bonds now yield only 0.12% above the Fed Funds rate.

The lowest level since 2007, preceding the Global Financial Crisis.

Every time credit spreads were at historically suppressed levels, a hard-landing scenario followed.

Perhaps this time is indeed different, but I would rather base my perspective on numerous indicators pointing towards an impending severe recession.

The profound issue of yield curve inversions is yet another example.

Recently, over 90% of the Treasury curve was inverted, a measure that has accurately predicted every major economic contraction in the last 50 years.

Moreover, the Fed’s policy stance should also be taken into consideration.

As we have learned repeatedly throughout history, tightening monetary policies work with a lag and we are yet to witness a significant credit contraction that could lead to further economic issues.

Even the apparent strength of the labor market should be taken with a grain of caution.

Historically low unemployment rates have served as one of the most reliable contrarian indicators in history.

Either these macro indicators are on the brink of being proven wrong, or the overall equity valuations are entirely out of line."

Stay tuned...

Europe's also catching a bid (so far this morning), with 13 of the 19 bourses we follow trading up as I type.

US equity averages are mixed to start the session: Dow up 13 points (0.04%), SP500 down 0.03%, SP500 Equal Weight up 0.27%, Nasdaq 100 down 0.23%, Nasdaq Comp down 0.22, Russell 2000 up 0.82%.

As for Friday’s session, US equity averages closed higher: Dow up 0.5%, SP500 up 1.0%, SP500 Equal Weight up 0.5%, Nasdaq 100 up 1.8%, Nasdaq Comp up 1.9%, Russell 2000 up 1.4%.

This morning the VIX sits at 14.00, up 5.03%.

Oil futures are up 1.04%, gold's up 0.53%, silver's up 1.67%, copper futures are up 1.46% and the ag complex (DBA) is down 0.36%.

The 10-year treasury is up (yield down) and the dollar is down 0.03%.

Among our 34 core positions (excluding options hedges, cash and money market funds), 25 -- led by URNM (uranium miners), XME (base metals miners), OIH (oil services stocks), XLE (energy companies) and SLV (silver) -- are in the green so far this morning... The losers are being led lower by JNJ, Range Resources, XLV (healthcare stocks), DBA (ag futures) and VWO (emerging mkt equities).

"If you're going to be an investor you have to think long-term, short-term, medium-term, and then upside down-term."

Marty

No comments:

Post a Comment