Finally, after 15 months without a positive overall score, our proprietary macro index peeked its nose above the zero line this week, albeit barely, coming in at +2.04:

"The ISM® Prices Index registered 82.1 percent, an increase of 4.5 percentage points compared to the December reading of 77.6 percent, indicating raw materials prices increased for the eighth consecutive month. This is the highest reading since April 2011, when the index registered 82.6 percent. “Aluminum, brass, copper, chemicals, steel, soy and corn products, petroleum-based products including plastics, transportation costs, electrical and electronic components, corrugate, wood and lumber products all continued to record price increases,” says Fiore. A Prices Index above 52.7 percent, over time, is generally consistent with an increase in the Bureau of Labor Statistics (BLS) Producer Price Index for Intermediate Materials.

All 18 industries reported paying increased prices for raw materials in January..."

And while the services survey's price subindex came in slightly below its December reading... well, here's from the report:

"The 16 services industries that reported an increase in prices paid during the month of January — listed in order — are: Wholesale Trade; Construction; Agriculture, Forestry, Fishing & Hunting; Retail Trade; Accommodation & Food Services; Mining; Arts, Entertainment & Recreation; Transportation & Warehousing; Health Care & Social Assistance; Professional, Scientific & Technical Services; Public Administration; Utilities; Management of Companies & Support Services; Other Services; Finance & Insurance; and Educational Services. No industry reported a decrease in prices paid for January."

The fundamental question of course being, what's causing the "inflation?" Is it rapidly rising demand or burdensome supply constraints? Or a bit of both?

I'll highlight spots in the manufacturing survey's featured respondent comments that offer clues:

“Supplier factory capacity is well utilized. Increased demand, labor constraints and upstream supply delays are pushing lead times. This is more prevalent with international than U.S.-based suppliers.” (Computer & Electronic Products)

“Business remains strong. Manufacturing running at full capacity.” (Chemical Products)

“Very strong demand with limitations in supply to meet increased demand.” (Transportation Equipment)

“Labor continues to be one of our largest challenges.” (Food, Beverage & Tobacco Products)

“Our current business demand is going way past pre-COVID-19 [levels].” (Fabricated Metal Products)

“Business is very good. Customer inventories are low, with a significant order backlog through April. Supply base is struggling to keep up with demand, disrupting our production here and there. Raw material lead times have been extended. COVID-19 continues to cause challenges throughout the supply chain. Huge logistics challenges, especially in getting product through ports and in getting containers. We are seeing significant cost increases in logistics and raw materials.” (Machinery)

“We have had an increase in employees testing positive for COVID-19, negatively impacting manufacturing.” (Miscellaneous Manufacturing)

“2020 growth at 5 percent during a very challenging and volatile year. 2021 is expected to bring growth at a 7-percent or even greater pace. Logistics is the critical concern, but we are currently abating risk.” (Electrical Equipment, Appliances & Components)

“January 2021 started with strong orders for plastic components in auto, electrical and other sectors. The industry outlook is optimistic. Looking at investing in new equipment for anticipated demand later this year. Reshoring is taking hold, with new customer potential.” (Plastics & Rubber Products)

“Business is improving, but we are still struggling with a shortage of available labor.” (Primary Metals)

Clearly, it's a bit of both...

Let's now zero in on jobs and the stock market:

Despite the legitimately optimistic feel we get from those snippets from the ISM surveys, I simply can't overstate how were it not for literally trillions of dollars worth of ongoing government stimulus we'd be mired in protracted recessionary/deflationary/bear market conditions.

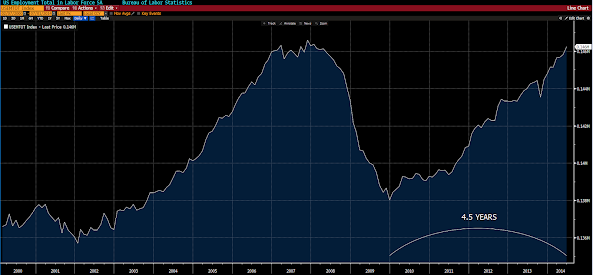

The underlying jobs data vividly emphasizes the point:

Here's the "U.S. Employment Total In Labor Force" 5-year chart:

Which means that, while we remain broadly diversified, we have a tilt toward commodities and materials -- think weak (on a long-term trend basis) dollar, low interest rates and major infrastructure spending going forward. As well as toward non-US developed and emerging economies -- think weak (trending) dollar, along with more compelling valuations and dividend income (in developed markets in particular), and greater growth potential, along with favorable demographics, in the emerging markets...

Have a nice weekend!

Marty

No comments:

Post a Comment