In yesterday's note I mentioned that "our modeling" favored the notion that the recent weakness in the tech sector is more about a change in leadership versus the harbinger of something more pernicious.

Here are a number of the key indicators that instruct our theses around equity markets and have us, per yesterday's note, relatively sanguine -- yet nevertheless cautious (the +1s, -1s and 0s denote positive, negative and neutral signals):US DOLLAR: +1

Established downtrend from March 2000 peak.

Established downtrend from March 2000 peak.

US Dollar Index:

INTEREST RATES: +1

Fed funds at zero lower bound, 10-year treasury yield remains in long-term downtrend. Inflation pressures on the other hand are high. However, given the present state of debt markets and the huge risk that a higher dollar, and interest rates, pose to asset bubbles, the Fed will resort to YCC if necessary. Therefore, rather than scoring a bearish -1, as we'd expect given that there’s no way to go but up from here, the bottom line is simply that there’s nowhere for interest rates to go, whatsoever.

INTEREST RATES: +1

Fed funds at zero lower bound, 10-year treasury yield remains in long-term downtrend. Inflation pressures on the other hand are high. However, given the present state of debt markets and the huge risk that a higher dollar, and interest rates, pose to asset bubbles, the Fed will resort to YCC if necessary. Therefore, rather than scoring a bearish -1, as we'd expect given that there’s no way to go but up from here, the bottom line is simply that there’s nowhere for interest rates to go, whatsoever.

Fed Funds Rate & 10-Year Treasury Yield Index

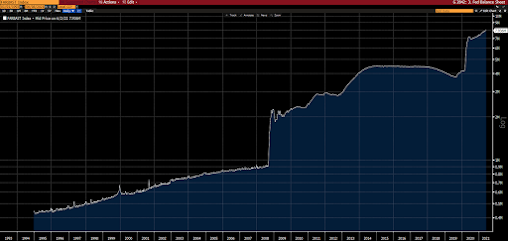

FED POLICY: +1

Resoundingly easy.

FED POLICY: +1

Resoundingly easy.

Fed Balance Sheet:

FISCAL POLICY: +1

Huge spending impulse enough (presently) to counter threat of higher taxes/regs.

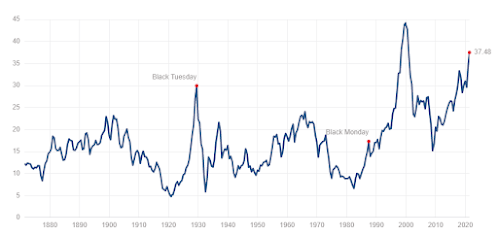

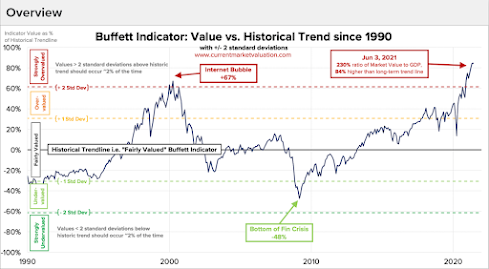

VALUATION: -1

Historically overvalued.

P/E:

CAPE:

P/S:

P/B:

MC/GDP:

SECTOR LEADERSHIP: 0

Tech is showing a toppy pattern… denoting either rotation, or classic leadership rollover that precedes bear markets: -1

However, save for Consumer Discretionary, the other cyclical sectors have outperformed SPX over the past 6 months, while the defensive sectors have underperformed: +1

MACRO CONDITIONS: +1

FISCAL POLICY: +1

Huge spending impulse enough (presently) to counter threat of higher taxes/regs.

VALUATION: -1

Historically overvalued.

P/E:

CAPE:

P/S:

P/B:

MC/GDP:

SECTOR LEADERSHIP: 0

Tech is showing a toppy pattern… denoting either rotation, or classic leadership rollover that precedes bear markets: -1

However, save for Consumer Discretionary, the other cyclical sectors have outperformed SPX over the past 6 months, while the defensive sectors have underperformed: +1

MACRO CONDITIONS: +1

PWA MACRO INDEX +39.58

GEOPOLITICS: -1

China losing its luster, notably (growing belligerence). U.S. and traditional allies’ relations improved of late. U.S., nevertheless, disconnecting militarily throughout the globe. U.S. no longer the protector of the world. Greatest potential for trade flow disruptions in decades.

GLOBAL ECONOMIC POLICY UNCERTAINTY INDEX:

TECHNICALS: 0

DAILY:

WEEKLY:

MONTHLY:

SENTIMENT: -1

FINANCIAL STRESS: +1

GOLD/COPPER RATIO: +1

GEOPOLITICS: -1

China losing its luster, notably (growing belligerence). U.S. and traditional allies’ relations improved of late. U.S., nevertheless, disconnecting militarily throughout the globe. U.S. no longer the protector of the world. Greatest potential for trade flow disruptions in decades.

GLOBAL ECONOMIC POLICY UNCERTAINTY INDEX:

TECHNICALS: 0

DAILY:

WEEKLY:

MONTHLY:

SENTIMENT: -1

FINANCIAL STRESS: +1

GOLD/COPPER RATIO: +1

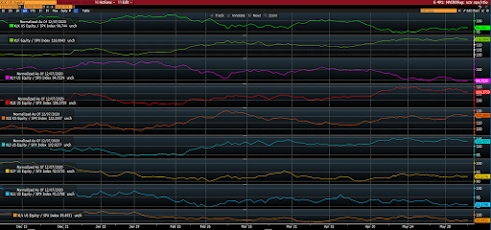

And here's a visual of an equity market model where we score the trends in the dollar (panel 2), the Fed Funds Rate (panel 3), the gold/copper ratio (panel 4) and the 10-year high yield credit spread (panel 5). S&P 500 Index in panel 1.

1/1/2020 to Present:

Yes, the fact that all four of those extremely key factors trend in an equity market-friendly manner says the present setup is indeed positive.

However -- and this is a huge however -- three of the four factors (the dollar, the fed funds rate and the high yield spread) read bullish entirely due to direct Federal Reserve manipulation. The gold/copper ratio favoring copper could be viewed as indirectly the result of Fed intervention.

Imagine what a policy misstep would do to markets right here. Surely the Fed's board members imagine that every single day. Make no mistake, the dollar and interest rates are the two factors keeping them up at night.

Here was the look heading into the market peak (ahead of a 30+% 3-week plunge) in February of last year:

Yes, the Fed (panel 3) tried to circumvent a breakdown as the economy began to rollover in late-summer 2019. However, cutting their benchmark rate was insufficient to offset the effects of a stronger dollar and rising credit risk (and, not to mention, covid).

Here was the look heading into the tech bubble burst of the early 2000s (-50% SP500, -85% Nasdaq Comp):

The market had no chance back then!

And here was the look heading into the 2008 bear market (SP500 -57%):

While, clearly, our model demanded caution heading into the '08 disaster, an aggressively easing Fed (panel 3) and an accommodatively weak dollar (panel 2) justifiably had many investors feeling all too sanguine just before all hell broke loose. Also, recall that the '08 experience was all about an overvalued residential real estate market and mortgage bubble, as opposed to a stock market/dotcom bubble (early 2000s) or a stock market/government and corporate debt bubble (last year, and, alas, presently as well). The consensus among many -- the Fed in particular -- was that the subprime mortgage mess did not present "systemic" risk. Well, as you know, they were wrong!!

The difference "as I type" is that the stakes (the debt bubbles) are so huge that the Fed has left themselves no room for error, hence the literally buying themselves (with $trillions) a bullish setup that to ultimately "succeed" will require an inflating down of a historic debt pile while keeping the dollar, interest rates and credit spreads at bay.

This is somewhat similar (in terms of debt to GDP, interest rates, and need/willingness for government spending) to the setup, and to the policymaker reaction function, coming out of World War II. They essentially pulled it off back then, but not without a good deal of inflation and asset market volatility along the way.

9/2/1945 to 12/31/1948 (SP500 top panel, CPI bottom):

And here's your U.S. government debt to GDP graph, 1940 to present:

Like I said, similar setup...

Thanks for reading!

Marty

No comments:

Post a Comment