This from Bespoke Investment Group's note this morning says lots about the present setup:

Emphasis mine...

"Yesterday, WMT had its largest one-day decline since the 1987 crash and now TGT is on pace to do the same. The experiences of both companies further reinforce the point that we are operating in one of the most complicated macro environments that any company or investor has had to deal with. Few companies are so entwined into so many aspects of the US economy as WMT and TGT, and their logistics and supply chain operations rival or exceed those of most other companies. If they're having these types of issues keeping up with the rapidly changing environment, who isn't?"I find myself echoing the above during client review meetings these days. I.e., while, in many respects I have more clarity than I recall ever having during my 37-year career (read deglobalization, rising populism, decarbonization, etc., and their long-term inflationary effects), at the same time the present setup is as challenging as any I can recall.

Walmart's and Target's woes, and what they portend overall, along with weak housing data this morning are putting pause to the snapback rally that our technical work suggests, or suggested, may have legs.

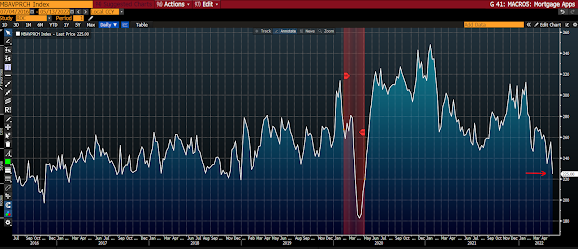

Mortgage Purchase Apps:

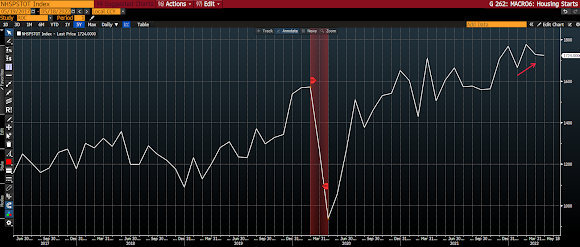

Housing Permits:

Housing Starts:

Homebuilder Sentiment (released yesterday):

Note that relative strength in multi-family permits and starts (in particular) are keeping those two graphs from looking notably worse.

Now, should the latest housing data turn out to be a harbinger of things to come (read rising recession risk), and the Fed (sooner than later) softens its tone as a result*, I suspect the equity market will initially respond accordingly (positively).

*But let's not hold our collective breaths right here... this Fed needs to gain some credibility -- i.e., show that it doesn't exist solely to support asset prices...

Speaking of the Fed's tone, here's Chairman Powell yesterday (HT Peter Boockvar):

“We will go until we feel like we are at a place where we can say, ‘Yes, financial conditions are at an appropriate place. We see inflation coming down. We will go to that point, and there will not be any hesitation about that.”

Hmm...

Here's Bianco Research's Jim Bianco's take on the fine fix the Fed has gotten itself into:

"Let me give you a statistic: Today, the inflation rate is 8.3%, and the Fed ultimately would like it to go back down under 3%, near 2%. That’s a decline in the inflation rate of around 5 percentage points. Since the end of World War II, there has never been a decline in inflation of 4 percentage points or more that was not coincident with a recession. When inflation declines to that degree, usually something is broken in the economy or in the financial markets. You get the reverse wealth effect, sapping demand and bringing down prices. So if the Fed is trying to engineer a decline in the inflation rate of 4 percentage points or more, it’s very likely that economy falls into a recession."

I couldn't agree more. However, given the consequences of trying to kill inflation in one fell tightening policy swoop, a la Paul Volker (late-70s), I don't suspect today's Fed has the gumption to stay the course to 2% inflation. I.e., given structural forces, beyond the challenges of the day, they'll virtually have to adjust their long-term inflation target upward as things unfold...

Asian equities traded higher overnight, with 13 of the 16 markets we track closing in the green.

Europe, on the other hand, is struggling this morning, 17 of the 19 bourses we follow are trading lower as I type.

US stocks are red across the board to start the session: Dow down 410 points (1.26%), SP500 down 1.61%, SP500 Equal Weight down 1.55%, Nasdaq 100 down 1.90%, Nasdaq Comp down 1.84%, Russell 2000 down 1.55%.

The VIX sits at 27.90, up 6.90%.

Oil futures are up 0.48%, gold's down 0.08%, silver's up 0.06%, copper futures are down 0.64% and the ag complex (DBA) is down 1.67%.

The 10-year treasury is down (yield up) and the dollar is up 0.04%.

Among our 37 core positions (excluding cash and short-term bond ETF), 9 -- led by treasury bonds, Albemarle, oil services stocks, solar stocks and wind stocks -- are in the green so far this morning. The losers are being led lower by consumer staples stocks, uranium miners, ag futures, Disney and tech stocks.

"In the past 25 years, geopolitics and politics have switched from being tailwinds to the global economy and markets to being headwinds. For many in business and finance, it feels like a rug has been pulled out from under them."

--Papic, Marko. Geopolitical Alpha

Have a great day!

Marty

No comments:

Post a Comment