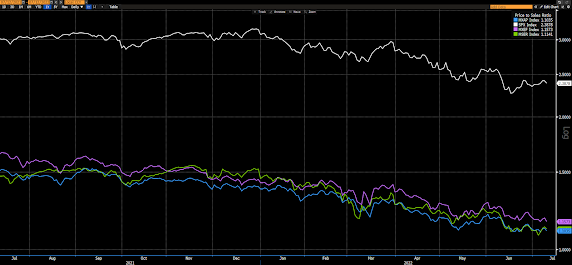

Not that we don't see pockets of long-term opportunity in certain sectors within the US market (we do), it's just that in a broader sense.... well... take a look:

SP500 (white), Asia Pacific (blue), Eurozone (green), Emerging Markets (purple)

Performance from GFC bottom (March 2009) to current:

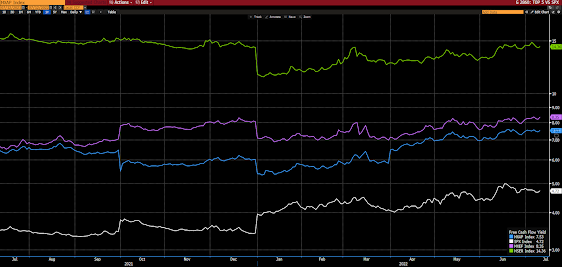

Price to Earnings Ratios (the lower the better):

Price to Sales Ratios (the lower the better):

Price to Book Ratios (the lower the better):

Free Cash Flow Yields (the higher the better):

Dividend Yields (the higher the better):

Whether we're talking valuations, cash generation or dividend yields, suffice to say that, on a relative basis, foreign equity markets look long-term attractive.

Operative words being "on a relative basis" and "long-term." I.e., we remain cautious in terms of our present global macro outlook (we actually reduced our European equity exposure just last week, and recently bought puts on Japanese equities). But, my, when the dust finally settles, we believe opportunities indeed abound beyond our borders.

Now, I must add, assessing valuation metrics and past performance alone does not a robust analysis make. Multiple other factors -- geopolitical, demographic, debt, reserves status, liquidity measures, fiscal and monetary policy, external account and currency dynamics, etc. -- have to be considered as well. But, nevertheless, in general, the above visuals are indeed long-term compelling!

Asian equities were a mess overnight, with 14 of the 16 markets we track closing lower.

Europe's leaning red so far this morning, with 12 of the 19 bourses we follow trading down as I type.

US stocks are green to start the session: Dow up 43 points (0.14%), SP500 up 0.30%, SP500 Equal Weight up 0.38%, Nasdaq 100 up 0.88%, Nasdaq Comp up 0.79%, Russell 2000 up 0.58%.

The VIX sits at 26.36, up 0.73%.

Oil futures are down 4.52%, gold's down 0.11%, silver's down 0.28%, copper futures are down 2.46% and the ag complex (DBA) is down 0.99%.

The 10-year treasury is up (yield down) and the dollar is up 0.01%.

Among our 38 core positions (excluding options hedges, cash and short-term bond ETF), 20 -- led by Sweden equities, treasury bonds, carbon credits, semiconductor and communications stocks -- are in the green so far this morning. The losers are being led lower by oil energy stocks, Brazil equities, AMD, ag and base metals futures.

In the quote below Dr. Frankl was pondering the meaning of life ("What matters is not the meaning of life in general but rather the specific meaning of a person's life at a given moment.")

Emphasis mine...

"To put the question in general terms would be comparable to the question posed to a chess champion: “Tell me, Master, what is the best move in the world?” There simply is no such thing as the best or even a good move apart from a particular situation in a game and the particular personality of one’s opponent."

--Frankl, Viktor E.. Man's Search for Meaning

Clearly, applies to investing as well...

Have a great day!

Marty

100% Agree! Thanks Marty!

ReplyDeleteAlways my pleasure Sam!

ReplyDelete