Well, folks, earnings season is upon us. And as we, and many others, have pointed out, margins have to be getting majorly squeezed due to significantly higher input costs. More so, perhaps, than what Wall Street has priced into their still optimistic earnings expectations.

Now, that said, it's never that easy. Here are a couple things to consider:

1. While input costs have indeed risen, the extent to which they hit profit margins is all about the extent to which higher prices have been passed on to the customer. I.e., have companies effectively -- meaningfully -- passed on those higher input costs, thus preserving margins in the process? I wonder if the bears have underestimated that potential…

2. Despite my opening paragraph, Wall Street analysts have actually been in a mad dash to cut their (still relatively high) earnings estimates (save for among energy stocks) over the past month. As if they just suddenly came to grips with reality, particularly with regard to the growthier sectors.

Here's Bespoke Investment Group illustrating the net result of recent earnings revisions by sector:

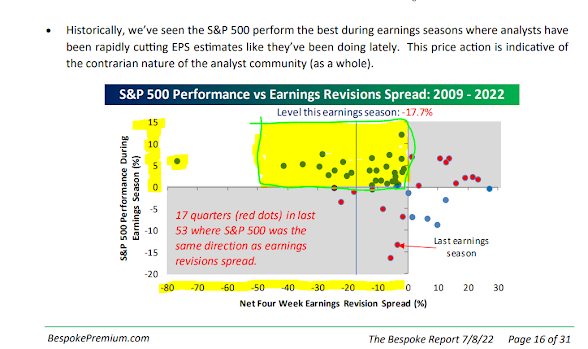

Now, here's the thing, also illustrated by Bespoke below, ironically, stocks tend to fare best during earnings seasons when analysts net earnings revisions are negative going in.

Those highlighted blue dots represent earnings seasons that saw the SP500 higher amid net negative earnings revisions:

So, who knows, perhaps any bad earnings news to come has already been priced into the market -- leaving the door open for a rally on any and all upside surprises or better than expected forward guidance.

While we're open to all possibilities, and appreciate, even sympathize with, the promise implied in that scatter plot above, we're nevertheless not holding our breaths right here.

"For many companies dependent on overseas sales, it’s set to be a gut punch to their bottom lines. That’s because a stronger greenback lessens the value of their foreign revenue when translated back into dollars. It also makes their products less competitive as prices rise in local currency terms, reducing demand."

Perhaps even bigger than earnings this week (along with retail sales data on Friday) will be the CPI report come Wednesday. As I pointed out in Saturday's video, base effects will be of no help in terms of quelling the year-over-year number for the July through September reads. June 2021’s print was plenty high, so this week’s read will indeed be interesting. I suggested that the monthly move will be the telling one to watch, and implied that it'll hint of somewhat of a taming of price pressures of late. And while that's our go-forward view based on the latest data, when it comes to "headline" CPI, we may see very little, if any, relief, even in the monthly number, given that energy prices ramped higher in June. The "core" number, which excludes energy, is more likely to reflect any recent letup in inflation.

That said, June's ISM Manufacturing Survey shows a still elevated (albeit at a slowing pace) price index:

Asian equities struggled overnight, with 11 of the 16 markets we track closing lower.

Europe's even worse so far this morning, with 18 of the 19 bourses we follow trading down as I type.

US stocks are starting off the week in the red: Dow down 129 points (0.43%), SP500 down 1.01%, SP500 Equal Weight down 0.77%, Nasdaq 100 down 1.89%, Nasdaq Comp down 1.84%, Russell 2000 down 1.21%.

The VIX sits at 26.45, up 7.55%.

Oil futures are down 2.11%, gold's down 0.21%, silver's down 0.56%, copper futures are down 3.27% and the ag complex (DBA) is up 0.22%.

The 10-year treasury is up (yield down) and the dollar is up a whopping 1.10%.

Among our 38 core positions (excluding options hedges, cash and short-term bond ETF), 5 -- treasury bonds, carbon credits, utilities stocks, consumer staples stocks and ag futures -- are in the green so far this morning. The losers are being led lower by uranium miners, Dutch Bros, Albemarle, MP materials and solar stocks.

"Over shorter segments of the market cycle, market fluctuations are heavily affected by investor psychology – which we infer from market action. When investors are inclined to speculate, they tend to be indiscriminate about it."

Thanks for this great research article Marty! I just want to pick your thoughts on China. Macau is shutdown. Shanghai is undergoing massive testing. Although China has the monetary stimulus, it can only shutdown for so long and so many times before their growth rate is impacted.

ReplyDeleteYeah, Sam, in fact those shutdowns have definitely been a serious drag on growth already. My contention has been that the political ramifications of these decisions (in the face of how the rest of the world is approaching Covid these days) place high odds of a pivot away from "zero-covid". For now it looks like they're attempting to stem the tide with aggressive fiscal stimulus (and monetary accommodation) -- their markets this morning are clearly signaling that it's not going to work. We'll see...

DeleteAgree! Thanks!

Delete