So, Q4 of the year is known for its friendliness toward the stock market... And, from a sentiment and Fed-speak standpoint, one could argue that -- geopolitical turmoil aside -- the 2023 Q4 setup isn't all that bad... I certainly don't think that Q3 earnings results, by themselves, will pose a challenge to the near-term bullish narrative.

That said, the risk to that sanguine view could be those all-important go-forward corporate outlooks... While today's CEO has been reduced to little more than shepherd of his/her company's stock price, if only for credibility's sake, corporate execs nevertheless need to tread softly (and cautiously) if and when they truly anticipate turbulent times ahead.

My point being, after all the high-fiving on Q3's results, the market will be looking to sniff out any hint of apprehension in the go-forward outlooks... Ultimately (sooner or later [not necessarily right here, mind you]), with real recession risk on the horizon, there'll likely come an inflection point where the market no longer treats bad news as good news, as it comes to realize that bad earnings news is indeed bad price news that'll have to play itself out, despite the Fed's best efforts... Time will tell.

Stay tuned...

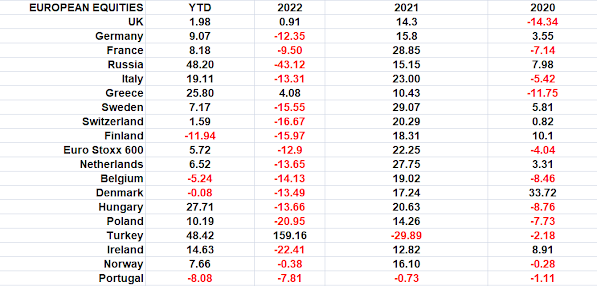

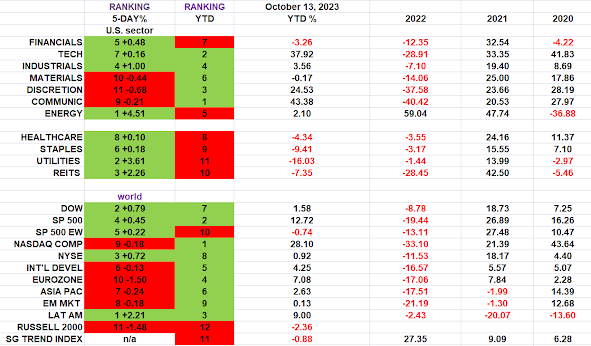

Here's your weekly sector, regional and asset class results update:

Asian stocks got hammered overnight, with all 16 markets we track closing lower.

Europe, on the other hand, is mostly green so far this morning, with 15 of the 19 bourses we follow trading up as I type.

US equity averages are higher to start the session: Dow down 248 points (0.74%), SP500 up 0.81%, SP500 Equal Weight up 0.81%, Nasdaq 100 up 0.92%, Nasdaq Comp up 0.91%, Russell 2000 up 1.18%.

As for Friday’s session, US equity averages traded lower: Dow by 0.1%, SP500 down 0.5%, SP500 Equal Weight down 0.2%, Nasdaq 100 down 1.2%, Nasdaq Comp down 1.2%, Russell 2000 down 0.8%.

This morning the VIX sits at 17.70, down 8.39%.

Oil futures are down 1.34%, nat gas futures are down 5.41%, gold's down 0.69%, silver's up 0.02%, copper futures are down 0.06% and the ag complex (DBA) is up 0.25%.

The 10-year treasury is down (yield up) and the dollar is down 0.20%.

Among our 33 core positions (excluding options hedges, cash and money market funds), 23 -- led by Dutch Bros, EWZ (Brazil equities), XLB (materials stocks), XME (base metals miners) and XLK (tech stocks) -- are in the green so far this morning... The losers are being led lower by REMX (rare earth miners), TLT (long-term treasuries), URNM (uranium miners), VNM (Vietnam equities) and XBI (biotech stocks).

"...generations are causal agents in history and that generational formation drives the pace and direction of social change in the modern world. Once people understand this, they are often tempted to judge one or another generation as “good” or “bad.”

This temptation must be resisted. In the words of the great German scholar Leopold von Ranke, who weighed so many Old World generations on the scales of history, “before God all the generations of humanity appear equally justified.” In “any generation,” he observed, “real moral greatness is the same as in any other.”

In truth, every generation is what it has to be. And, as you will soon learn, every generation usually turns out to be just what society needs when it first appears and makes its mark.

--Howe, Neil. The Fourth Turning Is Here: What the Seasons of History Tell Us about How and When This Crisis Will End

Have a great day!

Marty

No comments:

Post a Comment