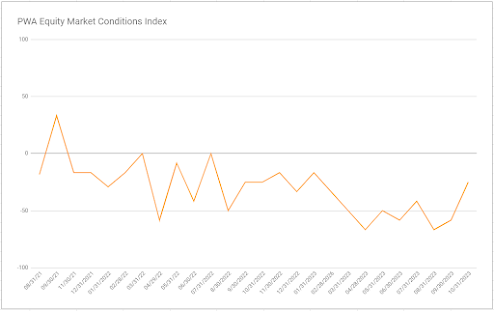

We published this month's equity market conditions report (the intro to our internal analysis) in a separate post, as Monday's will be long enough with our weekly sector, region and asset class results update:10/31/2023 PWA EQUITY MARKET CONDITIONS INDEX (EMCI): -25.00 (+33.33 from 9/30/2023)

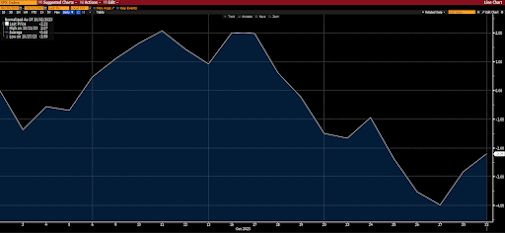

SP500 Index October 2023, -2.21%:

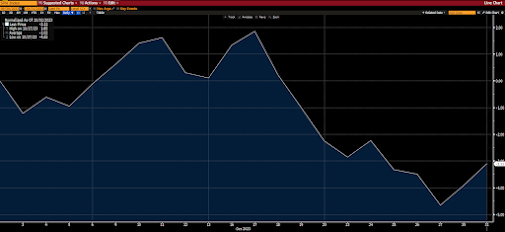

SP500 Equal Weight Index October 2023, -3.11%:

After an early month rally, US equities rolled over in October, the third consecutive down month.

The go-forward setup:

The end of October setup is similar to the end of September’s… A near-term rally looks likely, amid overall negative equity market conditions.

That said, October saw a dramatic improvement in the EMCI overall score – improving by 33 points, to a net -25.

Said improvement came from 4 components: The US Dollar (from neutral to positive), Interest Rates and Overall Liquidity (from negative to neutral), Fed Policy (from negative to neutral) and from the SPX Technicals (from negative to neutral)... Sentiment remained bullishly bearish to end October.

The Dollar: Last month we downgraded (upgraded in terms of prospects for equities) our dollar view to neutral... It turned in slightly negative results (-.25%)… Our near-term go forward view is now decidedly bearish (bullish for stocks), based primarily on the technicals, but also on our view that the economy will be exhibiting signs of (pre-recession) weakness over the next few weeks, which will have traders initially selling the dollar amid prospects for it losing some of its yield appeal.

Interest Rates and Overall Liquidity: A marked decline in global yields is a notably bullish backdrop for equities, at this juncture (until recession fears truly hit)... However, the tightening of liquidity reflected in M2 and TGA presents a bit of a headwind… Although yields would certainly win out right here… Hence, we’re upgrading this component to neutral.

10-year treasury yield remains notably above its previous multi-decade down trend line, although we anticipate a marked decline over the coming months (as data weaken):

Fed Policy: While Chair Powell continues to express concerns, and vigilance, around inflation, general conditions and subtle hints from Fedheads suggest that they’re done with rate hikes… Although I believe they believe that they can hold these levels far into next year… Our view of general conditions suggest that they may be unpleasantly surprised… Hence, for now, we’re upgrading this component to neutral:

In terms of the economic backdrop, the PWA (general conditions) Index continues to flash a recession signal, while the copper/gold ratio has recently rolled back over -- signaling weak economic sentiment.

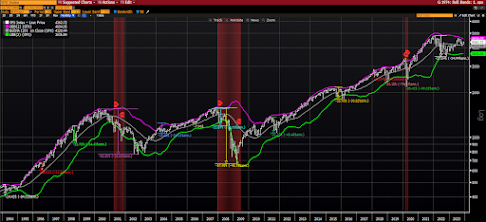

SPX Technicals: From the body of the report:

9. SPX TECHNICAL TREND: 0 (+1)

The daily chart setup currently reads bullish: Price has bounced right off of the level a previous bear flag targeted… MACD and RSI show bullish divergences:

The weekly setup continues pointing to a potential near-term bottom, with RSI turning higher while

testing the 50-w moving average (resistance):

MONTHLY: MACD buy signal still in place, yet threatening to turn to sell. MACD trend line rolling over, and there’s virtually zero chance of technical confirmation from MACD or RSI if new highs are reached anytime soon... Price is testing previous up trend line from below (resistance):

MONTHLY BOLLINGER BANDS: Price in July closed above the 20-mo MA, which is very historically bullish… Except, that is, when a recession follows shortly thereafter – that’s when the rare failure of this bullish pattern occurs… Currently, price has moved back down, dangerously close to a now slightly downward sloping 20-mo moving average:

As for the signal from the rest of the EMCI inputs, suffice to say that, while November will likely see a snapback rally (that may indeed prove short-term [weeks to, say, 2-3 months] durable), the current setup for equities remains precarious.

Bottom line: Given what are historically-high US equity market valuations, high geopolitical risks, notably uncertain economic conditions (above average recession odds on a 3-12 month outlook), and tight credit market conditions, prudence precludes us from adding measurable risk to our current core allocation.

Inputs that showed improvement:

US Dollar (from neutral to positive)

Interest Rates and overall liquidity (from negative to neutral)

Fed Policy (from negative to neutral)

SPX Technical Trends (from negative to neutral)

Inputs that deteriorated:

none

Inputs that remained bullish:

Sentiment

Inputs that remained bearish:

Valuation

Economic Conditions

Geopolitics

Breadth

Credit conditions

Inputs that remained neutral:

Fiscal Policy

Sector Leadership

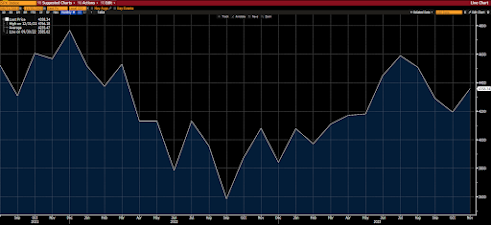

EMCI since inception:

SP500 since EMCI inception:

No comments:

Post a Comment