Dear Clients, there'll be no written post next week, as I'll be on my annual Montana excursion, which once again has me offering up the link to an old blogpost that I believe has our all time highest hit rate.

Ironically, it has nothing to do with markets, so only take it in if you're in the mood for something touchy-feely.

Here's the link to the 2020 version (disregard the days off mentioned, this time it's Tuesday - Saturday):

http://blog.pwa.net/2020/09/gods-greatest-work.html

Now before we get to the highlights I wanted to share what I believe may ultimately turn out to be a timely quote.

At the end of Larry Montgomery's latest book, How to Listen When Markets Speak, he offered up the following message, which to a not-small degree concurs with our longer-term go-forward view:

"Financial markets, much like the fashion industry, have hot sectors and boring sectors, and these are constantly shifting like desert sands. Places where billions are made will not always be that way. And sectors that once delivered tiny returns, if any at all, could one day be highly profitable. Precious metals, coal miners, uranium, copper, rare earths, oil and gas—once the great laggards of the stock market—will be among the most heavily populated sector in the coming years, and big tech will fall into the shadows. The world is about to witness the most epic migration of capital in the history of financial markets. Will your family’s wealth play a role in this and walk into that neglected meadow of value stocks, commodities, and hard assets, or will it fade away with the last decade’s portfolio? The choice is yours."

And here are some selected highlights of key global economic and market data, signals, trends, etc., from our internal log over the past few days.

Be sure and read start to finish, as we cover lots of important ground over the course of a week.

Clients, if you'd like more color on any of the below, or anything else that went on in global markets/economics this past week (even if it's not featured below, there's a good chance I commented on it internally), please feel free to reach out.

6/4/2024

As we’ve been reporting, Euro Zone data has been picking up (although we remain cautious that anything here is sustainable on a 6-12 month horizon):

Investor confidence has been picking up as well… A quarter point rate cut is priced in for Thursday’s ECB meeting, if they don’t deliver, stocks will take it very hard in my view:

6/4/2024

India:

Clearly, markets are surprised by Modi’s party doing poorly in yesterday’s India election, Indian equities down 7% this morning.

There has been huge bullishness around the Indian economy of late, the potential for the Modi regime losing some power has markets suddenly worrying about sustainability.

Mexico:

Note that yesterday saw Mexican equities down 10% on election news (ruling party won big), while this morning’s seeing a 2.5% rebound amid an otherwise global equity market selloff.

Commodities:

OPEC’s weekend meeting, while production cuts were extended, clearly, based on this week’s negative action in oil, markets wanted even more support for prices… I can argue that the prospects for demand weakens going forward, given our overall macro view right here, which would be bearish for the price as well.

Commodities are taking a pretty good hit this morning as well; our miners exposure is on our watchlist, looking to cut exposure a bit as early as this week… XME is testing technical support right here, we’ll be patient for now and see if we get a bit of a bounce off these levels before making any moves.

Labor Market:

Labor Market:

Today’s JOLTS (job openings) data was pretty weak this morning – again, consistent with our go-forward view…

Manufacturing Sector:

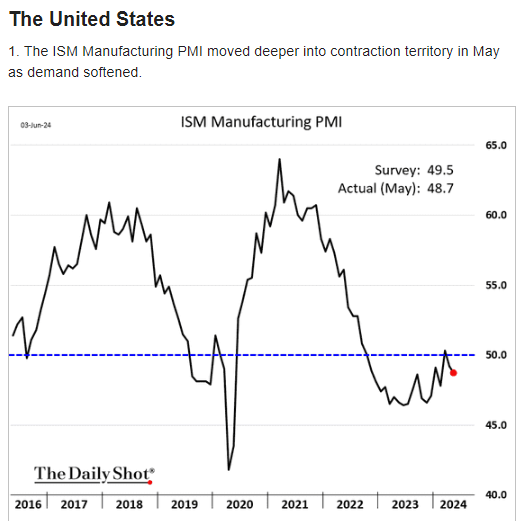

Yesterday’s ISM Manufacturing Index, save for its employment component, shows further weakening in the space… Although, conversely, S&P Global’s PMI showed expansion in Manufacturing (clearly different questions and/or different respondents).

I must say that Gold’s 1% decline today doesn’t jibe with what I believe is driving the commodity complex this morning… Could be the India news, as it’s a big buyer of gold, but it would have to be knee-jerk… Don’t see why Modi’s issues would be bearish for gold.

Here are some visuals, courtesy of Daily Shot, on yesterday’s ISM:

Per the below, again, S&P Global’s survey diverged from ISM’s:

6/2/24

We’re considering reducing our miners exposure, as I expect macro weakness to build over coming months… I.e., taking some profits and positioning to take larger positions if/when the anticipated dynamic plays out.

Ironically, just read the following by BCA… I.e., we concur:

6/2/2024

From John Hussman’s latest commentary (we share his concerns over US equities):

5/31/2024

BCA succinctly describes the mass rotation of debt – off of private sector balance sheets and on to the public sector’s – and warns of potential further-down-the-road risks:

Revisiting The Debt Supercycle

5/31/2024

Today’s PCE data came in close enough to expectations to not spook markets on the release… In a nutshell, inflation remained sticky at recent levels while consumer spending edged down a tick… Markets rose a bit initially (on the weaker spending read I suspect), but as I type the S&P is flat and the NDQ 100 is down 30bps.

My view is that the market is right to rally on weaker spending news, as indeed inflation will abate as overall demand declines… It’s just that if demand declines toward a recessionary outcome, the equity market will ultimately crack under the weight of declining corporate earnings

5/30/2024

Robin Brooks: “It’s hard to understate just how unprecedented the scale of US fiscal stimulus is at the moment.”

That, frankly, explains what’s kept markets buoyant further along than many (me included) anticipated, it explains stubbornly high inflation (and enhances the structural forces that’ll keep it higher for longer, after the next recession), it explains bitcoin, and it makes the present setup very precarious… Call it Wile E. Coyote risk:

Yesterday’s ISM Manufacturing Index, save for its employment component, shows further weakening in the space… Although, conversely, S&P Global’s PMI showed expansion in Manufacturing (clearly different questions and/or different respondents).

I must say that Gold’s 1% decline today doesn’t jibe with what I believe is driving the commodity complex this morning… Could be the India news, as it’s a big buyer of gold, but it would have to be knee-jerk… Don’t see why Modi’s issues would be bearish for gold.

Here are some visuals, courtesy of Daily Shot, on yesterday’s ISM:

Per the below, again, S&P Global’s survey diverged from ISM’s:

6/2/24

We’re considering reducing our miners exposure, as I expect macro weakness to build over coming months… I.e., taking some profits and positioning to take larger positions if/when the anticipated dynamic plays out.

Ironically, just read the following by BCA… I.e., we concur:

Better Entry Point Ahead For Copper

Copper prices have returned a whopping 25.6% YTD, briefly breaking above USD 5 earlier this month.

The red metal accounts for a large share of industrial metals indices and it is being buoyed by the same late-cycle dynamics as they are. Copper is deriving additional support from long-term structural tailwinds. The green transition, the advent of AI data centers and increased defense spending are meaningfully spurring long-term demand.

However, copper faces significant cyclical headwinds as a global recession looms. Notably, China accounts for the majority of global copper demand and we do not expect Beijing’s modest stimulus efforts will meaningfully revive Chinese domestic demand.

Moreover, our Commodity and Energy strategists have highlighted that aggregate copper inventories have risen briskly, providing another cyclical headwind.

Finally, strong bullish sentiment makes copper particularly vulnerable to a deterioration in global growth momentum.

The rally is thus likely to lose some steam as we head into a recession in late 2024/early 2025 and we are reluctant to chase it at current levels. However, investors should use the upcoming downturn as an opportunity to seek attractive entry points to initiate long copper positions on a structural investment horizon.

6/2/2024

From John Hussman’s latest commentary (we share his concerns over US equities):

“Measured from the January 2022 market peak, the total return of the S&P 500 lagged behind the return of Treasury bills through April of this year. Meanwhile, our own measures of valuations and market internals have remained unfavorable. With the market seeming to skate by the trap door of extreme valuations and unfavorable internals without consequence, the push to new highs in the past few weeks has created the impression of a runaway advance.

As I noted in late-2021, there are certain features of valuation, investor psychology, and price behavior that tend to emerge when the fear of missing out becomes particularly extreme and the focus of speculation becomes particularly narrow. Last Friday, we hit a fresh “motherlode” of these conditions.”

“At present, the “last straw” of market action that deserves monitoring in daily data relates to “leadership.” Expansion in the number of stocks hitting fresh 52-week lows (even 2.5-3% of issues traded) amid new highs in the major indices, tends to be a feature of market exhaustion. The reason is the same one I noted approaching the 2007 market peak:”

“I continue to view the market advance of recent months as an attempt to “grasp the suds of yesterday’s bubble” rather than a new, durable bull market advance. I also believe that the S&P 500 could lose something on the order of 50-70% over the completion of this cycle, simply to bring long-term expected returns to run-of-the-mill norms that investors associate with stocks. Yet as I also note in nearly every market comment, typically with the word “emphatically,” nothing in our investment discipline relies on any forecast of near-term market action, nor on a reversion of valuations to their long-term historical norms.”

“Our own investment discipline is to respond to market conditions as they change over time. The adaptations we introduced in 2021 encourage an aggressive outlook (I was frequently leveraged, for example, in the early-1990’s) or a constructive outlook (possibly with position limits or safety nets) in about two-thirds of historical periods, and over half of periods since the 2009 market low. Constructive market conditions will emerge soon enough, if only locally and sporadically at first. We do not observe those conditions here at all.”

5/31/2024

BCA succinctly describes the mass rotation of debt – off of private sector balance sheets and on to the public sector’s – and warns of potential further-down-the-road risks:

Revisiting The Debt Supercycle

BCA developed the Debt Supercycle thesis in the 1970s to characterize the postwar surge in private sector indebtedness. Because rising debt burdens increased economic vulnerability, policymakers were forced to pursue increasingly reflationary measures after each recession/crisis to keep the system running and debt growth was powerfully self-reinforcing.

The Global Financial Crisis brought the curtain down on the first phase of the Debt Supercycle by inspiring US consumers to develop an aversion to taking on more debt. Businesses have become more circumspect about borrowing as well, and private sector debt as a share of GDP is at its lowest levels in over two decades.

Had it occurred in isolation, the private sector’s deleveraging would have implied an unpalatably sharp slowdown in economic growth and perceived wellbeing. Since the crisis, however, public sector borrowing has filled the void left by the private sector and federal debt as a share of GDP is at a peacetime high and poised to keep rising.

The final phase of the Debt Supercycle will end once investors are no longer willing to buy Treasury securities at yields the economy can bear. No one knows when the bond vigilantes will return to impose fiscal discipline, but there is no sign that elected officials will voluntarily adopt it.

The outlook for the federal budget deficit is not going to drive a spike in yields in the immediate term but prudent long-term investors may want to consider ways of hedging portfolios against a potential riot in DM sovereign bond markets.

5/31/2024

Today’s PCE data came in close enough to expectations to not spook markets on the release… In a nutshell, inflation remained sticky at recent levels while consumer spending edged down a tick… Markets rose a bit initially (on the weaker spending read I suspect), but as I type the S&P is flat and the NDQ 100 is down 30bps.

My view is that the market is right to rally on weaker spending news, as indeed inflation will abate as overall demand declines… It’s just that if demand declines toward a recessionary outcome, the equity market will ultimately crack under the weight of declining corporate earnings

5/30/2024

Robin Brooks: “It’s hard to understate just how unprecedented the scale of US fiscal stimulus is at the moment.”

That, frankly, explains what’s kept markets buoyant further along than many (me included) anticipated, it explains stubbornly high inflation (and enhances the structural forces that’ll keep it higher for longer, after the next recession), it explains bitcoin, and it makes the present setup very precarious… Call it Wile E. Coyote risk:

5/30/2024

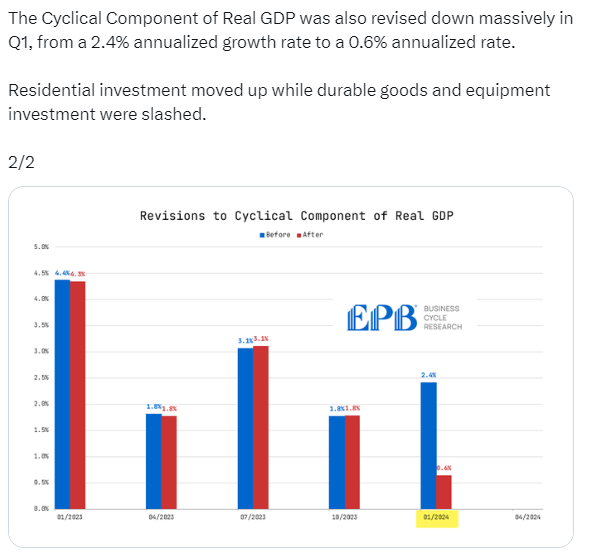

Eric Basmajian notes a marked weakening in the Cyclical Component of GDP, which very much supports our economic view going forward:

5/30/2024

Q1 GDP was revised lower, which jibes with our view that the economy will likely weaken from here, although today’s release was nothing earth shattering, or all that unexpected by markets at this point… However it does look like bonds are rallying nicely on that news (but they got creamed the past couple of days, so they were due for a snapback rally).

Salesforce disappointed on earnings guidance last night and the stock is getting destroyed as I type, down 20%! Call it a microcosm of our concern that a market that’s priced for perfection is bigly exposed to downside risk should the economy weaken, and bring corporate earnings down with it.

I.e., bear markets are far more concentrated/violent than bull markets.

5/29/2024

This is what we expect; I’m long-term bullish our EM debt exposure:

5/29/2024

The dynamics I keep describing for the US equity market – rallies on economic weakness, selloffs on strength and/or stubborn inflation data – predominate globally as well.

Case in point being today’s action in Europe, as Germany’s latest inflation reading came in higher than expected, at 2.8% year-on-year… Hence, their benchmark borrowing rate spiked to the highest since last November.

FEZ and IEUR are down 1.6% and 1.4% respectively, as I type.

US Equities are trading lower as well: Dow -0.91%, SPX -0.52%, SPX EW -1.03%, R2K -1.4%.

5/29/2024

From Bloomberg this morning; concurs with our present labor market view:

Eric Basmajian notes a marked weakening in the Cyclical Component of GDP, which very much supports our economic view going forward:

5/30/2024

Q1 GDP was revised lower, which jibes with our view that the economy will likely weaken from here, although today’s release was nothing earth shattering, or all that unexpected by markets at this point… However it does look like bonds are rallying nicely on that news (but they got creamed the past couple of days, so they were due for a snapback rally).

Salesforce disappointed on earnings guidance last night and the stock is getting destroyed as I type, down 20%! Call it a microcosm of our concern that a market that’s priced for perfection is bigly exposed to downside risk should the economy weaken, and bring corporate earnings down with it.

I.e., bear markets are far more concentrated/violent than bull markets.

5/29/2024

This is what we expect; I’m long-term bullish our EM debt exposure:

5/29/2024

The dynamics I keep describing for the US equity market – rallies on economic weakness, selloffs on strength and/or stubborn inflation data – predominate globally as well.

Case in point being today’s action in Europe, as Germany’s latest inflation reading came in higher than expected, at 2.8% year-on-year… Hence, their benchmark borrowing rate spiked to the highest since last November.

FEZ and IEUR are down 1.6% and 1.4% respectively, as I type.

US Equities are trading lower as well: Dow -0.91%, SPX -0.52%, SPX EW -1.03%, R2K -1.4%.

5/29/2024

From Bloomberg this morning; concurs with our present labor market view:

"Beige Book’s Labor Assessment Won’t Rule Out Higher Unemployment

The assessment of the labor market should improve slightly in today’s Beige Book, consistent with recent optimistic views from Fed officials. Still, hiring intentions from regional Fed surveys remain negative, suggesting unemployment is on track to increase. If the unemployment rate rises above the current consensus of 4.1% in the next few months, a Fed cut by September is more likely than the ~50% priced in rates markets."

Regional Surveys vs. Beige BookAdditionally, Bloomberg Economics Chief US Economist Anna Wong offers this chart of a Fed survey suggestive of rising unemployment rate to come:

Source: Beige Book, Bloomberg Economics

No comments:

Post a Comment