In the meantime, the following consists of a few highlights from our latest internal notes along with commentary I'll add for clarity and context... I'll close with some compelling (BCA) arguments against the growing notion that we're out of the woods just yet:

10/12/2024

The technical setup for the dollar (bullish) that we flagged a couple weeks ago has played out to a T:

The fact that stocks have nonetheless hung in there thus far, speaks to the improving headline economic data… I.e., the recent pullback in stocks was all about recession fears… Thing is, if those fears continue to abate, the dollar and interest rates (thus continuing higher) will ultimately prove problematic for stocks.

The fact that stocks have nonetheless hung in there thus far, speaks to the improving headline economic data… I.e., the recent pullback in stocks was all about recession fears… Thing is, if those fears continue to abate, the dollar and interest rates (thus continuing higher) will ultimately prove problematic for stocks.

That said, flows/seasonality right here (post-election in particular) are not bearish.

---------------------------------------------

Well, I suspect the folks who were hankering hard for a 50bps Fed cut – those in the lending space – are sorely disappointed in the aftermath:

Here’s the average 30-year fixed rate mortgage since the announcement:

What is also perhaps counterintuitive right here (more legitimately so than the rise in interest rates, btw) is how the stock market (SP500) has done while interest rates spiked:

Here’s a look at the relationship over the past year (mortgage rate blue, stocks white):

And here are other recent stints where stocks couldn't hang with rapidly rising mortgage rates:

Of course, in the event of a recession, the 2 will move in tandem (lower):

Now, the often negative correlation (outside of recession) notwithstanding -- I'll say it again -- year-end flows/seasonality may very well be sufficient (post election) to overcome it over the next few months.

10/11/2024

I have zero doubt that Powell (for whatever reason[s]) strong-armed the vote for a 50bp cut at the September FOMC meeting.

Here, via Daily Shot, is the key section from the minutes:

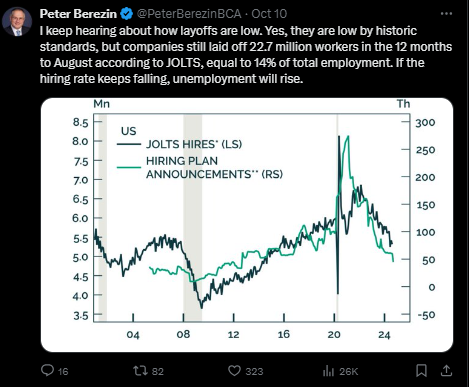

BCA’s Peter Berezin, one of the very few no-recession callers in 2023, is, ironically, one of the few analysts who now sees recession coming as we meander into 2025.

Here he is digging below the surface of the employment data:

And here's from the executive summary of his most-recent published analysis:

I have zero doubt that Powell (for whatever reason[s]) strong-armed the vote for a 50bp cut at the September FOMC meeting.

Here, via Daily Shot, is the key section from the minutes:

""…there was considerable debate among Committee members over whether to implement a 25 or 50 bps rate cut.

… noting that inflation was still somewhat elevated while economic growth remained solid and unemployment remained low, some participants observed that they would have preferred a 25 basis point reduction of the target range at this meeting, and a few others indicated that they could have supported such a decision. Several participants noted that a 25 basis point reduction would be in line with a gradual path of policy normalization that would allow policymakers time to assess the degree of policy restrictiveness as the economy evolved. A few participants also added that a 25 basis point move could signal a more predictable path of policy normalization."

As a result, Bloomberg’s Fed Minutes Sentiment indicator jumped into hawkish territory."

I.e., the board itself is not all that dovish – they had to be pushed to do the 50bp cut.

---------------------------------------------------BCA’s Peter Berezin, one of the very few no-recession callers in 2023, is, ironically, one of the few analysts who now sees recession coming as we meander into 2025.

Here he is digging below the surface of the employment data:

And here's from the executive summary of his most-recent published analysis:

- The September jobs report helped cement the consensus view that the US economy is heading for a soft landing.

- We are reluctant to crack open the champagne, however. There were enough oddities in both the payroll and household surveys to suggest that September's gains might be reversed in subsequent months.

- Unlike payrolls and the unemployment rate, which are both coincident indicators, most leading indicators point to a cooling labor market.

- Ultimately, whether the labor market freezes over will depend on whether spending holds up across the broader economy. We suspect that it will not.

- Slower income growth will lead to weaker consumer spending, while also putting downward pressure on investment via the so-called accelerator effect.

- The recent jump in mortgage rates could hurt the housing market at a time when the number of homes under construction has already begun to contract.

Bottom Line: It is too early to say that the US labor market has turned the corner. We assign a 60% chance that the US will enter a recession over the next 12 months, with the downturn likely to begin in the first half of 2025. Accordingly, investors should underweight equities.

10/9/2024

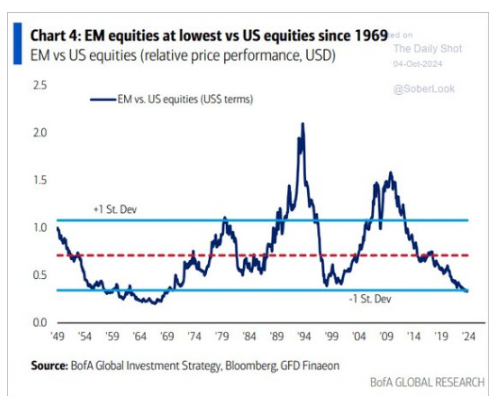

Here’s one (among a number of) reasons we are long-term bullish on emerging markets:

Speaking of emerging markets, here's from our core allocation notes:

Here’s one (among a number of) reasons we are long-term bullish on emerging markets:

Speaking of emerging markets, here's from our core allocation notes:

10/11/2024And, lastly, here are BCA's briefs on the latest consumer sentiment reads, and the present trend in capex:

The recent move to add EM exposure, inspired by our view that China would step up intervention over the coming months suddenly becomes a challenge, as, immediately following our move, China made policy announcements consistent with our expectations, but much sooner than we expected… Therefore, Chinese stocks saw a massive 30% 3-week rally that is now either being consolidated or being abandoned altogether.

Tonight Chinese policymakers are set to give detail to the impending fiscal measures… If they at all disappoint, there is significant downside risk right here… If they beat expectations, the rally will gain huge momentum…

Given our long-term view, we believe our increased weighting makes good sense… However, the move we anticipated over months, happened literally in 3 weeks… Therefore, we’ll be tactical right here and take off the add’l exposure we added on 9/23, collect our gains, and move proceeds to cash, till early next week…

"US Consumer Sentiment Unexpectedly Worsens

Preliminary estimates suggested that consumer sentiment as measured by the University of Michigan unexpectedly deteriorated from 70.1 to 68.9 in October, breaking a 3-month improvement streak. Both the current conditions and households’ expectations for the future worsened, from 63.3 to 62.7 and from 74.4 to 72.9, respectively. All three measures were expected to point to improved morale.

The University of Michigan questionnaire largely emphasizes respondents’ perceptions of inflation. The surprise rise in consumers’ short-term inflation expectations (from 2.7% to 2.9%) largely explains the souring mood. While gasoline prices have decreased, food prices increased at an accelerating pace in September (0.4% m/m, from 0.1% in August).

The disinflationary pressures in the economy nevertheless remain intact suggesting that elevated prices are less likely to constrain consumer spending than labor market conditions going forward. The alternative Conference Board Consumer Confidence survey is relatively more sensitive to labor market developments. It fell by nearly 7 points in September, the largest single-month drop in three years.

The totality of labor market indicators points to further softening of labor demand, presaging a deceleration in compensation growth, hobbling household spending’s main driver while other consumption supports are fading. Meanwhile, their outlooks for secondary growth vectors are also bleak (see Country Focus). They are thus unlikely to compensate for receding consumption spending. We also do not expect the Fed’s outsized rate cuts to reverberate through the economy in time to avoid a recession in the next year.

Investors should position defensively on a cyclical investment horizon."

"No Capex Reacceleration In The Pipeline

Our US recession view hinges on continued deterioration in labor market fundamentals and its passthrough to consumption. Could business investment compensate for the loss of momentum in spending?

Investors should first note that capex, as measured by real nonresidential fixed investment, is already slowing, growing at a mere 3.8% y/y today, contrasting with the above-5% levels consistent with past periods of economic expansions.

Moreover, coincident and forward-looking indicators point to a softening in capex growth.

1) We previously highlighted that the average of the capex intentions series from the regional Fed manufacturing surveys and the NFIB survey points to weaker capex growth.

2) The new orders component of both the ISM and S&P Global manufacturing PMIs for the US are also weak.

3) Real manufacturers’ new orders of nondefense capital goods ex-aircraft continue to contract on a year-over-year basis. They move in tandem with nonresidential fixed investment growth.

4) Firms tend to finance investments out of corporate profits, making them leading indicators of capex. Corporate profit growth was revised higher in Q2, though not by enough to point to a meaningful reacceleration in capex.

5) Firms tend to invest on evidence of demonstrated demand for additional capacity. Consumption therefore tends to lead capex, and we remain convinced household spending momentum will fade.

The advent of AI could potentially mitigate these headwinds. However, AI adoption is a multi-year phenomenon which hasn’t yet surfaced in firms’ capex intentions. Moreover, our Bank Credit Analyst colleagues have shown that AI capex is far from broad-based.

Therefore, the outlook for capex is uninspiring. Moreover, it accounts for a much smaller share of GDP than consumption and is thus unlikely to steer the overall economy away from a consumption-induced slowdown."

No comments:

Post a Comment