The good news is that our U.S. Macro Index improved by 7.74 points over past week. The bad news is this week marks the 16th consecutive below-zero score (-8.93).

Click each insert below to enlarge... red shaded areas denote past recessions...

In terms of adjustments made to component scores, this week saw nothing but improvement.

Non-farm payrolls went from yellow (0) to green (+1):

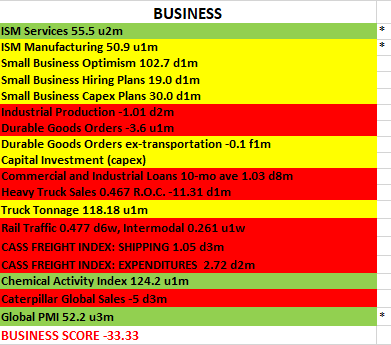

ISM Services Survey Report went from yellow (0) to green (+1), while ISM Manufacturing went from red (-1) to yellow (0):

Global PMI improved for the 3rd straight month to 52.2, moving from yellow (0) to green (1):

And the U.S. Economic Surprise Index surged (as the payroll and ISM prints would predict) into the green (1) from yellow (0):

So if we stop right here, we could sound credibly optimistic by stating that the jobs numbers have improved markedly, sentiment among purchasing managers is looking up and the U.S. economy overall is far and away outperforming economists' expectations. The economy's in great shape!

Well, there's a reason we crunch more than a few data points that in the aggregate allow us to take the temperature of the world's largest economy. And while there weren't any new "red" indicators to report, the ones that stayed red, well, stayed red, if not got redder.

For Example:

Freight Data:

Heavy truck sales:

Heavy equipment (Caterpillar) sales:

To give you a feel for overall conditions, without cramming dozens more charts herein, here's color on the consumer:

Business Data:

"General Economy" Stats:

Commodities:

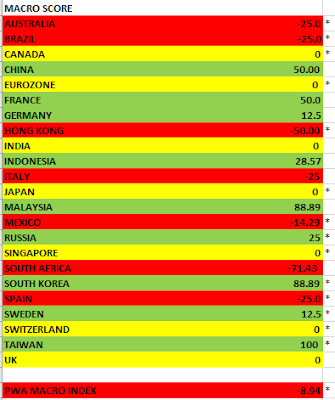

As for the rest of the world, while still a mixed picture, this week's data releases definitely brightened up many of our individual country indices: (Caveat: Virtually all of the data that comprise each index was compiled before the coronavirus outbreak)

To help you appreciate our emphasis on the weakening trend in industrial data, a new study released by MIT and State Street says that when its index -- back-tested to 1916 -- tops 70%, the likelihood of recession six months later is 70%. Of the four areas the index tracks, industrial production is at the top of the list (not that it necessarily weights it more than other components); nonfarm payrolls, stock market returns and the slope of the yield curve make up the other three.

While our assessment finds recession risk to be higher today than it's been during this entire expansion, we're not suggesting that there's a 70% chance of recession this year. However, the MIT/State Street study is; it's latest reading is 76%!

Here's our industrial production graph:

Stay tuned...

No comments:

Post a Comment