Yes, our conviction remains high that inflation -- well above the past few-decade-average -- is a protracted thing going forward. And, yet, we do see it coming off the boil. Whether in a peaking or a plateauing sense remains to be seen.

A few signs:

Price of a shipping container from Shanghai to LA:

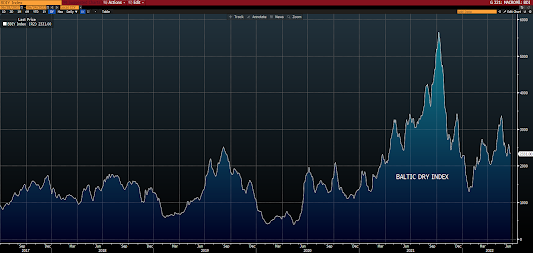

Baltic Dry Index:

On those containers:

https://gcaptain.com/checking-in-on-southern-californias-containership-backup/

"With a busy summer expected at the San Pedro Bay ports of Los Angeles and Long Beach, vessel traffic officials are reporting a new record low number of containerships waiting for a berth.

The Marine Exchange of Southern California on Friday reported just 16 containerships in the backup, setting a new record low for 2022.

For comparison, this is down from an all-time record high of 109 containerships in the backup in early January of this year. Compared to 2021, the backup hit a low of 9 ships in June 2021, decreasing from a peak of 40 in February 2021. However, the backup increased steadily from the June 2021 through the end of the year—and January’s record. To put it another way, year-over-year the backup is up 77%, but down over 85% compared to the peak."

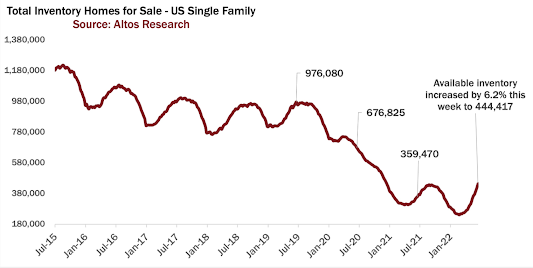

So, that's exciting, right? I mean, despite still historically-elevated levels, the direction of, among other things, shipping costs and supply chain pressures -- and the rapid acceleration of homes for sale -- surely has to bring inflation somewhat to bay, right?

Well, sure, but "somewhat", for the time being, is perhaps all we should be hoping for.

You see, employment is most companies' greatest expense, wages are sticky, and, on balance, they're still rising...

Employment Cost Index:

Total Unemployed US Workers:

Stay tuned...

Asian equities rallied overnight, with 13 of the 16 markets we track closing higher.

Europe's up this morning as well, with 15 of the 19 bourses we follow trading higher as I type.

US stocks are nicely bid to start the session: Dow up 398 points (1.27%), SP500 up 1.09%, SP500 Equal Weight up 1.20%, Nasdaq 100 up 0.95%, Nasdaq Comp up 0.95%, Russell 2000 up 0.92%.

The VIX sits at 26.50, down 1.67%.

Oil futures are up 1.01%, gold's up 0.06%, silver's down 0.07%, copper futures are up 0.89% and the ag complex (DBA) is up 0.76%.

The 10-year treasury is down (yield up) and the dollar is up 0.47%.

Among our 38 core positions (excluding options hedges, cash and short-term bond ETF), 35 -- led by MP Materials, Disney, Dutch Bros, energy stocks and Albemarle -- are in the green so far this morning. The losers are treasury bonds, silver and emerging market bonds.

"In reality, all our actions have unintended consequences. Many of these may have been foreseeable with greater effort and cost, but others simply cannot be predicted."

--Popper, Karl. All Life is Problem Solving

Have a great day!

Marty

Thanks for the charts!

ReplyDelete