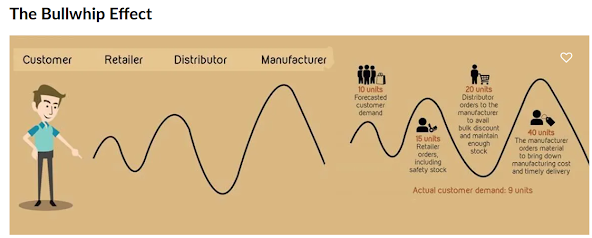

Some smart macro thinkers are pointing to the above, and to what they call the bullwhip effect.

Bullwhip Effect in today’s context:

1. Stimulus checks to everybody.

2. Everybody (well, most everybody) spends them all at once.

3. Retailers interpret this huge consumer demand as a booming economy, ramp up their inventory and place job opening ads.

4. Wholesalers interpret retailers’ demand as a booming economy, up their orders to manufacturers and place job opening ads.

5. Manufacturers interpret wholesalers’ demand as a booming economy, up their orders for materials, hire tons of people, yada yada..

But then, alas:

6. No more stimulus checks means demand craters all at once.

7. Retail sales tank.

8. While retail inventories are bulging.

9. While wholesale inventories are bulging.

10. While manufacturing orders come to a screeching halt, forcing layoffs, etc.

Economic Ramifications:

1. Inventory to sales ratio goes through the roof.

2. Retailers, wholesalers and manufacturers have to cut prices to unload inventory bulge.

3. Retailers, wholesalers and manufacturers have to cut jobs, etc., to stay alive.

4. Odds of recession rise notably.

Now, it would not be a stretch, given recent history, to see the government resort right back to handing out stimulus checks should those potential economic ramifications play themselves out. And at first blush one would expect the bullwhip effect to then start all over again.

However, one would have to assume that retailers and wholesalers will be suffering from acute amnesia, if indeed they were to make the same over-purchasing mistakes inspired by the very same phenomenon that recently got them into some serious trouble.

Calls to mind the mining industry: As China was gobbling up the majority of the world’s industrial metal supply leading into the 2008 crisis (and beyond), miners leveraged themselves to the hilt, as they saw no end in sight to the world’s number two economy attempting to urbanize its billion+ population.

Well, miners experienced first hand the bullwhip effect stemming from China’s aggressive campaign to, again, urbanize its people. When the party ended they found themselves indebted to the gills, with loads of excess capacity, at the onset of a historic commodity bear market.

Fast forward to today and we notice that despite what will very likely be sustainably huge demand for all things copper (for example) in the years to come – against insufficient capacity to produce what’ll likely be needed – miners have been slow to embark on expanding their operations. And who can blame them, given from whence they just came.

So, suffice to say that if/when government once again attempts to cure long-term ills with short-term stimulus measures, that recently-bitten retailers and wholesalers will not take the bait... Just one of a number of factors that’ll likely keep inflation, on balance, elevated for many years to come.

The analysts who are making the bullwhip case are generally quite bearish on the go-forward prospects for the economy and for equities.

Now, as compelling as that all sounds, where/how might they end up getting it wrong?

Well, given that consumers’ checking accounts are now far removed from the last stimulus checks, one would think that we’d be in the thick of bullwhip steps 6 and 7 (demand craters, retail sales tank).

But hang on a minute…

Here’s from our morning note last Friday:

For the moment, it appears as though consumers are not walking their talk. As evidenced by the spending data above (keeping in mind that those are nominal stats, meaning the increase was due to inflation, not increased unit buying. But, nevertheless, it does mean that spending held up, despite such sour sentiment). And, not to mention, as evidenced by the airline action of late (up, big, vs last year).

Hmm….. not what the bullwhip consensus would suggest…

There are other not so dire factors to consider:

11.2 million job openings – for which ~6 million unemployed Americans are vying – suggests that rather than mass layoffs occurring over the next few months, a withdrawal of openings is perhaps a more likely response to slowing economic conditions.

With regard to the employers of the majority of Americans – small businesses – we’ve yet to see the kind of sentiment around labor that smacks of the risk of a deep recession.

Here’s from the latest NFIB Small Business Survey:

Lastly, there’s no question that, in many key places, inflation is presently coming off the boil. In addition to – or among – what I’ve recently featured on the blog, there's:

The cost of shipping goods from Shanghai to LA:

The Baltic Dry Index:

Bloomberg Commodity Index:

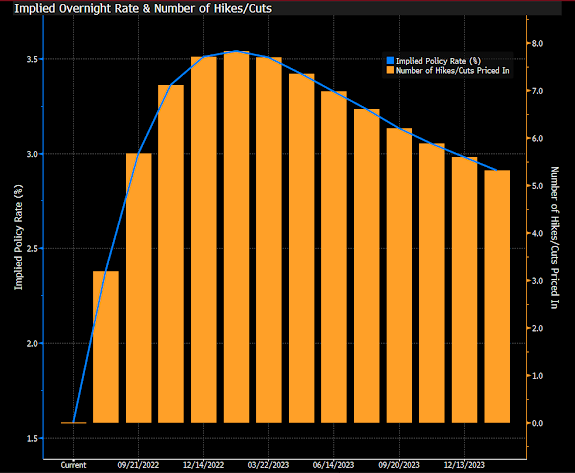

And, despite what you’re hearing around aggressive Fed rate hikes going forward, Fed funds futures, while forecasting rate hikes throughout the rest of the year, are now discounting rate cuts, believe it or not, beginning next March:

Speaking of market expectations, last week saw notable inflows to the types of ETFs (dotted below) that tend to do well when inflation and interest rates are peaking and set to roll over:

And here’s a look at 2, 5 and 10 year inflation swaps:

Of course I can throw in the unambiguously positive impact of a Russia/Ukraine truce (it’ll happen, it’s simply a matter of when), of China abandoning its zero-Covid policy and allocating its scheduled not-small stimulus measures, and other possibilities the bulls might prematurely celebrate. But suffice to say that – while we still view present conditions as anything but bullish – there is a case to be made that things may not be quite as dire as those bullwhipping bears would have us believe.

Maybe, just maybe, mind you, our 3,500 SP500 downside line isn't all that thin after all…

Stay tuned…

Asian equities rallied overnight, with all but 2 of the markets we track closing higher.

Europe's rallying so far this morning as well, with 17 of the 19 bourses we follow trading up as I type.

Same for US stocks to start the session: Dow up 205 points (0.66%), SP500 up 0.89%, SP500 Equal Weight up 0.79%, Nasdaq 100 up 1.35%, Nasdaq Comp up 1.45%, Russell 2000 up 1.47%.

The VIX sits at 24.78, up 2.19% (interesting).

Oil futures up 4.98%, gold's up 0.67%, silver's up 1.45%, copper futures are up 3.74% and the ag complex (DBA) is up 2.49%.

The 10-year treasury is down (yield up) and the dollar is down 0.77%.

Among our 35 (adjustments this morning netted us 3 fewer) core positions (excluding options hedges, cash and short-term bond ETF), 28 -- led by energy stocks, base metals futures, Albemarle, Sweden equities and uranium miners -- are in the green so far this morning. The losers are being led lower by treasury bonds, utility stocks, healthcare stocks, water stocks and AT&T.

Have a great day!

Marty

1. Stimulus checks to everybody.

2. Everybody (well, most everybody) spends them all at once.

3. Retailers interpret this huge consumer demand as a booming economy, ramp up their inventory and place job opening ads.

4. Wholesalers interpret retailers’ demand as a booming economy, up their orders to manufacturers and place job opening ads.

5. Manufacturers interpret wholesalers’ demand as a booming economy, up their orders for materials, hire tons of people, yada yada..

But then, alas:

6. No more stimulus checks means demand craters all at once.

7. Retail sales tank.

8. While retail inventories are bulging.

9. While wholesale inventories are bulging.

10. While manufacturing orders come to a screeching halt, forcing layoffs, etc.

Economic Ramifications:

1. Inventory to sales ratio goes through the roof.

2. Retailers, wholesalers and manufacturers have to cut prices to unload inventory bulge.

3. Retailers, wholesalers and manufacturers have to cut jobs, etc., to stay alive.

4. Odds of recession rise notably.

Now, it would not be a stretch, given recent history, to see the government resort right back to handing out stimulus checks should those potential economic ramifications play themselves out. And at first blush one would expect the bullwhip effect to then start all over again.

However, one would have to assume that retailers and wholesalers will be suffering from acute amnesia, if indeed they were to make the same over-purchasing mistakes inspired by the very same phenomenon that recently got them into some serious trouble.

Calls to mind the mining industry: As China was gobbling up the majority of the world’s industrial metal supply leading into the 2008 crisis (and beyond), miners leveraged themselves to the hilt, as they saw no end in sight to the world’s number two economy attempting to urbanize its billion+ population.

Well, miners experienced first hand the bullwhip effect stemming from China’s aggressive campaign to, again, urbanize its people. When the party ended they found themselves indebted to the gills, with loads of excess capacity, at the onset of a historic commodity bear market.

Fast forward to today and we notice that despite what will very likely be sustainably huge demand for all things copper (for example) in the years to come – against insufficient capacity to produce what’ll likely be needed – miners have been slow to embark on expanding their operations. And who can blame them, given from whence they just came.

So, suffice to say that if/when government once again attempts to cure long-term ills with short-term stimulus measures, that recently-bitten retailers and wholesalers will not take the bait... Just one of a number of factors that’ll likely keep inflation, on balance, elevated for many years to come.

The analysts who are making the bullwhip case are generally quite bearish on the go-forward prospects for the economy and for equities.

Now, as compelling as that all sounds, where/how might they end up getting it wrong?

Well, given that consumers’ checking accounts are now far removed from the last stimulus checks, one would think that we’d be in the thick of bullwhip steps 6 and 7 (demand craters, retail sales tank).

But hang on a minute…

Here’s from our morning note last Friday:

Retail Sales for June came in better than expected, with net positive revisions to the May numbers:

The Empire State Manufacturing Index killed expectations (to the upside):

Import and Export Prices came in way under expectations. Especially month-on-month, which, as I've explained, is what you want to watch right here:

And while we know that the reported mountain of US consumer savings out there is concentrated among the wealthier among us (they say 70% of it) -- according to yesterday's Wall Street Journal the remaining 30% is quite diffuse:"The hit from the pandemic proved short-lived for many. Two years since it began, household finances are remarkably strong.

At the end of March, households had $18.5 trillion socked away in deposit, savings and money-market accounts, more than $5 trillion above what they had heading into the pandemic, according to Federal Reserve data.

So, according to JPMorgan, consumers didn’t blow all of that “free money” after all… Those are not small numbers when we think about consumers’ ability to spend during the months to come. Which I must say conflicts with what we’re reading in the consumer sentiment surveys…Cash reserves rose across income groups. JPMorgan, tracking 7.5 million of its own accounts, found that checking-account balances averaged nearly $1,400 among its lowest-income customers in the first quarter, up from under $900 before the pandemic. Among its highest-income accounts, balances rose to almost $7,000 from less than $5,500."I must say, this is indeed encouraging stuff, particularly if, as the consensus seems to think, we're heading into recession.

For the moment, it appears as though consumers are not walking their talk. As evidenced by the spending data above (keeping in mind that those are nominal stats, meaning the increase was due to inflation, not increased unit buying. But, nevertheless, it does mean that spending held up, despite such sour sentiment). And, not to mention, as evidenced by the airline action of late (up, big, vs last year).

Hmm….. not what the bullwhip consensus would suggest…

There are other not so dire factors to consider:

11.2 million job openings – for which ~6 million unemployed Americans are vying – suggests that rather than mass layoffs occurring over the next few months, a withdrawal of openings is perhaps a more likely response to slowing economic conditions.

With regard to the employers of the majority of Americans – small businesses – we’ve yet to see the kind of sentiment around labor that smacks of the risk of a deep recession.

Here’s from the latest NFIB Small Business Survey:

"NFIB’s monthly jobs report shows half of small business owners (seasonally adjusted) reported job openings they could not fill in the current period, down one point from May’s 48-year record high. Twenty-three percent of owners said that labor quality was their top business problem, unchanged from May and in second place behind inflation. Eight percent of owners cited labor costs as their top business problem, historically high.And here’s a snip from last month’s ISM Manufacturing Survey:

“The labor force participation rate has been slowly rising this year, with more people taking jobs,” said NFIB Chief Economist Bill Dunkelberg. “However, the labor shortage continues to be a difficult problem for small businesses. A few more good months of increased employment might get total employment back to pre-pandemic levels.”

Small business owners’ plans to fill open positions remain elevated, with a seasonally adjusted net 19% planning to create new jobs in the next three months, even though down seven points from May. Ninety-four percent of those hiring or trying to hire reported few or no qualified applicants for the positions they were trying to fill. Thirty-three percent of owners reported few qualified applicants for their open positions and 27% reported none.

A net 48% of owners (seasonally adjusted) reported raising compensation, down one point from May but only two points below the 48-year record high set in January. A net 28% plan to raise compensation in the next three months, up three points from May. Hopefully this will attract new workers into the labor force.

Forty-two percent of owners have openings for skilled workers (unchanged) and 22% have openings for unskilled labor, down three points. Fifty-eight percent of the construction firms with job openings reported few or no qualified applicants, down three points from May."

"“The U.S. manufacturing sector continues to be powered — though less so in June — by demand while held back by supply chain constraints. Despite the Employment Index contracting in May and June, companies improved their progress on addressing moderate-term labor shortages at all tiers of the supply chain, according to Business Survey Committee respondents’ comments. Panelists reported lower rates of quits compared to May."And from the Services Survey:

"Employment activity in the services sector contracted in June for the third time in the last five months. ISM®’s Employment Index registered 47.4 percent, down 2.8 percentage points from the reading of 50.2 percent registered in May. Comments from respondents include: “Unable to fill positions with qualified applicants” and “Extremely hard to find truck drivers.” Also: “Demand for talent is higher, but availability of candidates to fill open roles continues to keep employment levels from increasing.”"Again, while definitely not the rosiest of pictures, it still doesn’t paint what you’d typically see (zero desire to hire, mass layoffs, etc.) amid deep recession fears.

Lastly, there’s no question that, in many key places, inflation is presently coming off the boil. In addition to – or among – what I’ve recently featured on the blog, there's:

The cost of shipping goods from Shanghai to LA:

The Baltic Dry Index:

Bloomberg Commodity Index:

And, despite what you’re hearing around aggressive Fed rate hikes going forward, Fed funds futures, while forecasting rate hikes throughout the rest of the year, are now discounting rate cuts, believe it or not, beginning next March:

Speaking of market expectations, last week saw notable inflows to the types of ETFs (dotted below) that tend to do well when inflation and interest rates are peaking and set to roll over:

And here’s a look at 2, 5 and 10 year inflation swaps:

Of course I can throw in the unambiguously positive impact of a Russia/Ukraine truce (it’ll happen, it’s simply a matter of when), of China abandoning its zero-Covid policy and allocating its scheduled not-small stimulus measures, and other possibilities the bulls might prematurely celebrate. But suffice to say that – while we still view present conditions as anything but bullish – there is a case to be made that things may not be quite as dire as those bullwhipping bears would have us believe.

Maybe, just maybe, mind you, our 3,500 SP500 downside line isn't all that thin after all…

Stay tuned…

Asian equities rallied overnight, with all but 2 of the markets we track closing higher.

Europe's rallying so far this morning as well, with 17 of the 19 bourses we follow trading up as I type.

Same for US stocks to start the session: Dow up 205 points (0.66%), SP500 up 0.89%, SP500 Equal Weight up 0.79%, Nasdaq 100 up 1.35%, Nasdaq Comp up 1.45%, Russell 2000 up 1.47%.

The VIX sits at 24.78, up 2.19% (interesting).

Oil futures up 4.98%, gold's up 0.67%, silver's up 1.45%, copper futures are up 3.74% and the ag complex (DBA) is up 2.49%.

The 10-year treasury is down (yield up) and the dollar is down 0.77%.

Among our 35 (adjustments this morning netted us 3 fewer) core positions (excluding options hedges, cash and short-term bond ETF), 28 -- led by energy stocks, base metals futures, Albemarle, Sweden equities and uranium miners -- are in the green so far this morning. The losers are being led lower by treasury bonds, utility stocks, healthcare stocks, water stocks and AT&T.

Another quote I never tire of sharing:

"That is about all I have learned—to study general conditions, to take a position and stick to it. I can wait without a twinge of impatience. I can see a setback without being shaken, knowing that it is only temporary. I have been short one hundred thousand shares and I have seen a big rally coming. I have figured—and figured correctly—that such a rally as I felt was inevitable, and even wholesome, would make a difference of one million dollars in my paper profits. And I nevertheless have stood pat and seen half my paper profit wiped out, without once considering the advisability of covering my shorts to put them out again on the rally. I knew that if I did I might lose my position and with it the certainty of a big killing. It is the big swing that makes the big money for you."

--Jesse Livermore

Have a great day!

Marty

I always admire your writing. Reading it is like I am watching a well scripted and well written movie. It flows so well and definitely got me engaged. With the market being so dynamic, anything is possible. Traders are being obsessed with the record profits in 2021; they may be complacent with the dynamic market. This week is an interesting week with a lot of earning reports coming out. But I am more interested to see what Ben Bernanke has to say about our State of Economy.

ReplyDeleteThanks so much Sam! Glad you're finding this stuff useful!

DeleteI think people are trying to keep their savings intact right now because they don't know what the future will bring in these unstable times...

ReplyDelete