Here's from our internal chat thread over the weekend:

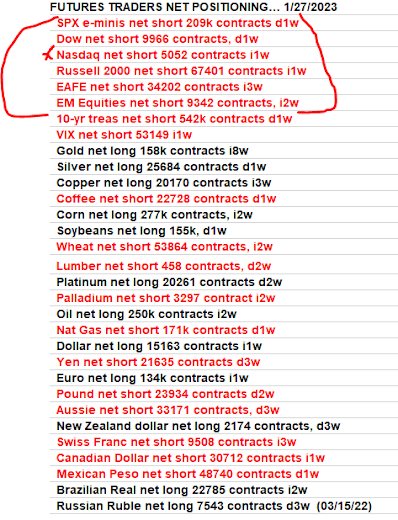

"Net short equity futures across the board! Amazing the ndx... shorting it hard right in the face of this rally! Clearly, speculators expect the Fed to come in hawkish next week... Huge short-covering to come if they come in dovish..."

Nasdaq 100 Non-Commercial Traders Net Futures Positioning:

I.e., the bears are still sticking their necks out there -- risking getting their heads handed to them if indeed the Fed delivers a dovish message... I.e., that "huge short-covering if they come in dovish," will serve to add a not-small upside boost to stocks in that scenario... If, on the other hand, the Fed aggressively reemphasizes its promise to keep rates higher for longer (say, drain the punchbowl), then, the shorts got it right, and stocks take a hit.

Now, if the Fed -- to the short sellers' delight -- delivers the latter, the following chart suggests it has reason... The top panel being the Goldman Sachs Financial Conditions Index, when it rises financial conditions are tightening, when it falls, they're loosening... The bottom panel is year-over-year inflation (CPI)... Note the negative correlation over time, and note the recent decline in (loosening of) financial conditions, at what remains a high, albeit declining of late, level of inflation:

Yeah, "UH OH!!"

Asian stocks were mixed overnight, with 8 of the 16 markets we track closed lower.

Europe's leaning slightly red far this morning, with 10 of the 19 bourses we follow trading down as I type.

US equity averages are down to start the session: Dow by 48 points (0.13%), SP500 down 0.48%, SP500 Equal Weight down 0.26%, Nasdaq 100 up 0.95%, Nasdaq Comp down 0.90%, Russell 2000 down 0.65%.

The VIX sits at 19.58, up 5.78%.

Oil futures are down 1.20%, gold's down 0.12%, silver's up 0.45%, copper futures are down 0.41% and the ag complex (DBA) is up 0.58%.

The 10-year treasury is down (yield up) and the dollar is down 0.03%.

Among our 36 core positions (excluding options hedges, cash and short-term bond ETF), 13 -- led by Dutch Bros, Nokia, AT&T, uranium miners and ag futures -- are in the green so far this morning. The losers being led lower by AMD, Vietnam equities, emerging market equities ETF, energy stocks and Amazon.

Wow! Thanks for the updates!

ReplyDeleteMy pleasure Sam!

Delete