It seems there's this popular notion that with employment as strong as it presently is, the odds of recession anytime soon have to be near zero.

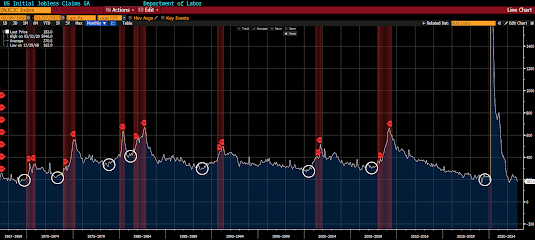

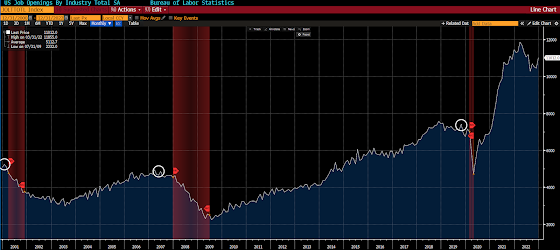

Makes sense, right? Well, let's have a look (red shaded areas = past recessions) -- and note, when we're talking economics, while levels are to be considered, in our view it's direction and rate of change that really matter.

Unemployment Rate:

Oof!! There's been the tiniest of lag between past spikes in unemployment and the onset of recession... And, counterintuitively, it seems the lower the base we start from, the sooner recession begins.

Weekly Jobless Claims (data only go back to 1967):

Total job openings (data back to Dec 2000):

While not every apparent peak, or trough, means imminent recession, history strongly says to be on your toes when the employment data begin to turn.

In case you missed it, here again is yesterday's video commentary... It offers up some insight into what's underneath the latest market action:

Asian stocks leaned slightly red overnight, with 9 of the 16 markets we track closed lower.

Europe, on the other hand, is mostly in the green so far this morning, with 15 of the 19 bourses we follow trading up as I type.

US equity averages are up to start the session: Dow by 225 points (0.66%), SP500 up 0.69%, SP500 Equal Weight down 0.60%, Nasdaq 100 up 1.09%, Nasdaq Comp up 0.96%, Russell 2000 up 0.54%.

The VIX sits at 19.19, down 2.24%.

Oil futures are down 1.24%, gold's up 0.24%, silver's up 0.16%, copper futures are up 1.50% and the ag complex (DBA) is down 0.25%.

The 10-year treasury is up (yield down) and the dollar is down 0.58%.

Among our 36 core positions (excluding options hedges, cash and short-term bond ETF), 30 -- led by uranium miners, Disney, MP Materials, Albemarle and cyber security stocks -- are in the green so far this morning. The losers being led lower by Brazil equities, energy stocks, ag futures, AT&T and communication services stocks.

"I can't tell you how it came to take me so many years to learn that instead of placing piking bets on what the next few quotations were going to be, my game was to anticipate what was going to happen in a big way."

-- Jesse Livermore

Have a great day!

Marty

No comments:

Post a Comment