Mixing it up a little, we'll do last week's economic update in writing, and make it this morning's main message.

In a nutshell, our present assessment remains that go-forward odds favor recession over expansion... Question being, timing?

When our indicators turned red last August we pegged the first half of this year to mark the recession's official start... Now, as the data roll in, while, for now, we'll stick to our H1 assessment, we're sensing that it could be a second-half affair (if indeed we're right on the recession call)... And recall that at the get-go we expected it to be a mild one by historical comparison -- still do (for now).Our overall score -- via our PWA Index -- dipped back further into the red by 4.4 points, to -22.22:

A few highlights:

Core Retail Sales bested expectations with a month-on-month increase of 1.7% (panel 2 below)... However, we also track Redbook's weekly reading (panel 3), which continues to show a notably declining rate of growth... I.e., mixed signals:

Mortgage Purchase Apps dipped 5.5% last week, as the average 30-year fixed rate edged up to 6.39%:

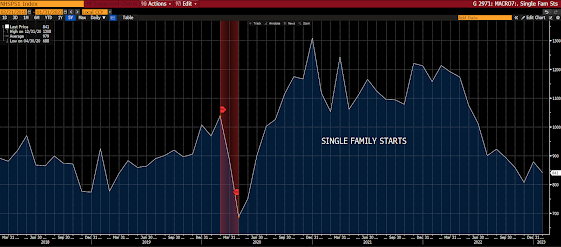

Single Family Starts and Permits continue to paint a not-so-good housing picture:

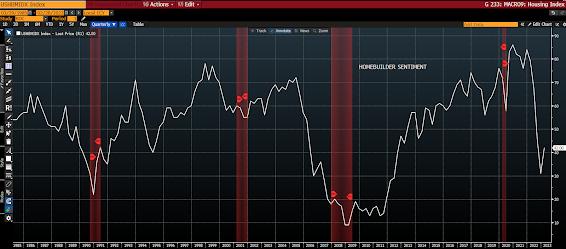

Homebuilder Sentiment, on the other hand -- while still (pardon the pun) nothing to write home about -- improved a bit last month:

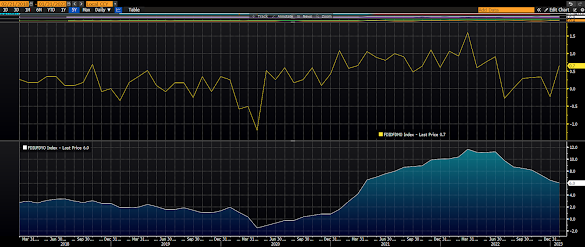

Weekly Jobless Claims (top panel) continue to impress... Continuing Claims (bottom panel), however, look suspect:

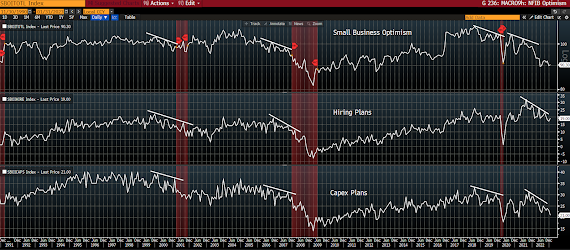

While optimism picked up at the margin, suffice to say that US small business owners see recession coming:

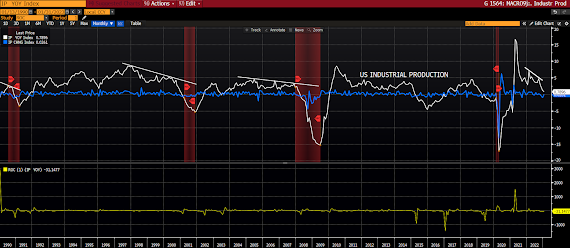

Industrial Production missed economists' estimates:

Commercial and Industrial Loans lost steam as well in January:

CASS freight data, while (considering the details) not all bad, continue to unimpress:

Leading Economic Indicators compared to Coincident Indicators continue to look scary:

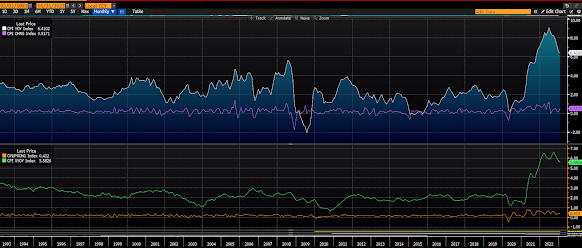

The Consumer Price Index for January (top panel features headline [6.41%], bottom features core [5.6%]), came in a titch hotter than economists expected:

As did Producer Prices (particularly month-on-month [top panel]):

All in, 22% of our inputs (45 in total) score positive, 47% negative, 31% neutral.

Stay tuned.

Europe's mostly red so far this morning, with 14 of the 19 bourses we follow trading down as I type.

US equity averages are down to start the session: Dow by 287 points (0.85%), SP500 down 0.89%, SP500 Equal Weight down 0.87%, Nasdaq 100 down 1.16%, Nasdaq Comp down 1.17%, Russell 2000 down 1.07%.

The VIX sits at 22.15, up 10.64%.

Oil futures are up 0.73%, gold's up 0.10%, silver's up 0.59%, copper futures are up 2.92% and the ag complex (DBA) is up 1.20%.

The 10-year treasury is down (yield up) and the dollar is up 0.15%.

Among our 36 core positions (excluding options hedges, cash and short-term bond ETF), 9 -- led by base metals futures, Vietnam equities, ag futures, silver and MP Materials -- are in the green so far this morning. The losers being led lower by Albemarle, uranium miners, Amazon, Disney and long-term treasuries.

"Acceptance or denial does not alter a fact nor will reason bring about a necessary impact. What does is "seeing" the fact. There's no "seeing" if there is condemnation or justification or identification with the fact."

--J. Krishnamurti

Marty

No comments:

Post a Comment