The following captures the intro to our internal report, and, to follow up on yesterday's message, features the inputs to our assessment of valuations. We also featured the section on economic conditions, which we considered upgrading to neutral, although, as you'll see in the brief narrative, wasn't justified just yet.

03/31/2024 PWA EQUITY MARKET CONDITIONS INDEX (EMCI): -22.22 (+22.22 vs February)

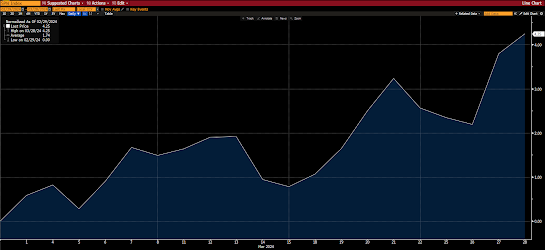

SP500 (cap-weighted) Index February 2024, +3.10%:

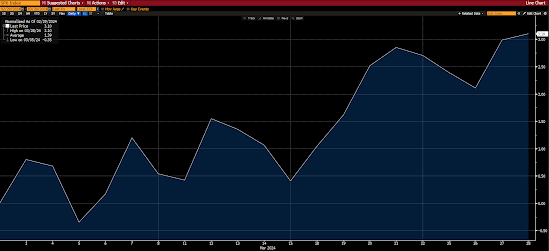

SP500 Equal Weight Index February 2024, +4.25%:

Stocks continued to advance over the past month, despite the notable headwinds outlined in our February report.

SP500 (cap-weighted) Index February 2024, +3.10%:

SP500 Equal Weight Index February 2024, +4.25%:

Stocks continued to advance over the past month, despite the notable headwinds outlined in our February report.

While sector leadership remains bullish – and breadth has improved notably – valuation, sentiment and the technicals, in particular, continue to reflect significant downside risk going forward.

Bottom line: Per the above, and the entirety of this report, current overall conditions leave us uninspired to add measurable equity market risk, or to hedge less, at this juncture.

Inputs that showed improvement:

Fiscal Policy (from neutral to positive)

Breadth (from negative to neutral)

Inputs that deteriorated:

None

Inputs that remained bullish:

Sector Leadership

Inputs that remained bearish:

Valuation

Economic Conditions

SPX Technical Trends

Sentiment

Inputs that remained neutral:

US Dollar

Interest Rates, Liquidity and Overall Financial Conditions

Bottom line: Per the above, and the entirety of this report, current overall conditions leave us uninspired to add measurable equity market risk, or to hedge less, at this juncture.

Inputs that showed improvement:

Fiscal Policy (from neutral to positive)

Breadth (from negative to neutral)

Inputs that deteriorated:

None

Inputs that remained bullish:

Sector Leadership

Inputs that remained bearish:

Valuation

Economic Conditions

SPX Technical Trends

Sentiment

Inputs that remained neutral:

US Dollar

Interest Rates, Liquidity and Overall Financial Conditions

EMCI since inception:

SP500 since EMCI inception:

SP500 Equal Weight since EMCI inception:

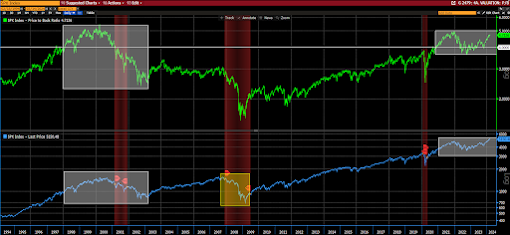

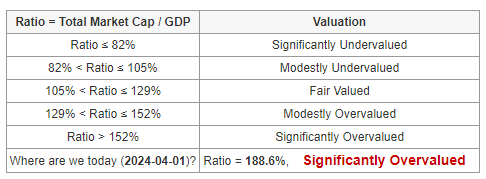

4. VALUATION: -1 (nc)

US equity market valuations remain historically-high:

P/E 24.32

CAPE 35.04

:

:

P/S 2.76:

P/B 4.71:

MC/GDP 184%:

MC/GDP 184%:

6. ECONOMIC CONDITIONS: -1 (nc)

The PWA Index improved markedly to -8.51 (from -19), while, conversely, the copper/gold ratio plunged by 4.34%... While, clearly, despite the signals from the likes of the copper/gold indicator, conditions have improved of late, our assessment still has recession odds over the next 6-12 months too high to upgrade our rating of the overall economic setup at this juncture:

PWA MACRO INDEX -8.51:

COPPER/GOLD RATIO past month -4.34%:

No comments:

Post a Comment