Clients, if you'd like more color on any of the below, or anything else that went on in global markets/economics this past week (even if it's not featured below, there's a good chance I commented on it internally), please feel free to reach out.

Last Thursday 5/2

Generally speaking, it’s pretty clear that the market (equity mkt in particular) is pricing in a soft landing and strong go-forward corporate earnings growth.

Given that there are sufficient leading indicators to cause concern, the soft landing thesis continues to stand on shaky ground, which of course conflicts with that forward earnings bullishness.

Ironically, while my stated concern ultimately leads to consequently-lower equity prices, along the way to a harder-than-priced-in-landing, a notable rally in equities (classic “blowoff top” perhaps) is very much on the cards – as the economy/inflation cools.

Bottom line, the likely equity market transition for the no-soft-landing scenario sees stocks flat to down as long as inflation remains elevated… Then stocks rally as the economy and, thus, inflation cools… Then stocks finally rollover when recession becomes reality… Then a fundamentally-sound buying opportunity presents itself.

Last Friday 5/3

Given global macro dynamics, valuations, our long-term currency view, etc., we’re targeting a 50/50 (US vs rest of the world) mix for our equity markets exposure going forward.

Europe is a bit underweight in our core allocation, relative to other regions, and relative to our current macro view… Plus, our view of the US economic trajectory over the next 12 months justifies a modest cut to US cyclical exposures, keeping our allocation to defensives (staples and healthcare) elevated relative to other sectors.

While I remain guarded, and cognizant of the potential for a head fake here, it appears that the Eurozone is in the early stages of emerging from, in some spots, recession, while the US appears to us to be very late-cycle.

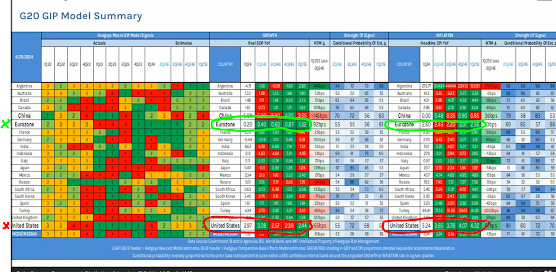

Hedgeye’s model concurs… The table below shows Eurozone GDP increasing each quarter from here through Q1 2025, with inflation holding in the mid 2%s… While showing US GDP growth contracting from here through Q1 2025, with inflation going from 3.6% to 4.3% over that time period.

Note, with regard to US inflation, I do not concur with Hedgeye’s estimates… I firmly expect that we’ll see inflation cool notably as the US economy cools – and I also expect more notable cooling between now and mid-2025 than what Hedgey estimates.

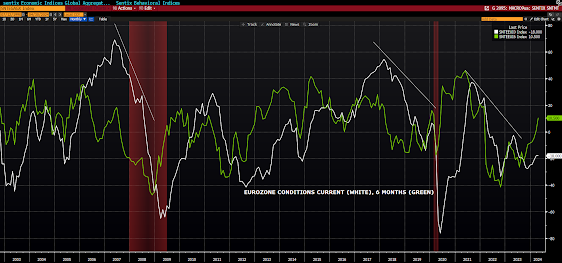

And here’s our chart of the Sentix Survey’s Eurozone signal (the 6-month outlook has improved notably):

Regarding valuation:

Europe is a bit underweight in our core allocation, relative to other regions, and relative to our current macro view… Plus, our view of the US economic trajectory over the next 12 months justifies a modest cut to US cyclical exposures, keeping our allocation to defensives (staples and healthcare) elevated relative to other sectors.

While I remain guarded, and cognizant of the potential for a head fake here, it appears that the Eurozone is in the early stages of emerging from, in some spots, recession, while the US appears to us to be very late-cycle.

Hedgeye’s model concurs… The table below shows Eurozone GDP increasing each quarter from here through Q1 2025, with inflation holding in the mid 2%s… While showing US GDP growth contracting from here through Q1 2025, with inflation going from 3.6% to 4.3% over that time period.

Note, with regard to US inflation, I do not concur with Hedgeye’s estimates… I firmly expect that we’ll see inflation cool notably as the US economy cools – and I also expect more notable cooling between now and mid-2025 than what Hedgey estimates.

And here’s our chart of the Sentix Survey’s Eurozone signal (the 6-month outlook has improved notably):

Regarding valuation:

US vs Eurozone Price to Earnings

Price to Sales

Price to Book:

Last Friday 5/3

The pre-market reaction (stocks and bonds up) to this morning’s weaker than expected jobs (and wage) print jibes perfectly with what I said yesterday:

Per this note I also added herein yesterday:

Last Friday 5/3

Re: jobs report

170k vs 220 estimate, unemployment ticked up barely (they round up) to 3.9%, average hourly earnings growth declined, hours worked declined slightly in goods producing industries, etc.

Again, markets are loving this news, right on cue… Longer-term this jibes with our view that recession risk is not-small, but not the least bit discounted yet in markets.

Last Friday 5/3

Totally in line with our concerns, the ISM Services Survey was just released and it dipped below 50 (contractionary), with the employment component, among others, declining notably.

Tech didn’t budge on the ISM news, but suddenly financials are in the red, staples and energy each dipped a little further into the red.

Again, softness here will be greeted well (on balance) by markets – while continued and accelerated softness later becomes problematic.

Last Friday 5/3

The global PMI came out this morning as well, showing some strength outside the US, while the US may indeed be peaking… Consistent with yesterday’s comment herein and supports our recent allocation shift(s).

Last Friday 5/3

While I remain very cautious/guarded in our emerging view that maybe the rest of the world economies are entering a new phase (big head fake risk here!), the latest Citi Economic Surprise Indices support that narrative (US now negative, ROW positive):

“...the moment the jobs market, in particular, softens, look out above – as Powell and company swoop in… Longer-term, if a weakening jobs market morphs into recession, as it historically tends to, look out (below) for what will at last become a fundamentally-compelling moment to buy (the right stuff) with both fists.”Essentially this is the kind of data that ultimately allows the Fed to cut rates.

Per this note I also added herein yesterday:

“He said they'll cut if they see weakness in the labor market, independent of inflation (in essence)... I absolutely do see weakness in the labor market coming… Until Recession is obvious, that's going to be bullish for equities! There's still some not-small risk embedded in the current setup, but, say, on a 5-6 month horizon, upside risk is probably pretty high…”

Last Friday 5/3

Re: jobs report

170k vs 220 estimate, unemployment ticked up barely (they round up) to 3.9%, average hourly earnings growth declined, hours worked declined slightly in goods producing industries, etc.

Again, markets are loving this news, right on cue… Longer-term this jibes with our view that recession risk is not-small, but not the least bit discounted yet in markets.

Last Friday 5/3

Totally in line with our concerns, the ISM Services Survey was just released and it dipped below 50 (contractionary), with the employment component, among others, declining notably.

Tech didn’t budge on the ISM news, but suddenly financials are in the red, staples and energy each dipped a little further into the red.

Again, softness here will be greeted well (on balance) by markets – while continued and accelerated softness later becomes problematic.

Last Friday 5/3

The global PMI came out this morning as well, showing some strength outside the US, while the US may indeed be peaking… Consistent with yesterday’s comment herein and supports our recent allocation shift(s).

Last Friday 5/3

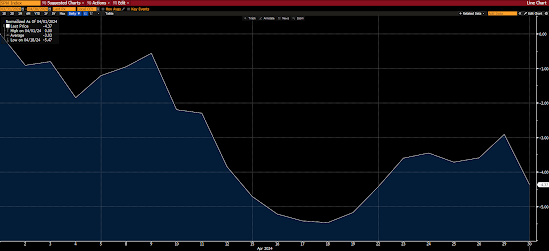

While I remain very cautious/guarded in our emerging view that maybe the rest of the world economies are entering a new phase (big head fake risk here!), the latest Citi Economic Surprise Indices support that narrative (US now negative, ROW positive):

Last Friday 5/3

Just scored the PWA Index, and, per our concerns, general economic conditions have deteriorated markedly of late… Which, ironically, as we’ve been anticipating, is initially bullish for equities:

Last Friday 5/3

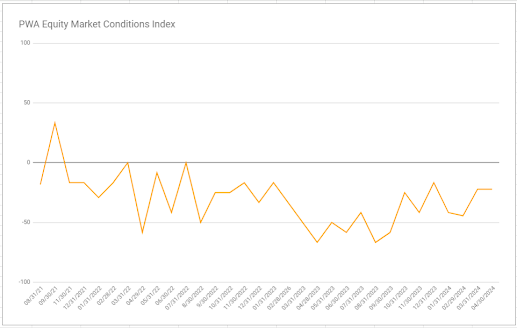

Our Equity Market Conditions Index score and intro to our April analysis:

04/30/2024 PWA EQUITY MARKET CONDITIONS INDEX (EMCI): -22.22 (nc)

SP500 (cap-weighted) Index April 2024, -3.97%:

SP500 Equal Weight Index April 2024, -4.37%:

This line from our 3/31 report speaks to the drawdown stocks suffered in April:

That said, here’s essentially how we see the near-term go forward setup:

Interest Rates, Liquidity and Overall Financial Conditions (from neutral to positive)

Sentiment (from negative to neutral)

Inputs that deteriorated:

Fiscal Policy (from positive to neutral)

Sector Leadership (from positive to negative)

Inputs that remained bullish:

none

Inputs that remained bearish:

Valuation

Economic Conditions

SPX Technical Trends

Just scored the PWA Index, and, per our concerns, general economic conditions have deteriorated markedly of late… Which, ironically, as we’ve been anticipating, is initially bullish for equities:

Our Equity Market Conditions Index score and intro to our April analysis:

04/30/2024 PWA EQUITY MARKET CONDITIONS INDEX (EMCI): -22.22 (nc)

SP500 (cap-weighted) Index April 2024, -3.97%:

SP500 Equal Weight Index April 2024, -4.37%:

This line from our 3/31 report speaks to the drawdown stocks suffered in April:

“...valuation, sentiment and the technicals, in particular, continue to reflect significant downside going forward.”Bottom line: While, again, current overall conditions leave us uninspired to add measurable equity market risk, or to hedge less, at this juncture, we do see opportunity here for tactical shifts (we implemented a few over the past month) within our core allocation, and, therefore, to put a bit more of our new money inventory to work.

That said, here’s essentially how we see the near-term go forward setup:

“Generally speaking, it’s pretty clear that the market (equity mkt in particular) is pricing in a soft landing and strong go-forward corporate earnings growth.

Given that there are sufficient leading indicators to cause concern, the soft landing thesis continues to stand on shaky ground, which of course conflicts with that forward earnings bullishness.

Ironically, while my stated concern ultimately leads to consequently-lower equity prices, along the way to a harder-than-priced-in-landing, a notable rally in equities (classic “blowoff top” perhaps) is very much on the cards – as the economy/inflation cools.

Bottom line, the likely equity market transition for the no-soft-landing scenario sees stocks flat to down as long as inflation remains elevated… Then stocks rally as the economy and, thus, inflation cools… Then stocks finally rollover when recession becomes reality… Then a fundamentally-sound buying opportunity presents itself.”

Inputs that showed improvement:

US Dollar (neutral to positive)Interest Rates, Liquidity and Overall Financial Conditions (from neutral to positive)

Sentiment (from negative to neutral)

Inputs that deteriorated:

Fiscal Policy (from positive to neutral)

Sector Leadership (from positive to negative)

Inputs that remained bullish:

none

Inputs that remained bearish:

Valuation

Economic Conditions

SPX Technical Trends

Inputs that remained neutral:

Breadth

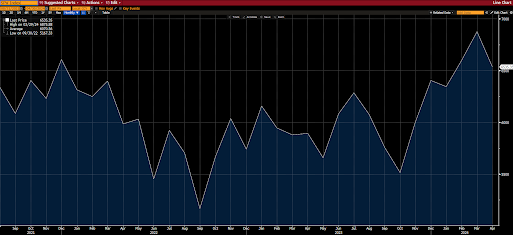

EMCI since inception:

SP500 since EMCI inception:

Breadth

EMCI since inception:

SP500 since EMCI inception:

SP500 Equal Weight since EMCI inception:

Last Saturday 5/4

The following summarizes BCA’s US Bond Strategy Team’s view of what the latest labor market data portends going forward… I concur:

This Monday 5/6

While I remain cautious on the global economy overall, the following from Peter Boockvar jibes with my comments (Europe’s Stage of the Cycle vs the Us’s) in Saturday’s video:

Last Saturday 5/4

The following summarizes BCA’s US Bond Strategy Team’s view of what the latest labor market data portends going forward… I concur:

“According to BCA Research’s US Bond Strategy service, while US economic data clearly show that labor demand has slowed from its peak two years ago, it isn’t yet clear whether this slowing represents a re-normalization to pre-pandemic levels or the start of a downtrend that will culminate in a US recession.

For example, growth in aggregate weekly payrolls – an index that combines nonfarm payrolls with hours worked and average hourly earnings – is down significantly from its peak but it also appears to be stabilizing above its average pre-pandemic level. However, a look at the three components of the index shows that the growth rates of nonfarm payrolls and average weekly hours are already back to their average pre-pandemic levels. In other words, it is only wage growth that is propping up the overall index and we know that wages tend to lag other labor market indicators.

Further, other indicators of labor demand such as the gross hiring rate and surveys of business’ hiring plans are all below pre-pandemic levels and are consistent with further labor demand deceleration ahead.

The team concludes that the slowdown in labor demand will continue and will culminate in a US recession, perhaps near the end of this year.”

While I remain cautious on the global economy overall, the following from Peter Boockvar jibes with my comments (Europe’s Stage of the Cycle vs the Us’s) in Saturday’s video:

“The service sector is also carrying the economic weight in Europe as their PMI was revised up by .4 pts to 53.3 from the initial print seen a few weeks ago. That is up from 51.5 in March and the best read since May 2023 led by Spain and Italy and their tourism industries, both outperforming Germany and France. While the ECB is going to cut in June and we don't know when the Fed will, the drop in US yields last week has the euro nearing a one month high vs the US dollar.”

No comments:

Post a Comment