Here are some selected highlights of key global economic and market data, signals, trends, etc., from our internal log over the past few days.

Be sure and read start to finish, as we cover lots of important ground over the course of a week.

Clients, if you'd like more color on any of the below, or anything else that went on in global markets/economics this past week (even if it's not featured below, there's a good chance I commented on it internally), please feel free to reach out.

Last Wednesday 5/15

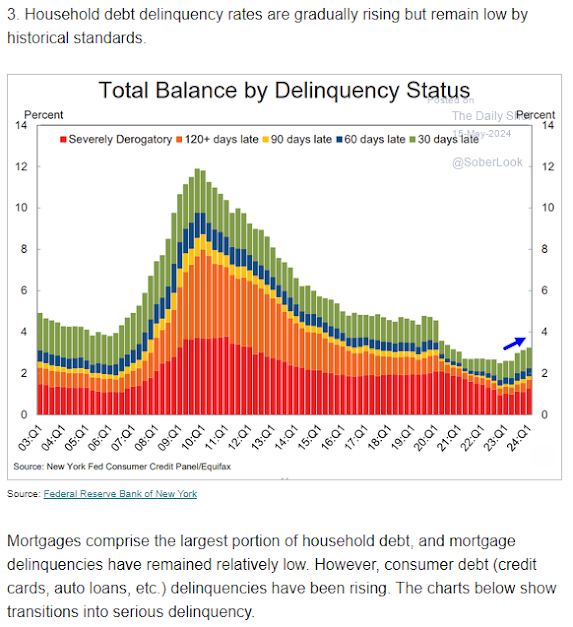

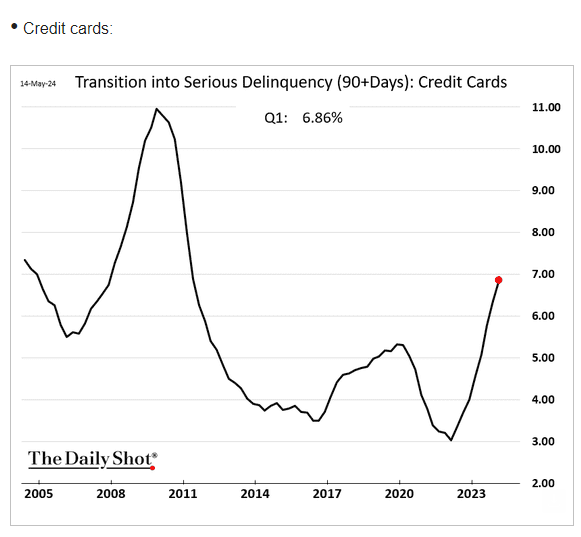

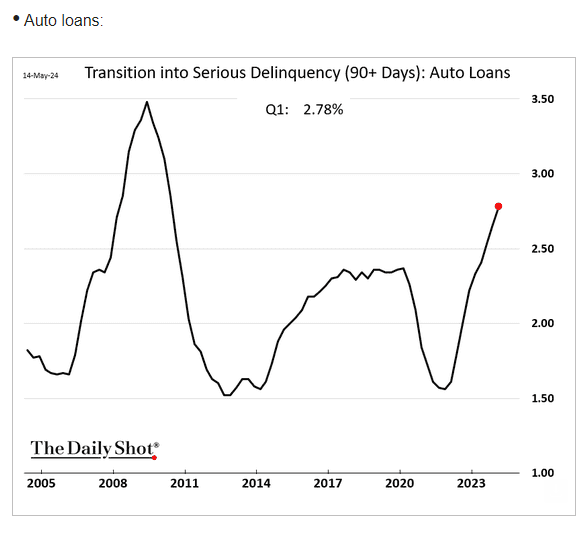

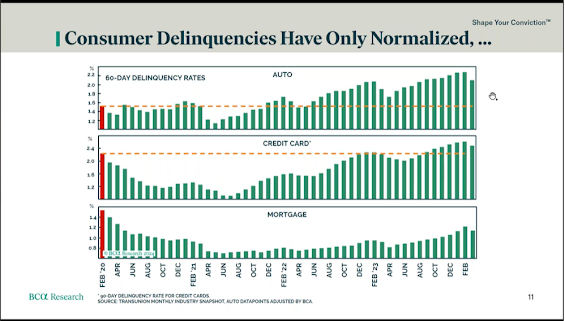

When we look at the consumer debt picture in total, the delinquency rate, while rising, isn’t alarming… However, that’s explained by the still low occurrence of mortgage delinquencies… When we factor in credit cards and auto loan delinquencies, however, it is indeed troubling.

Per this morning’s Daily Shot chart deck:

Sentiment is already back over its skis a bit… I mentioned S&P Global’s Investment Manager Survey yesterday (giddy), Merrill’s fund manager survey shows the most overweight stocks since January 2022 (2022 turned into an ugly bear market year)… The Investor Intelligence Advisor Bull/Bear Spread is back into the danger zone (38%), and as of last week the AAII individual investor bull/bear spread was back up to +17.

Of course this makes stocks vulnerable to a notable downside hit, but it'll take a catalyst.

Last Thursday 5/16

...our economic view supports the market’s notion that indeed rate cuts are coming this year... However, there’s a legitimate narrative among some respected macro analysts that inflation will not abate sufficiently to allow the Fed to cut… I do think, however, that those same analysts may be missing the point that Powell implied during his last press conference, that if the employment data roll over they’re cutting, even before they get to their inflation target.

Last Thursday 5/16

Copper just hit an all time high! Given its history of reflecting, if not sniffing out, global economic strength, I have to acknowledge the fact that the recent price action flies in the face of our view that we’ll see accelerated economic weakness in the months ahead.

Of course it could simply be traders bidding up the price to compensate for the following:

I.e., in anticipation of a pickup in infrastructure spending and the massive pressure coming from its use in all things green energy…

BCA’s US Investment Strategy Team was among the rare few who did not anticipate recession in 2023… Now they are, ironically, in the minority who sees one beginning by the end of 2024 (i.e., the majority of analysts have changed their minds; last year’s economic bears are largely now bulls).

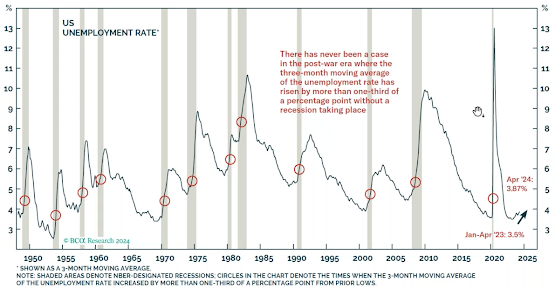

They reference the short historic lag separating rising unemployment and recession:

And the direction of some leading employment indicators…

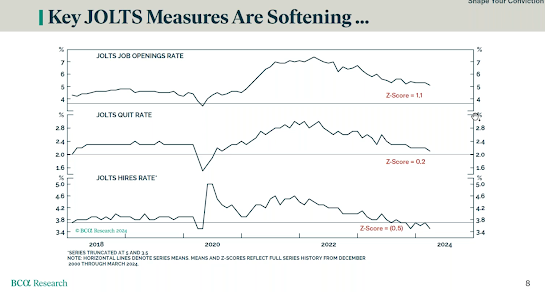

Now, from a levels standpoint, openings are still historically elevated… However, the quits rate, and the hires rate, are back to “normalized levels” – the hires rate is below, actually, for the past 5 months (through March).

Other metrics flashing potential labor market weakness going forward:

While, unlike some bears, they’re not alarmists on delinquency rates, they simply acknowledge that they’ve normalized to February 2020 which was a “tough compare.”

Essentially, as we’ve been pointing out, save for March to May seasonality (income tax refunds), delinquency rates are clearly in an uptrend:

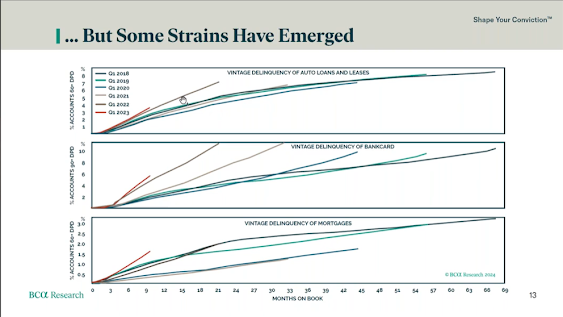

And delinquencies by vintage are growing more concerning as we go:

And, by the way, per the SLOOS, banks have tightened lending standards for consumer loans for 7 straight quarters… And banks have also reported over the same period that demand for consumer loans is tepid.

I.e., BCA’s team sees this weakening trend in delinquencies continuing from here… And, thus, it will be more and more difficult for consumers who need it to leverage future income to support their spending… While that past-income (savings) tailwind is rapidly abating (reflecting their view that “excess savings” will be entirely depleted this year).

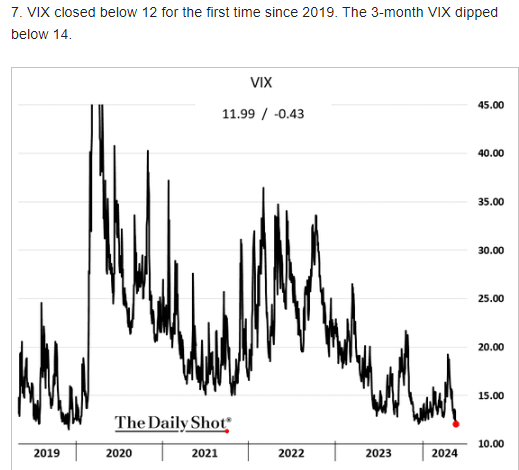

The incredible, but not necessarily surprising, complacency right here is clearly reflected in the VIX:

This Monday 5/20

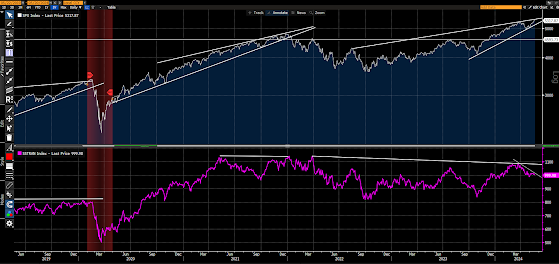

The transportation sector (bottom panel) performance signal is an old-timer, but even recent history suggests it shouldn’t be ignored…

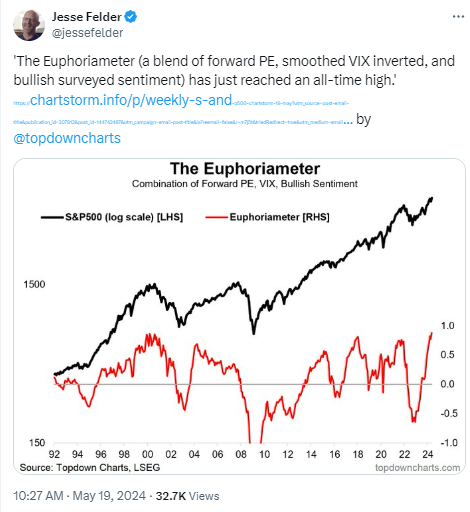

Our fear/greed barometer is already getting back to the danger zone (was there late march, plunged with the market in April, now moving swiftly back into the zone)... Thus, the following comes as no surprise:

This Monday 5/20

I'm in the Berezin camp on inflation right here... I.e., while it could stay a bit sticky in the very near-term, ultimately I see it moving lower as the cycle finishes out, then right back to the fore after the next recession.

Last Wednesday 5/15

CPI came in a bit softer than expected, core pretty much in line… Markets, bonds in particular, are, as expected (on soft data), rallying on the news…

Weaker than expected retail sales for April didn’t hurt markets either – as weak news is good news presently (all eyes on the Fed); which, alas, tends to be the making of greater market pain if indeed weak news ultimately becomes recession news.

A September rate cut is now priced into fed funds futures, if data continue to weaken that’ll get moved up in a hurry; right now there’s a 30% chance of a cut in July.

Europe, whose equities we’ve been adding to lately, has a June rate cut presently priced in.

A September rate cut is now priced into fed funds futures, if data continue to weaken that’ll get moved up in a hurry; right now there’s a 30% chance of a cut in July.

Europe, whose equities we’ve been adding to lately, has a June rate cut presently priced in.

Last Wednesday 5/15

When we look at the consumer debt picture in total, the delinquency rate, while rising, isn’t alarming… However, that’s explained by the still low occurrence of mortgage delinquencies… When we factor in credit cards and auto loan delinquencies, however, it is indeed troubling.

Per this morning’s Daily Shot chart deck:

Last Wednesday 5/15

Of course this makes stocks vulnerable to a notable downside hit, but it'll take a catalyst.

Last Thursday 5/16

...our economic view supports the market’s notion that indeed rate cuts are coming this year... However, there’s a legitimate narrative among some respected macro analysts that inflation will not abate sufficiently to allow the Fed to cut… I do think, however, that those same analysts may be missing the point that Powell implied during his last press conference, that if the employment data roll over they’re cutting, even before they get to their inflation target.

Last Thursday 5/16

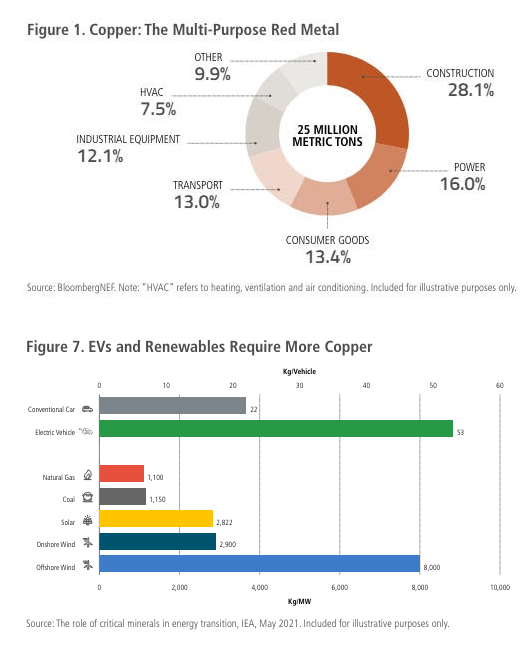

Copper just hit an all time high! Given its history of reflecting, if not sniffing out, global economic strength, I have to acknowledge the fact that the recent price action flies in the face of our view that we’ll see accelerated economic weakness in the months ahead.

Of course it could simply be traders bidding up the price to compensate for the following:

I.e., in anticipation of a pickup in infrastructure spending and the massive pressure coming from its use in all things green energy…

Although news that China is stockpiling the metal is certainly not hurting the price right here either.

This, with its attendant inflationary pressure, is not supportive of a Fed that wants to cut rates.

This, with its attendant inflationary pressure, is not supportive of a Fed that wants to cut rates.

Last Thursday 5/16

The following (courtesy of P. Boockvar) provided quite the boost to Chinese equities when it was announced, and speaks to the powers-that-be’s desire to diffuse history’s greatest property bubble.

The following (courtesy of P. Boockvar) provided quite the boost to Chinese equities when it was announced, and speaks to the powers-that-be’s desire to diffuse history’s greatest property bubble.

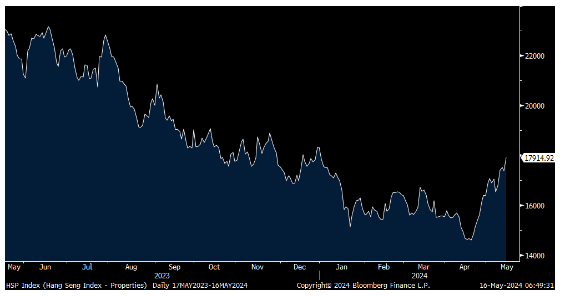

We’re still sufficiently exposed to benefit from any upside in Chinese equities going forward, although less exposed after recent adjustments (per our concerns over growing geopolitical risk between here and the US election, and so on):

"Chinese stocks rallied again, with the Hang Seng up another 1.5% on excitement about the proposal being discussed that local governments would start buying unsold homes from distressed property developers and then possibly rent them out. The Hang Seng property stock index jumped 3.1% overnight and is up 22% over the past month as just maybe the Chinese are getting to the latter stages of the residential real estate developer distress which is multiple years in at this point. When this massive problem of excessive apartment supply gets resolved, the Chinese economy will be on much firmer footing."

Hang Seng Property Stock index

"Chinese stocks rallied again, with the Hang Seng up another 1.5% on excitement about the proposal being discussed that local governments would start buying unsold homes from distressed property developers and then possibly rent them out. The Hang Seng property stock index jumped 3.1% overnight and is up 22% over the past month as just maybe the Chinese are getting to the latter stages of the residential real estate developer distress which is multiple years in at this point. When this massive problem of excessive apartment supply gets resolved, the Chinese economy will be on much firmer footing."

Hang Seng Property Stock index

Last Friday 5/17

China's overnight releases showed increased industrial production and generally weak consumer spending and credit-demand data.

China's overnight releases showed increased industrial production and generally weak consumer spending and credit-demand data.

Per yesterday’s note, Chinese policymakers can be expected to continue to step up the measures to stem their economy's still-concerning tide. They'll have to, as I suspect the already-stiff countervailing winds, at a minimum, will not abate anytime soon.

Last Saturday 5/18

Last Saturday 5/18

BCA’s US Investment Strategy Team was among the rare few who did not anticipate recession in 2023… Now they are, ironically, in the minority who sees one beginning by the end of 2024 (i.e., the majority of analysts have changed their minds; last year’s economic bears are largely now bulls).

They reference the short historic lag separating rising unemployment and recession:

And the direction of some leading employment indicators…

Now, from a levels standpoint, openings are still historically elevated… However, the quits rate, and the hires rate, are back to “normalized levels” – the hires rate is below, actually, for the past 5 months (through March).

Other metrics flashing potential labor market weakness going forward:

While, unlike some bears, they’re not alarmists on delinquency rates, they simply acknowledge that they’ve normalized to February 2020 which was a “tough compare.”

Essentially, as we’ve been pointing out, save for March to May seasonality (income tax refunds), delinquency rates are clearly in an uptrend:

And delinquencies by vintage are growing more concerning as we go:

And, by the way, per the SLOOS, banks have tightened lending standards for consumer loans for 7 straight quarters… And banks have also reported over the same period that demand for consumer loans is tepid.

I.e., BCA’s team sees this weakening trend in delinquencies continuing from here… And, thus, it will be more and more difficult for consumers who need it to leverage future income to support their spending… While that past-income (savings) tailwind is rapidly abating (reflecting their view that “excess savings” will be entirely depleted this year).

This Monday 5/20

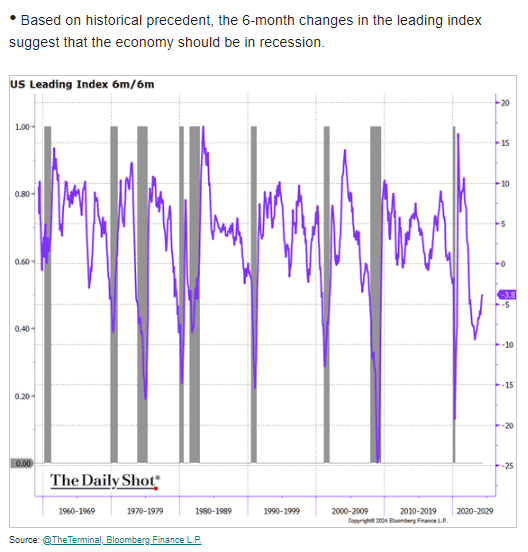

Leading indicators continue to flash red:

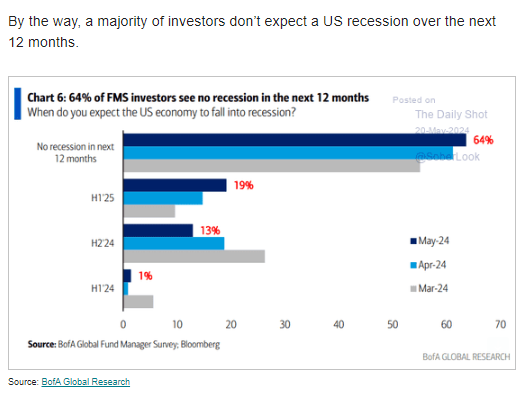

Recession is no longer the consensus, which, ironically, isn’t comforting… Last year the consensus overwhelmingly forecast recession; folks don’t want to be wrong two years in a row:

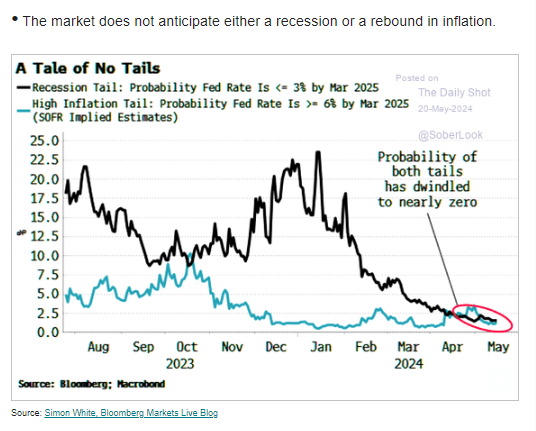

And “the market” is all in on a Goldilocks outcome… That’s cause for concern:

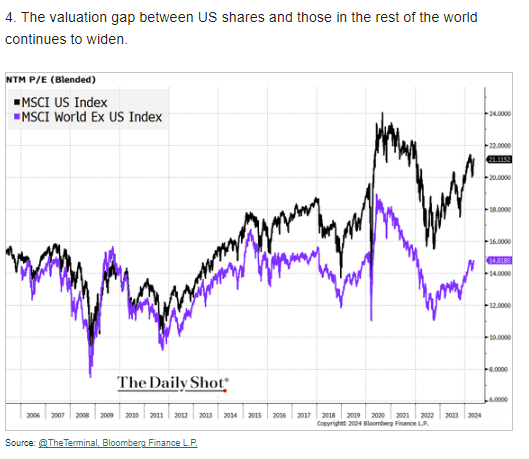

As I continue to point out, US stocks are historically-expensive vs most other markets – or, let’s say, most other markets look relatively cheap right here… All else equal this bodes very well for our core allocation, given our go-forward, long-term, thesis:

This Monday 5/20

Leading indicators continue to flash red:

Recession is no longer the consensus, which, ironically, isn’t comforting… Last year the consensus overwhelmingly forecast recession; folks don’t want to be wrong two years in a row:

And “the market” is all in on a Goldilocks outcome… That’s cause for concern:

This Monday 5/20

This Monday 5/20

The incredible, but not necessarily surprising, complacency right here is clearly reflected in the VIX:

This Monday 5/20

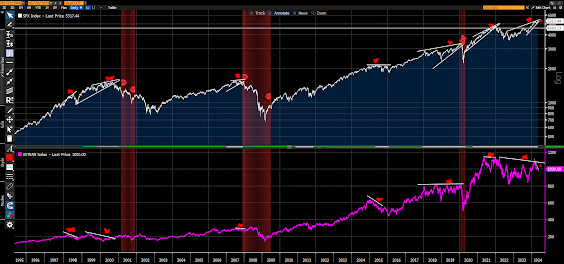

The transportation sector (bottom panel) performance signal is an old-timer, but even recent history suggests it shouldn’t be ignored…

It looks concerning right here:

Since 1995 (I marked the bearish divergences):

This Monday 5/20

Since 1995 (I marked the bearish divergences):

This Monday 5/20

Our fear/greed barometer is already getting back to the danger zone (was there late march, plunged with the market in April, now moving swiftly back into the zone)... Thus, the following comes as no surprise:

This Monday 5/20

I'm in the Berezin camp on inflation right here... I.e., while it could stay a bit sticky in the very near-term, ultimately I see it moving lower as the cycle finishes out, then right back to the fore after the next recession.

This Tuesday 5/21

While I can't disagree with Tavi below -- as I'm long-term very bullish commodities -- I wouldn't entirely back up the truck right here, as some seem to be doing... Economic weakness in the near-term would likely break a few hearts and offer us up an opportunity to take meaningfully to our positions heading into the next cycle:

No comments:

Post a Comment