Here are some selected highlights of key global economic and market data, signals, trends, etc., from our internal log over the past few days.

Clients, if you'd like more color on any of the below, or anything else that went on in global markets/economics this past week (even if it's not featured below, there's a good chance I commented on it internally), please feel free to reach out.Last Wednesday 5/8

BCA’s US Equity Strategy Team’s remarkably accurate model is the most bearish it’s been since I’ve been following it… Chief strategist Peter Berezin, however, sees potential near-term upside should data begin to weaken soon, as the market will likely rally on the notion that the Fed will, thus, become measurably accommodative... Which is my current base case as well.

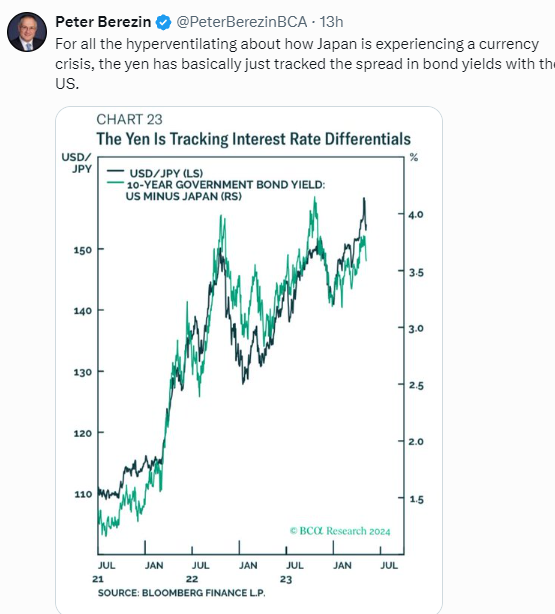

Despite it being down slightly since we put on our small starter position, I’m liking the longer-term setup for the yen right here.

My view from the get-go is far more basic than the rantings of those who see a currency crisis in the making… I.e., it’s simply a matter of macro cycle timing and interest rate differentials.

BCA seems to agree:

But, as I implied when we took the position, we may very likely be early… Not adding here, but I suspect we will as the current cycle plays itself out.

This from BCA today reflects the newfound strength we’re seeing outside the US… As I keep saying, however, I’m concerned that what we’re viewing will ultimately turn out to be a late-cycle head-fake, or call it a false breakout… Seems like, per the last 2 paragraphs below, BCA is certain that it is:

While our recent moves bringing healthcare to near the top of our sector weightings has to do with our go-forward economic outlook, and simple reversion (the sector has notably underperformed the past year+), the following, again from BCA, adds another positive wrinkle:

BCA’s US Equity Strategy Team’s remarkably accurate model is the most bearish it’s been since I’ve been following it… Chief strategist Peter Berezin, however, sees potential near-term upside should data begin to weaken soon, as the market will likely rally on the notion that the Fed will, thus, become measurably accommodative... Which is my current base case as well.

Last Wednesday 5/8

Despite it being down slightly since we put on our small starter position, I’m liking the longer-term setup for the yen right here.

My view from the get-go is far more basic than the rantings of those who see a currency crisis in the making… I.e., it’s simply a matter of macro cycle timing and interest rate differentials.

BCA seems to agree:

But, as I implied when we took the position, we may very likely be early… Not adding here, but I suspect we will as the current cycle plays itself out.

Last Wednesday 5/8

This from BCA today reflects the newfound strength we’re seeing outside the US… As I keep saying, however, I’m concerned that what we’re viewing will ultimately turn out to be a late-cycle head-fake, or call it a false breakout… Seems like, per the last 2 paragraphs below, BCA is certain that it is:

The revival in global growth momentum continued in April. The JPM Global Manufacturing PMI came in at 50.3, marking its third consecutive month of expansion.

Details underscored solid demand conditions. Output and new orders continued to rise and new export orders returned to growth (50.5) from their previous contraction level (49.6). Notably, demand accelerated despite evidence of further price pressures. Both input and output prices accelerated in April.

Alternative measures such as trade data from small open economies like Taiwan and South Korea also point to accelerating global growth momentum. Taiwan’s manufacturing PMI returned to growth in April after 22 consecutive months of contraction, and the highly cyclical electronics new export orders component surged in March (61, following a prior contraction) and April (55.3). Meanwhile, Sweden’s new export orders accelerated sharply in April (56.7).

Further improvements in global growth are supportive of the performance of global stocks relative to bonds. However, we expect this momentum will be short-lived. A large source of global demand will fade as further softening in the US labor market eventually tips the economy into a recession by late 2024/early 2025. Recent data already suggests that US growth is slowing. Moreover, demand from China is likely to remain lackluster given insufficient stimulus, housing market woes and weak private sector morale.

We recommend investors underweight global equities and overweight bonds on a cyclical investment horizon.

While our recent moves bringing healthcare to near the top of our sector weightings has to do with our go-forward economic outlook, and simple reversion (the sector has notably underperformed the past year+), the following, again from BCA, adds another positive wrinkle:

Health care stocks have underperformed the US broad market by over 20% since the beginning of 2023. Indeed, vaccination campaigns during the pandemic years had initially boosted health care companies’ earnings. However, this tailwind eventually faded. Moreover, as a defensive sector, healthcare underperformed as markets rallied last year. Margins also contracted, as costs for health care providers rose at a faster pace than revenues.

However, these dynamics will reverse going forward. The prices charged by health care companies are usually locked in on a contractual basis for a set period time, which has caused sales prices to lag costs. However, a lot of these contracts are now set to renew, providing health care companies with improved pricing power, and lifting margins in the process. In addition, its defensive properties make it a favorable sector to own in a downturn. We expect a recession to occur later this year or in early 2025.

Currently, both our Global Asset Allocation and Global Investment Strategy teams are overweight health care stocks within a global equity portfolio.

Last Thursday 5/9

The consensus has it that the BOE (Bank of England) will be easing policy as inflation, while presently higher than in the US, seems to be abating (which jibes with our current go-forward macro view)… That would be near-term bullish for our UK equity exposure.

US equities popped on higher than expected jobless claims, which essentially confirms our current view that any weakness in labor is near-term bullish for stocks… Thing is, there were seasonal factors (NY teachers, for example) that likely explains the bump in claims.

Overnight Japanese data came in somewhat weak (and weaker than expected), bolstering yen shorts.

UK data came in on-balance stronger than expected… We’ll see if that lowers odds of a June BOE rate cut.

The consensus has it that the BOE (Bank of England) will be easing policy as inflation, while presently higher than in the US, seems to be abating (which jibes with our current go-forward macro view)… That would be near-term bullish for our UK equity exposure.

Last Thursday 5/9

US equities popped on higher than expected jobless claims, which essentially confirms our current view that any weakness in labor is near-term bullish for stocks… Thing is, there were seasonal factors (NY teachers, for example) that likely explains the bump in claims.

Overnight Japanese data came in somewhat weak (and weaker than expected), bolstering yen shorts.

UK data came in on-balance stronger than expected… We’ll see if that lowers odds of a June BOE rate cut.

Last Friday 5/10

The recent strength in equities owes to decent earnings results and – more key in my view – the very strong signal from J. Powell that the Fed stands ready to pounce on any signs that the economy is looking to roll over into recession… The labor market being the key thing to watch.

Barring surprisingly hot inflation (PPI and CPI next week), or notably better than expected data (retail sales next week), it’s hard to feel very near-term bearish right here.

Ironically, while, ultimately, it’ll be a weak economy that brings equities back down to earth, the near-term downside risk remains the possibility that the economy is durably stronger under the surface than our analysis suggests.

Time will tell.

Powell continues to say conditions are sufficiently tight to quell inflation… And while I can sympathize when I look at things like the stress building in the consumer credit space, tight lending standards, leading labor mkt indicators, earnings commentary (some) from retail, waning consumer sentiment, etc., when I look at the likes of high yield spreads, the MOVE Index, and CDS spreads, I sure don’t see anything that smacks of heightened credit risk out there.

I suspect that the Fed’s response to covid, and to last year’s regional bank crisis, etc., explains what would otherwise (and maybe still should) be viewed as some very dangerous complacency right here.

Cocoa futures are getting absolutely crushed this morning, as rain forecasts (rain coming, which is a very good thing for the crop) in Ghana, and Indonesia, and very low open interest in futures (lack of liquidity), are serving up a massive 19% decline… Which is having a not-small impact on our PDBA/DBA position, despite the fact that grains (wheat in particular) are seeing a nice rally as I type (although coffee’s down 2%).

In retrospect, while global dynamics justify a long-term position in ag futures, I’m glad we recently cut the position in half, although still up 10% year-to-date (which is way off its gain of a month or two ago).

We’ll continue to keep a very close eye on this one.

As for other markets, stocks are flat, bonds are up a fraction, gold’s off 1%... The ag futures hit explains all of our minor 0.17% decline in the core so far this morning. Otherwise we’d be flat at the moment.

This Monday 5/13

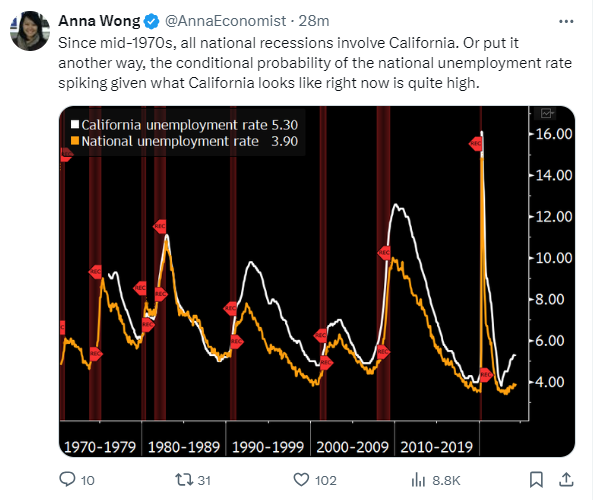

Interesting:

This Tuesday 5/14

Feeling a bit less sanguine right here regarding China – per the below from our core allocation file:

The latest S&P Global Investment Manager Index for US Equities (which I participate in each month) shows money managers, as a group, feeling very bullish right here… While I’m near-term somewhat constructive on equities, I don’t share quite the giddiness the majority of my fellow respondents seem to have right here:

PPI, at first blush, came in somewhat hot… Although right at consensus year-over-year… Month-on-month came in at .5%, but that comes off of a March that saw the number revised lower.

Markets met the release with a selloff in the pre-market, but then, as the reality set in that producer price inflation pretty much held at present pace, stocks found their way back to the flatline.

Tomorrow’s CPI release will have the market’s undivided attention for sure.

This Tuesday 5/14

While the NFIB’s April Small Business Survey results improved marginally over March’s, the following from the report tells a not-so-rosy story:

Barring surprisingly hot inflation (PPI and CPI next week), or notably better than expected data (retail sales next week), it’s hard to feel very near-term bearish right here.

Ironically, while, ultimately, it’ll be a weak economy that brings equities back down to earth, the near-term downside risk remains the possibility that the economy is durably stronger under the surface than our analysis suggests.

Time will tell.

Powell continues to say conditions are sufficiently tight to quell inflation… And while I can sympathize when I look at things like the stress building in the consumer credit space, tight lending standards, leading labor mkt indicators, earnings commentary (some) from retail, waning consumer sentiment, etc., when I look at the likes of high yield spreads, the MOVE Index, and CDS spreads, I sure don’t see anything that smacks of heightened credit risk out there.

I suspect that the Fed’s response to covid, and to last year’s regional bank crisis, etc., explains what would otherwise (and maybe still should) be viewed as some very dangerous complacency right here.

Cocoa futures are getting absolutely crushed this morning, as rain forecasts (rain coming, which is a very good thing for the crop) in Ghana, and Indonesia, and very low open interest in futures (lack of liquidity), are serving up a massive 19% decline… Which is having a not-small impact on our PDBA/DBA position, despite the fact that grains (wheat in particular) are seeing a nice rally as I type (although coffee’s down 2%).

In retrospect, while global dynamics justify a long-term position in ag futures, I’m glad we recently cut the position in half, although still up 10% year-to-date (which is way off its gain of a month or two ago).

We’ll continue to keep a very close eye on this one.

As for other markets, stocks are flat, bonds are up a fraction, gold’s off 1%... The ag futures hit explains all of our minor 0.17% decline in the core so far this morning. Otherwise we’d be flat at the moment.

This Monday 5/13

Interesting:

This Tuesday 5/14

Feeling a bit less sanguine right here regarding China – per the below from our core allocation file:

5/14/2024

Selling ½ VWO, proceeds going 50% XCEM, 25% FEZ, 25% IEUR

Looking across our EM exposure, I’m less comfortable right here with our China allocation… As we anticipated, it’s seen a very nice run of late, but the totality of the geopolitical risk right here makes it uncertain enough to book a chunk of the recent gains.

China’s leadership just scheduled their third plenum meetings for July; I do suspect we’ll see significant commitments there that may potentially boost Chinese equities further during the second half of the year, but the political risk coming primarily out of the US will present a major headwind…

The potential positives inspire me to maintain some exposure (through the remaining VWO and DEM positions), but the potential negatives has a reduction right here feeling prudent.

XCEM captures EM without exposure to China… FEZ and IEUR capture the growingly attractive setup across the Eurozone.

The latest S&P Global Investment Manager Index for US Equities (which I participate in each month) shows money managers, as a group, feeling very bullish right here… While I’m near-term somewhat constructive on equities, I don’t share quite the giddiness the majority of my fellow respondents seem to have right here:

Here’s from the report:

Risk appetite has revived sharply in May, according to S&P Global’s Investment Manager Index™ (IMI™) survey, surging from April’s three-month low to its highest in two-and-a-half years. Investors have also become more upbeat about market performance over the coming month, contrasting with the negativity seen over the first four months of the year. Optimism is also spreading to more sectors. Most notable is a rebound in views towards tech stocks.

Sentiment has been buoyed by better-than-anticipated earnings performance, which has propelled shareholder returns and equity fundamentals to the fore in terms of perceived market drivers. The US economy and fiscal policy are also seen as supportive to equities, contrasting with drags from central bank policy and the broader global economy, and in particular from concerns over valuations and geopolitics. The IMI’s headline Risk Appetite Index has jumped from +5% in April to +28% in May to now sit at its highest since November 2021 and thereby signals a strong revival of risk-on sentiment.

PPI, at first blush, came in somewhat hot… Although right at consensus year-over-year… Month-on-month came in at .5%, but that comes off of a March that saw the number revised lower.

Markets met the release with a selloff in the pre-market, but then, as the reality set in that producer price inflation pretty much held at present pace, stocks found their way back to the flatline.

Tomorrow’s CPI release will have the market’s undivided attention for sure.

This Tuesday 5/14

While the NFIB’s April Small Business Survey results improved marginally over March’s, the following from the report tells a not-so-rosy story:

"Cost pressures remain the top issue for small business owners, including historically high levels of owners raising compensation to keep and attract employees. Overall, small business owners remain historically very pessimistic as they continue to navigate these challenges. Owners are dealing with a rising level of uncertainty but will continue to do what they do best - serve their customers."

This Tuesday 5/14

This from Peter Boockvar on the latest ZEW survey out of Europe gibes with what we’re seeing in the data, and supports our recent allocation moves, picking up more European equity exposure:

This from Peter Boockvar on the latest ZEW survey out of Europe gibes with what we’re seeing in the data, and supports our recent allocation moves, picking up more European equity exposure:

“In Europe, the German ZEW measuring expectations of the German economy rose to 47.1 from 42.9 and the Current Situation was less bad at -72.3 from -79.2. The ZEW said "Signs of an economic recovery are growing, bolstered by better assessments of the overall eurozone and of China as a key export market. The increased optimism is reflected in particular in the sharp rise in expectations for domestic consumption, followed by the construction and machinery sectors." The Germany economy has been in a slight recession but just maybe a bottom is being formed here with some green shoots. If an eventual recovery in manufacturing takes place, if, and China's economy stabilizes, German will certainly be a key beneficiary of that.”

This Tuesday 5/14

Also from Boockvar, the latest UK data doesn’t entirely gibe with the nascent strength showing up in the Eurozone… Although, given that it, in some minds, begs for a rate cut, it could bolster the UK equities position we added in January of this year (up 11% so far):

This Tuesday 5/14

Per this morning’s analysts’ call, BCA’s European Investment Team agrees with our view that presently European equities have a notable edge over US equities… As I’ve stated, the data, the valuations and monetary policy stance favors Europe at the moment.

However, BCA’s team reiterated that, in their view, this as a short-term 3 to 6-month window, after which they’re in the global recession camp and see equities ultimately suffering notably as that plays out.

As I’ve also stated, I am concerned that what we’re seeing from the European data may indeed turn out to be a head-fake, as BCA implies, but of course that remains to be seen… It does keep us from backing up the truck right here.

Also from Boockvar, the latest UK data doesn’t entirely gibe with the nascent strength showing up in the Eurozone… Although, given that it, in some minds, begs for a rate cut, it could bolster the UK equities position we added in January of this year (up 11% so far):

The UK labor market softened in Q1 with their unemployment rate rising by one tenth to 4.3%, which matches the highest since September 2021. The number of employed fell by 178k, though that wasn't as much as the expectations for a drop of 220k. Wage growth though remained good, rising by 6% y/o/y ex bonuses, the same pace seen in the month prior.

The market is hoping this leads to a BoE rate cut and the 2 yr gilt yield is down by 2 bps to 4.31%. Odds of a June rate cut stand at about 50% and the pound is down too but only very slightly. We remain bullish on the UK market and some individual stocks within it, particularly in energy as they are cheap.

Per this morning’s analysts’ call, BCA’s European Investment Team agrees with our view that presently European equities have a notable edge over US equities… As I’ve stated, the data, the valuations and monetary policy stance favors Europe at the moment.

However, BCA’s team reiterated that, in their view, this as a short-term 3 to 6-month window, after which they’re in the global recession camp and see equities ultimately suffering notably as that plays out.

As I’ve also stated, I am concerned that what we’re seeing from the European data may indeed turn out to be a head-fake, as BCA implies, but of course that remains to be seen… It does keep us from backing up the truck right here.

No comments:

Post a Comment