I’m thinking about the institutional trader, the hedge fund manager, yada yada, and how they live and die by their running P&L… Those who are experienced, thoughtful and objective know that we are late-cycle, that valuations are extended, and that a potentially consequential repricing of stocks is likely in the not-too-distant offing… Nevertheless, we’re not there yet, the dips continue to get bought, and – as evidenced by the Bank of Japan’s jawboning reaction to recent hemorrhaging, and likely by this week’s Fed Jackson Hole meeting – the powers that wield policy have little stomach for downward volatility.

So, despite the present ever-rising risk, today’s trader believes that, in pure self-interest/preservation, they must continue to rock to the infamous 2007 tune played by ex-Citi CEO Chuck Prince:

“... as long as the music’s playing you gotta get up and dance.”Now, in today’s extreme (in my view) market-myopia, 2007 is an utter eternity ago… So now I’m wondering how many institutional traders active today were even wrestling with markets 17 years ago, let alone the last time valuations were this high (the ‘90s tech bubble peak)? And, for those who were, do they somehow believe – now that there’s seemingly no constraints on the printing press – that indeed, in covidesque fashion, long-term-crippling drawdowns, the likes of which followed Mr. Prince’s statement, and the tech bubble peak, are not even possible today?

Ultimately, I believe there’s some serious career-ending risk for those who’d answer yes to that last question… I’ll just say that history has not been at all kind to such views!

And then we have the everyday trader/investor, the so-called “retail” trader/investor… I worry greatly about the message the perpetually-unsuspecting (at tops and bottoms) retail player has received from post-covid market action… I.e., BUY EVERY DIP!

For, in the words of one of history’s great investors, in August 2000, at the very peak of the internet bubble:

“The impact of expectations underpinned by emotion adds up to a trend on stock markets. Those who attest to the singular nature of our current bull market – or, for that matter, any bull market – really ought to know better. The lessons of history are very clear in this regard.

All bull markets come to an end, typically when people are most optimistic about the future, and they are followed by bear markets which similarly reach their conclusion when sentiment is at its most negative.”

–Sir John TempletonIn their latest podcast, Grant Williams and Bill Fleckenstein hosted James Aitken – advisor to many of the world’s most powerful, most sophisticated & most successful investors… They dug deep into the most-pressing market topics of the day, including the one I’m musing on this morning (emphasis mine):

Bill Fleckenstein:Bottom line, the odds of this all not ending well are way too high for comfort! I.e., we’ll remain very diversified and continue to pick our spots right here… Ultimately, massive opportunities await if we remain patient.

"Well, and the other misperception, I think that people have, particularly the newer generation of the last 10 or 20 years, is they assume that all prices will be continuous at all times. And what you were talking about is some of the reasons why that doesn’t happen, and then the US stock market structure, of course, has that same thing in spades for a variety of other reasons. I think that’s the thing that people that haven’t been around a long time, that haven’t seen this, don’t appreciate that you cannot assume that any price will probably be continuous if the wrong thing happens.

James Aitken:

Bill, it’s worse than that. It’s not just all these people that have come to market since COVID, and I was flabbergasted by a statistic I read the other day, and I should have known this, but something like 40 million, maybe 45 million, new investment accounts, which actually means trading accounts, have been opened since COVID. And of course some of those have done all right, but you wonder about the collective expertise because let’s face it, with a little bit of a bump here and there, it’s basically been one way for four years because we try to influence future consumption and perceptions of permanent income.

Let’s blow another bubble so we muddle through, and that’s why we’ve gotten this far.

Bill Fleckenstein:

Wow, that’s a staggering number.

James Aitken:

Yeah, I think that number, we should check it, but I’m confident it’s 40 million because that quote was from BlackRock.

Grant Williams:

I’m just putting up something quick here, 10 million in 2020, so that tracks.

James Aitken:

There we go. So let’s say 30 million new trading accounts, now, not all of them may be active, so let’s be conservative and say 30 million new accounts have been opened, of which 10 million are active. What the hell? 10 million active trading accounts all day long? Golly gosh, that’s not a healthy situation. Think about that as 10 million units of productive capital that could be better allocated to starting a business or helping invent things, or whatever. No, no, no, we’re going to trade on that. Okay, well, the casino is open every day, but it’s an unhealthy state of affairs."

On another note:

Clearly, folks on the upper rungs of the income ladder have been doing the heavy economic heavy lifting for quite some time now… Of course, by definition, nothing lasts forever in a cyclical economy.

Signs:

Signs:

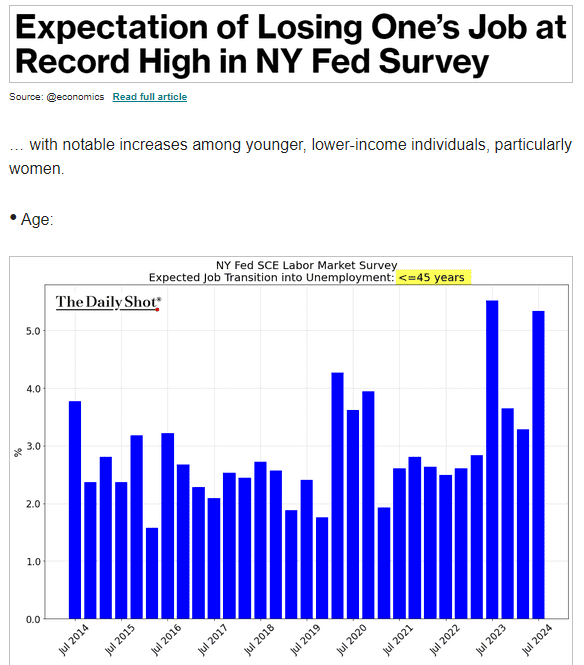

As for folks who don't find themselves on those upper income rungs:

No comments:

Post a Comment