From our August 9th morning note:

"...given that present Fed policy, amid a generally weakening macro backdrop, remains in tightening mode (with QT set to double next month) — odds that the latest (short-covering and gamma-hedging) rally will fail and give way to, at a minimum, a test of the bear market lows remain elevated.Last week BCA Research, more succinctly, delivered essentially the same message:

But what if we don’t actually enter recession? Won’t corporate earnings indeed hold up, supporting a new bull market trend going forward?

Well, yes, in terms of earnings. However, a no-recession scenario, with its attendant animal spirits, will likely keep inflation elevated to the point that has the Fed maintaining its tighter stance far longer than markets are presently discounting. Which would provide a potentially serious headwind for equity multiples going forward.

In fact, equities don’t look to me like they’re remotely discounting the inevitable earnings decline that would occur should we enter recession…"

"...any evidence that inflation is seriously coming off the boil will surely inspire rallies in global equities. But, again, rallies in equities are essentially a loosening of financial conditions. I.e., such rallies will likely turn out to be the short-lived victims of fed quashings."

"Faced with surging unit labor costs, US companies will continue to raise their prices to protect their profit margins and profitability. This will lead to one of the following two possible scenarios in the months ahead.

Scenario 1: If customers are willing to pay considerably higher prices, nominal sales will remain robust, profits will not collapse, and a recession is unlikely. However, this also implies that the Fed will have to tighten policy by more than what is currently priced in by markets.

Scenario 2: If customers push back against higher prices and curtail their purchases, then the economy will enter a recession. In this scenario, inflation will plummet, corporate margins will shrink, and their profits will plunge.

In both scenarios, the outlook for stocks is poor. However, one key difference is that scenario 1 is bearish for US Treasuries while scenario 2 is bond bullish. BCAStay tuned...

Asian equities leaned green overnight, with 9 of the 16 markets we track closing higher.

Europe's rallying so far this morning as well, with 16 of the 19 bourses we follow trading up as I type.

US stocks are in the green as well to start the session: Dow up 74 points (0.23%), SP500 up 0.28%, SP500 Equal Weight up 0.22%, Nasdaq 100 up 0.53%, Nasdaq Comp up 0.47%, Russell 2000 up 0.26%

The VIX sits at 25.67 down 2.06%.

Oil futures are down 3.42%, gold's down 0.34%, silver's down 0.51%, copper futures are down 0.98% and the ag complex (DBA) is down 0.46%.

The 10-year treasury is down (yield up) and the dollar is down 0.10%.

Among our 35 core positions (excluding options hedges, cash and short-term bond ETF), 23 -- led by Sweden equities, Nokia, our Eurozone ETF, Disney and Asia-Pac equities -- are in the green so far this morning. The losers are being led lower by energy stocks, uranium miners, base metals miners, base metals futures and Dutch Bros.

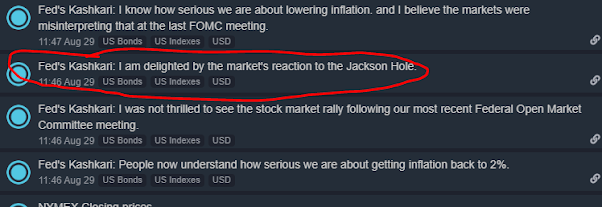

Well well well!! Talk about a change of tune! Here, speaking out yesterday, is who has been until recently your arguably most dovish Fed governor:

Have a great day!

Marty

Marty: Thanks for the updates!

ReplyDeleteLOL. I feel the pain that Fed Powell was talking about.

LOL!

Delete