During our daily portfolio and macro session yesterday morning, Nick and I discussed the dynamics around the 2008 "Great Financial Crisis" and the milder early-00s (tech bubble) recession, and acknowledged the adage "generals are always fighting the last battle."

I.e., the powers-that-be are forever reacting to and regulating conditions past in their efforts to influence conditions present and future. Inevitably engendering what becomes your proverbial finger in the dike metaphor:

Yep, while there is indeed a serious structural inflation regime shift in play, make no mistake, the bailouts, the money printing, the financial repression (holding interest rates down), have been no small contributors to the inflation that has to this point overwhelmed all the Fed's fingers and toes.

Hence, on a virtually daily basis of late, we're hearing Fedhead commentary such as the following (yesterday):

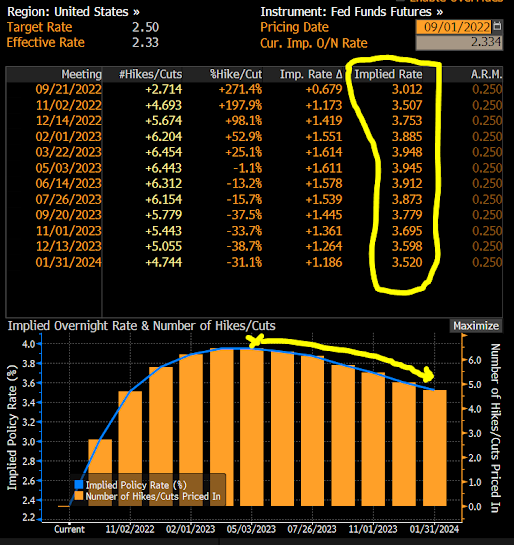

"My current view is that it will be necessary to move the fed funds rate up to somewhat above 4% by early next year and hold it there."

"I do not anticipate the Fed cutting the fed funds rate next year."

"Even if the economy were to go into a recession, we have to get inflation down."

--Cleveland Fed President Loretta Mester

Well, I can tell ya, the market just ain't buying it.

Note that Fed Funds Futures presently don't get to 4%, let alone "somewhat above." In fact, the market's actually pricing in rate cuts beginning next May:

Asian equities struggled overnight, with 12 of the 16 markets we track closing lower.

Europe's a mess as well so far morning, with 17 of the 19 bourses we follow trading down as I type.

US stocks continue their descent to start today's session: Dow down 205 points (0.65%), SP500 down 0.76%, SP500 Equal Weight down 0.99%, Nasdaq 100 down 0.87%, Nasdaq Comp down 0.95%, Russell 2000 down 1.44%

The VIX sits at 25.62, up 2.90%.

Oil futures are down 2.48%, gold's down 0.92%, silver's down 1.38%, copper futures are down 2.15% and the ag complex (DBA) is down 0.55%.

The 10-year treasury is down (yield up) and the dollar is up 0.60%.

Among our 35 core positions (excluding options hedges, cash and short-term bond ETF), only 2 -- communications and utilities stocks -- are in the green so far this morning. The losers are being led lower by AMD, base metals futures, base metals miners, our semiconductor ETF, cyber security and oil services stocks.

"...capital markets have shifted their character from being essentially money-raising mechanisms into becoming more refinancing and capital redistribution mechanisms, dominated by these rapid flows of Global Liquidity."

--Howell, Michael J.. Capital Wars

Have a great day!

Marty

Love the picture. In my opinion, the Fed has failed at every measure. He is very closed in pushing the economy to a recession.

ReplyDeleteCan't help but agree with you there Sam!

Delete